Answered step by step

Verified Expert Solution

Question

1 Approved Answer

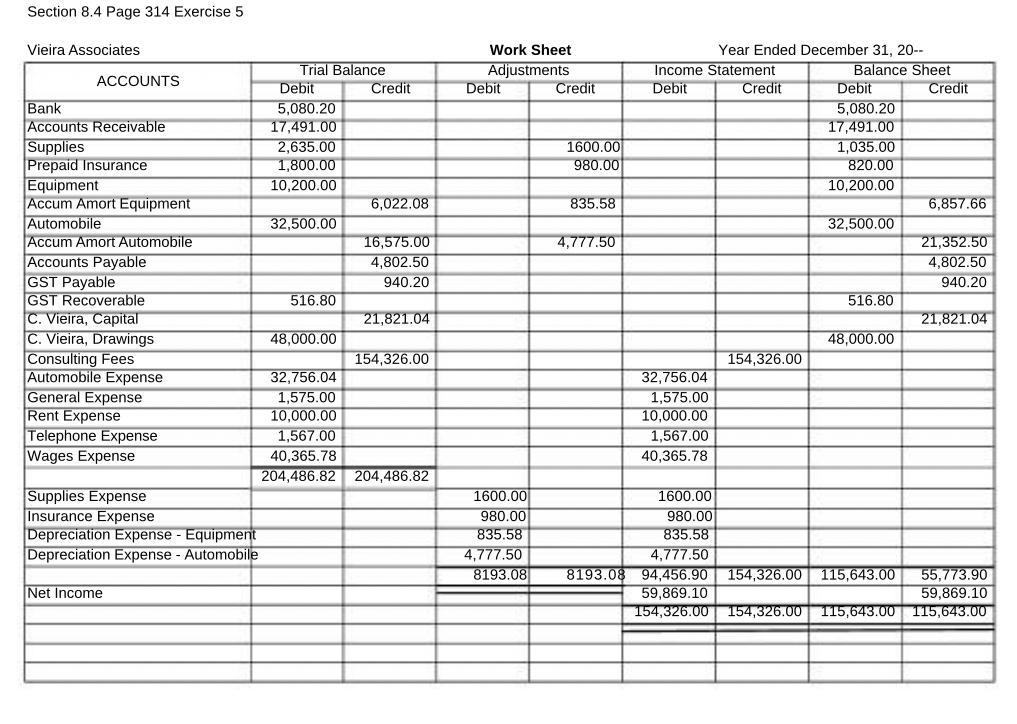

Prepare an Income Statement and a Balance Sheet. Section 8.4 Page 314 Exercise 5 Vieira Associates Trial Balance Work Sheet Adjustments Year Ended December 31,

Prepare an Income Statement and a Balance Sheet.

Section 8.4 Page 314 Exercise 5 Vieira Associates Trial Balance Work Sheet Adjustments Year Ended December 31, 20-- ACCOUNTS Debit Credit Debit Credit Income Statement Debit Credit Bank 5,080.20 Balance Sheet Debit Credit 5,080.20 Accounts Receivable 17,491.00 Supplies 2,635.00 1600.00 Prepaid Insurance 1,800.00 980.00 17,491.00 1,035.00 820.00 Equipment 10,200.00 Accum Amort Equipment 6,022.08 835.58 Automobile 32,500.00 Accum Amort Automobile Accounts Payable 16,575.00 4,802.50 4,777.50 GST Payable 940.20 GST Recoverable C. Vieira, Capital 516.80 21,821.04 C. Vieira, Drawings 48,000.00 Consulting Fees 154,326.00 Automobile Expense 32,756.04 General Expense 1,575.00 Rent Expense 10,000.00 Telephone Expense 1,567.00 10,200.00 6,857.66 32,500.00 21,352.50 4,802.50 940.20 516.80 21,821.04 48,000.00 154,326.00 32,756.04 1,575.00 10,000.00 1,567.00 Wages Expense 40,365.78 40,365.78 204,486.82 204,486.82 Supplies Expense 1600.00 1600.00 Insurance Expense Depreciation Expense - Equipment Depreciation Expense - Automobile 980.00 980.00 835.58 4,777.50 8193.08 Net Income 835.58 4,777.50 8193.08 94,456.90 154,326.00 115,643.00 55,773.90 59,869.10 59,869.10 154,326.00 154,326.00 115,643.00 115,643.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started