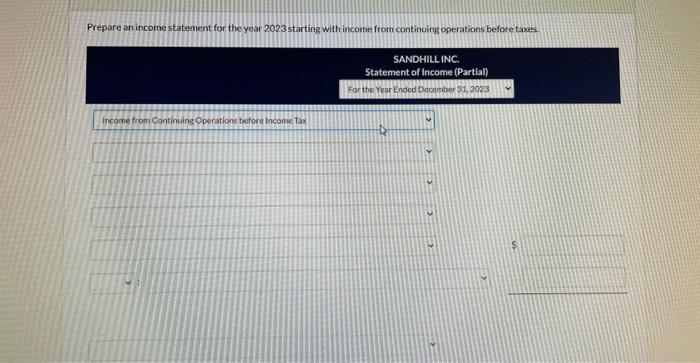

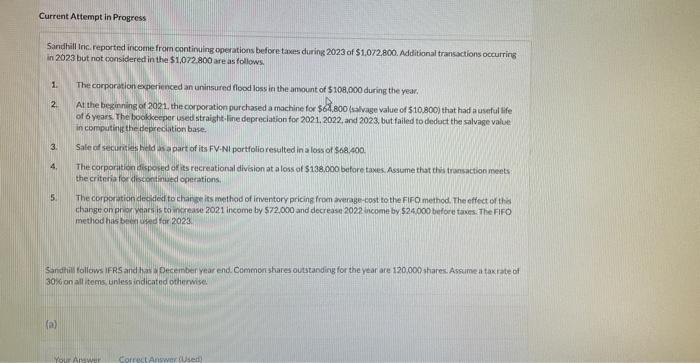

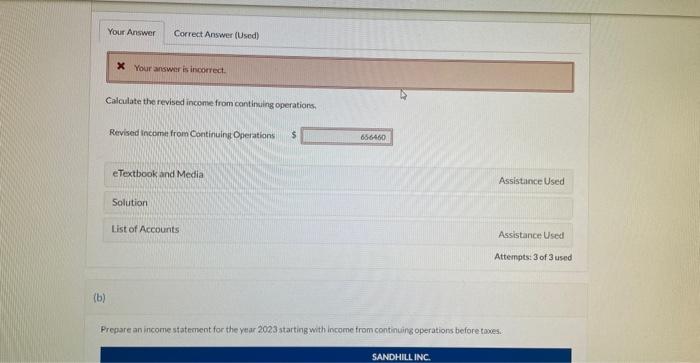

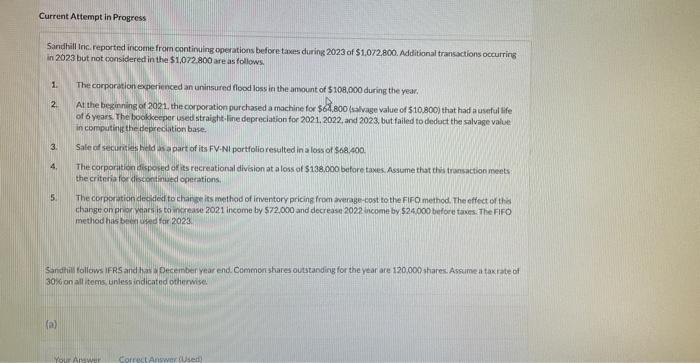

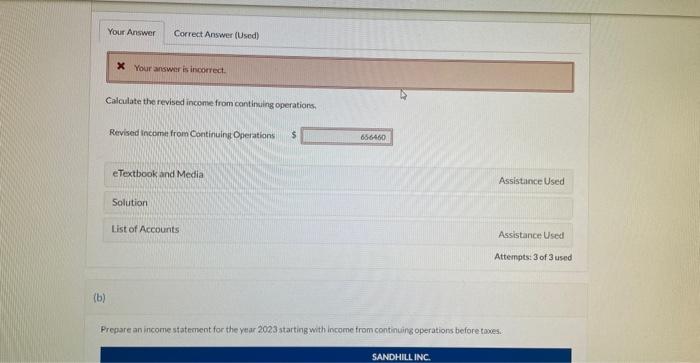

Prepare an income statement for the year 2023 starting with income from continuing operations before taxes. Sandhill Iric. reported inceme from continuing operations before tapes during 2023 of $1.072.800. Additional transactions occurring in 2023 but not considered in the 51,072800 are as follows. 1. The corporation experienced an uninsured flood loss in the amount of $108,000 during the year, 2. At the beginning of 2021 , the corporation purchased a machine for 564.800 (s wage value of 510.800) that had a useful life of 6 years. The bookkeeper used straight-line depreciation for 2021,2022 , and 2023 , but failed to dedect the salvage value in corpatinie the deprocation base. 3. Sale of secunties hicld as apart of its FV-N1 portfolio resulted in a loss of $68.400 4. The corporation disposed of its recreational division at aloss of 5138,000 before taves. Assume that this transaction ments: the critpria for discon inued ogerations. 5. The corporationdecifed to charse its method of imventory pricing from average-cost to the fir O method. The effect of thid change on procyers is to increase 2021 income by $72,000 and decrease 2022 income by $24,000 before taxes. The Fifo method has beor wied far 2023 . Sandrii fallows IFRS and has y December year end. Common shares outstanding for the year are 120000 shares. Assameat tax rate of 30% on all items uniess indicated otherwise. Calculate the revised income from continuing operations, Revised income from Continuing Operations $5 eTextbook and Media Solution List of Accounts (b) Prepare an income statement for the year 2023 starting with income trom continuing operations before towes. Prepare an income statement for the year 2023 starting with income from continuing operations before taxes. Sandhill Iric. reported inceme from continuing operations before tapes during 2023 of $1.072.800. Additional transactions occurring in 2023 but not considered in the 51,072800 are as follows. 1. The corporation experienced an uninsured flood loss in the amount of $108,000 during the year, 2. At the beginning of 2021 , the corporation purchased a machine for 564.800 (s wage value of 510.800) that had a useful life of 6 years. The bookkeeper used straight-line depreciation for 2021,2022 , and 2023 , but failed to dedect the salvage value in corpatinie the deprocation base. 3. Sale of secunties hicld as apart of its FV-N1 portfolio resulted in a loss of $68.400 4. The corporation disposed of its recreational division at aloss of 5138,000 before taves. Assume that this transaction ments: the critpria for discon inued ogerations. 5. The corporationdecifed to charse its method of imventory pricing from average-cost to the fir O method. The effect of thid change on procyers is to increase 2021 income by $72,000 and decrease 2022 income by $24,000 before taxes. The Fifo method has beor wied far 2023 . Sandrii fallows IFRS and has y December year end. Common shares outstanding for the year are 120000 shares. Assameat tax rate of 30% on all items uniess indicated otherwise. Calculate the revised income from continuing operations, Revised income from Continuing Operations $5 eTextbook and Media Solution List of Accounts (b) Prepare an income statement for the year 2023 starting with income trom continuing operations before towes