Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PREPARE AN INCOME STATEMENT AND STATEMENT OF CHANGES IN EQUITY AND STATEMENT FOR FINANCIAL POSITION (ACCOUNT FORMAT) FOR THE MONTH OF JUNE The following transactions

PREPARE AN INCOME STATEMENT AND STATEMENT OF CHANGES IN EQUITY AND STATEMENT FOR FINANCIAL POSITION (ACCOUNT FORMAT) FOR THE MONTH OF JUNE

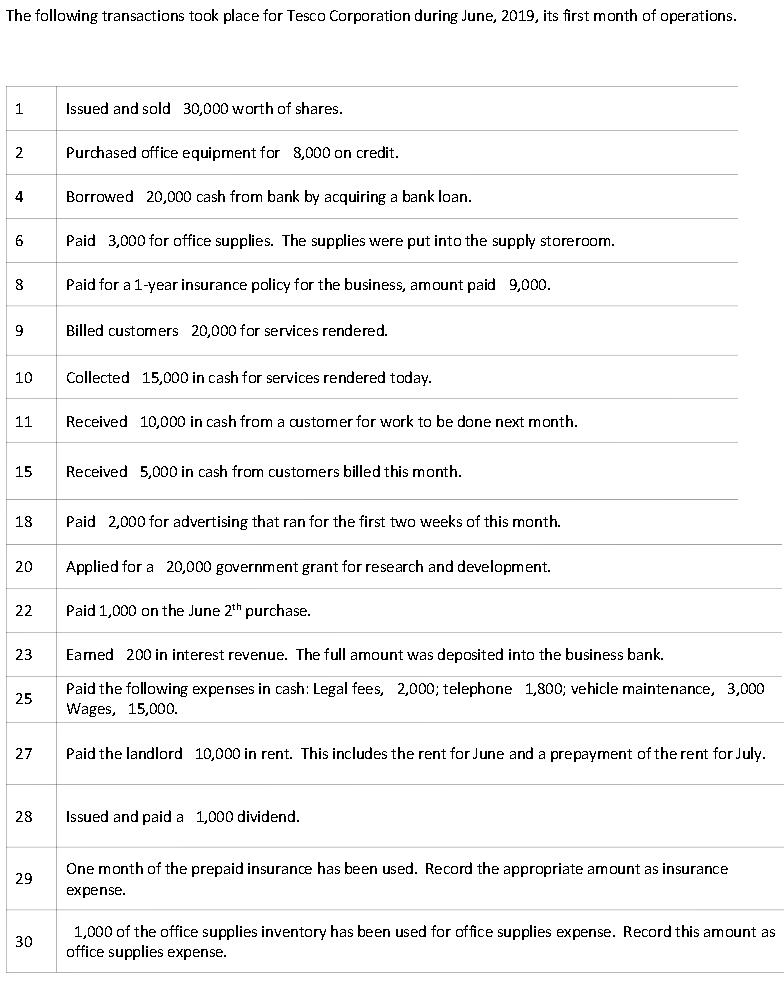

PREPARE AN INCOME STATEMENT AND STATEMENT OF CHANGES IN EQUITY AND STATEMENT FOR FINANCIAL POSITION (ACCOUNT FORMAT) FOR THE MONTH OF JUNE The following transactions took place for Tesco Corporation during June, 2019, its first month of operations. 1 2 4 6 8 9 10 11 15 18 20 22 23 25 27 28 29 30 Issued and sold 30,000 worth of shares. Purchased office equipment for 8,000 on credit. Borrowed 20,000 cash from bank by acquiring a bank loan. Paid 3,000 for office supplies. The supplies were put into the supply storeroom. Paid for a 1-year insurance policy for the business, amount paid 9,000. Billed customers 20,000 for services rendered. Collected 15,000 in cash for services rendered today. Received 10,000 in cash from a customer for work to be done next month. Received 5,000 in cash from customers billed this month. Paid 2,000 for advertising that ran for the first two weeks of this month. Applied for a 20,000 government grant for research and development. Paid 1,000 on the June 2th purchase. Eamed 200 in interest revenue. The full amount was deposited into the business bank. Paid the following expenses in cash: Legal fees, 2,000; telephone 1,800; vehicle maintenance, 3,000 Wages, 15,000. Paid the landlord 10,000 in rent. This includes the rent for June and a prepayment of the rent for July. Issued and paid a 1,000 dividend. One month of the prepaid insurance has been used. Record the appropriate amount as insurance expense. 1,000 of the office supplies inventory has been used for office supplies expense. Record this amount as office supplies expense.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Adjusted Trial Balance Accounts Title Debit Credit Calculation Cash 32400 30000200003000900015000100...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started