Answered step by step

Verified Expert Solution

Question

1 Approved Answer

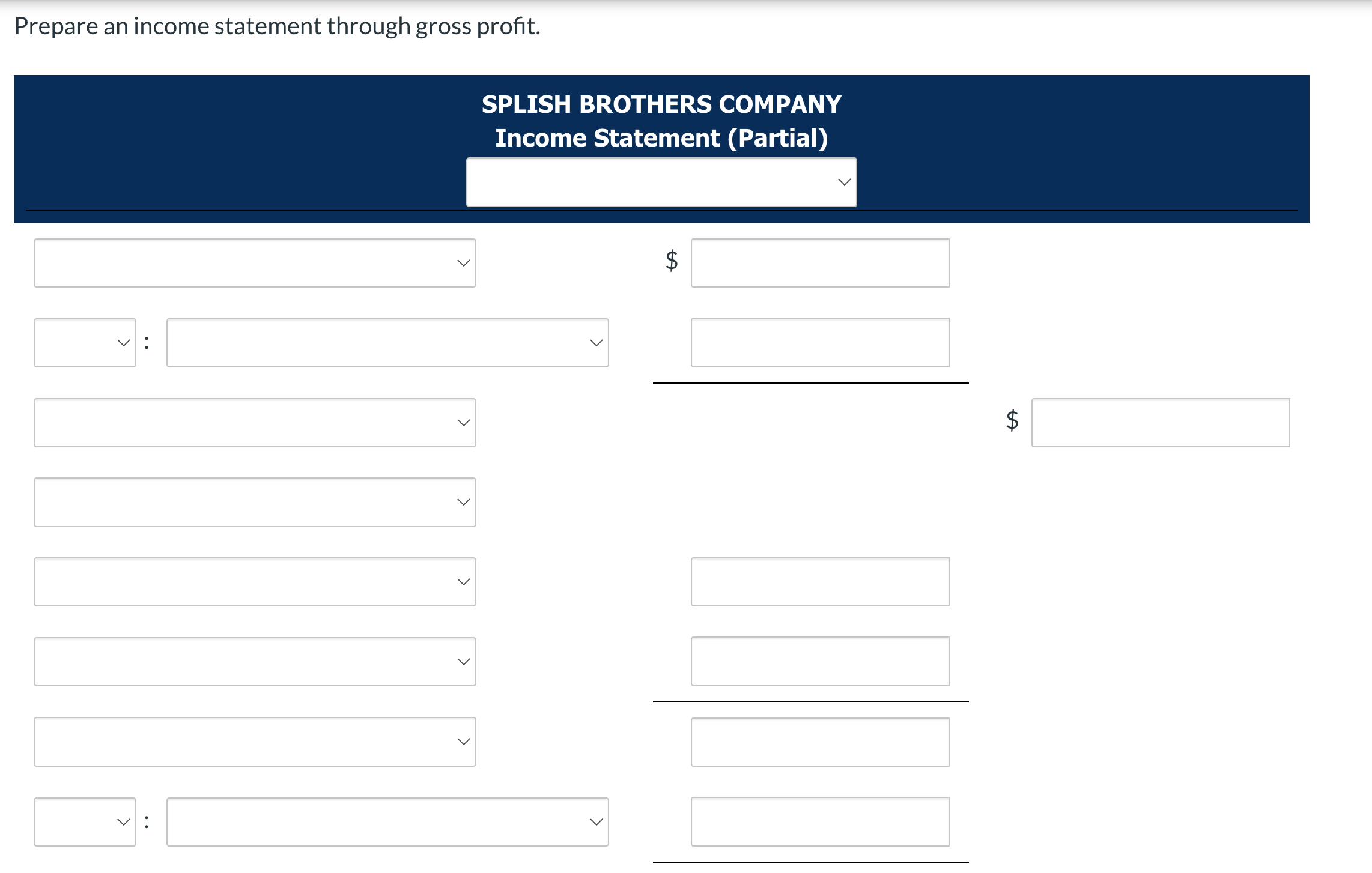

Prepare an income statement through gross profit. SPLISH BROTHERS COMPANY Income Statement (Partial) $ $ The following data were taken from the records of

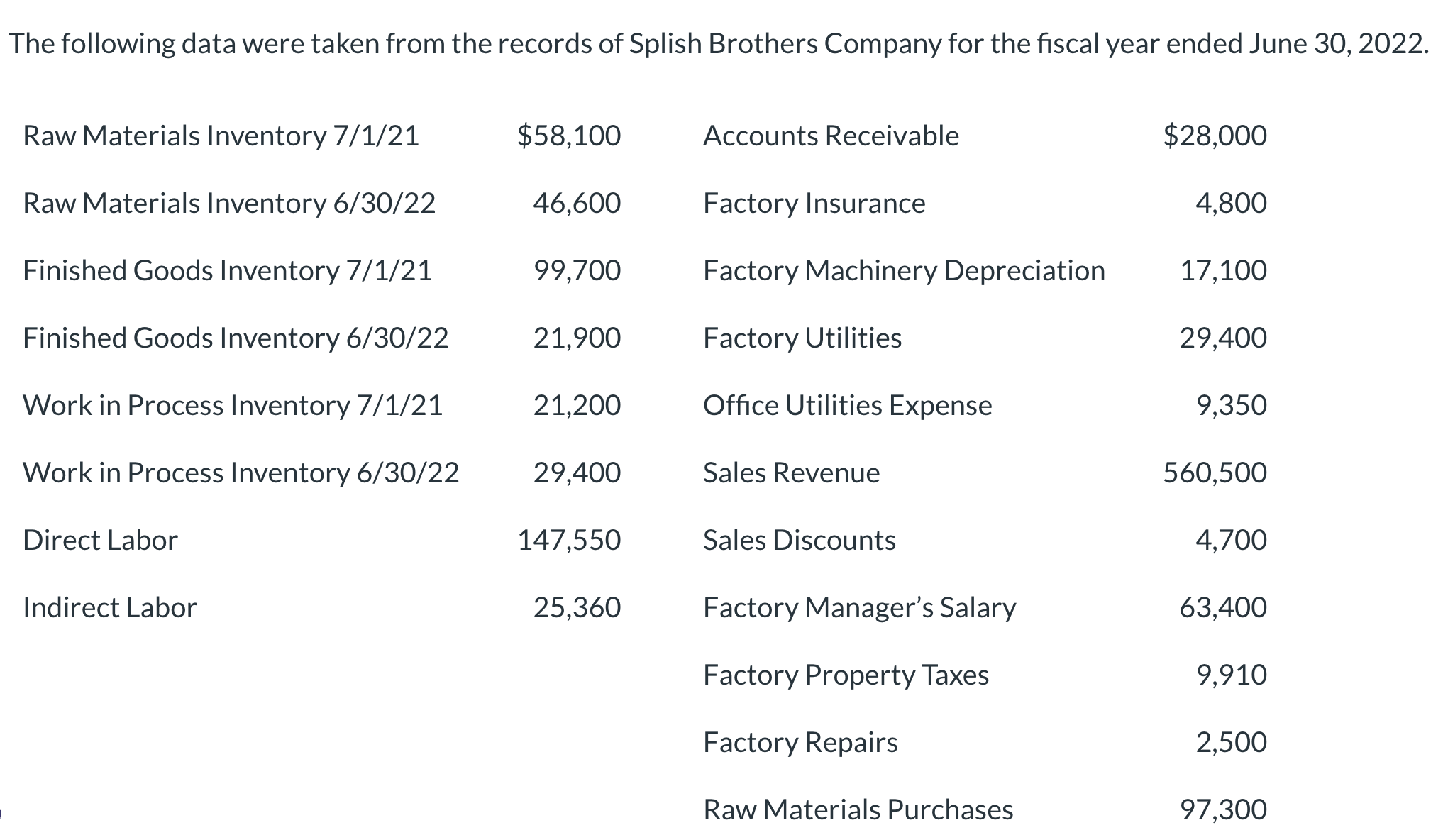

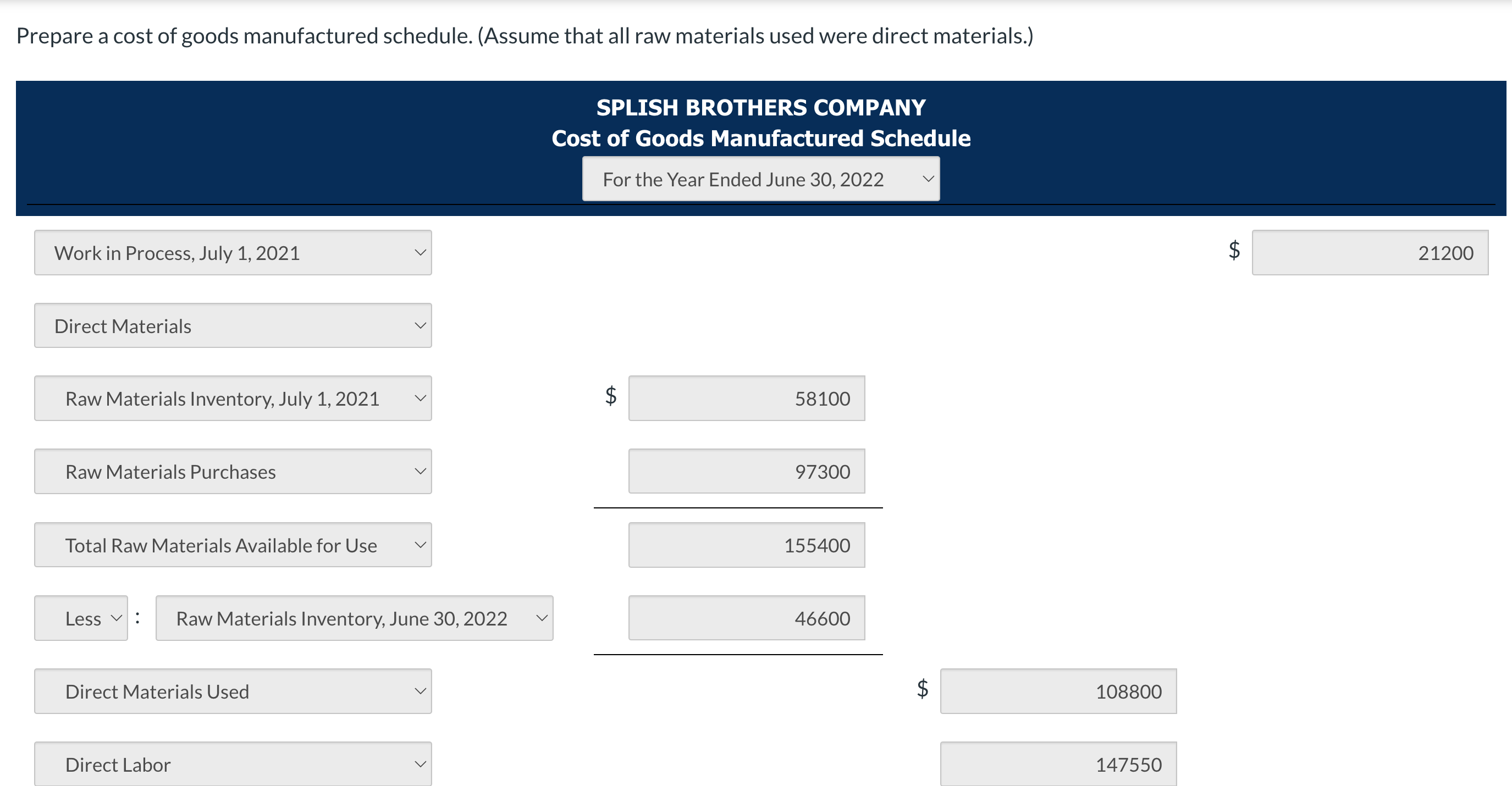

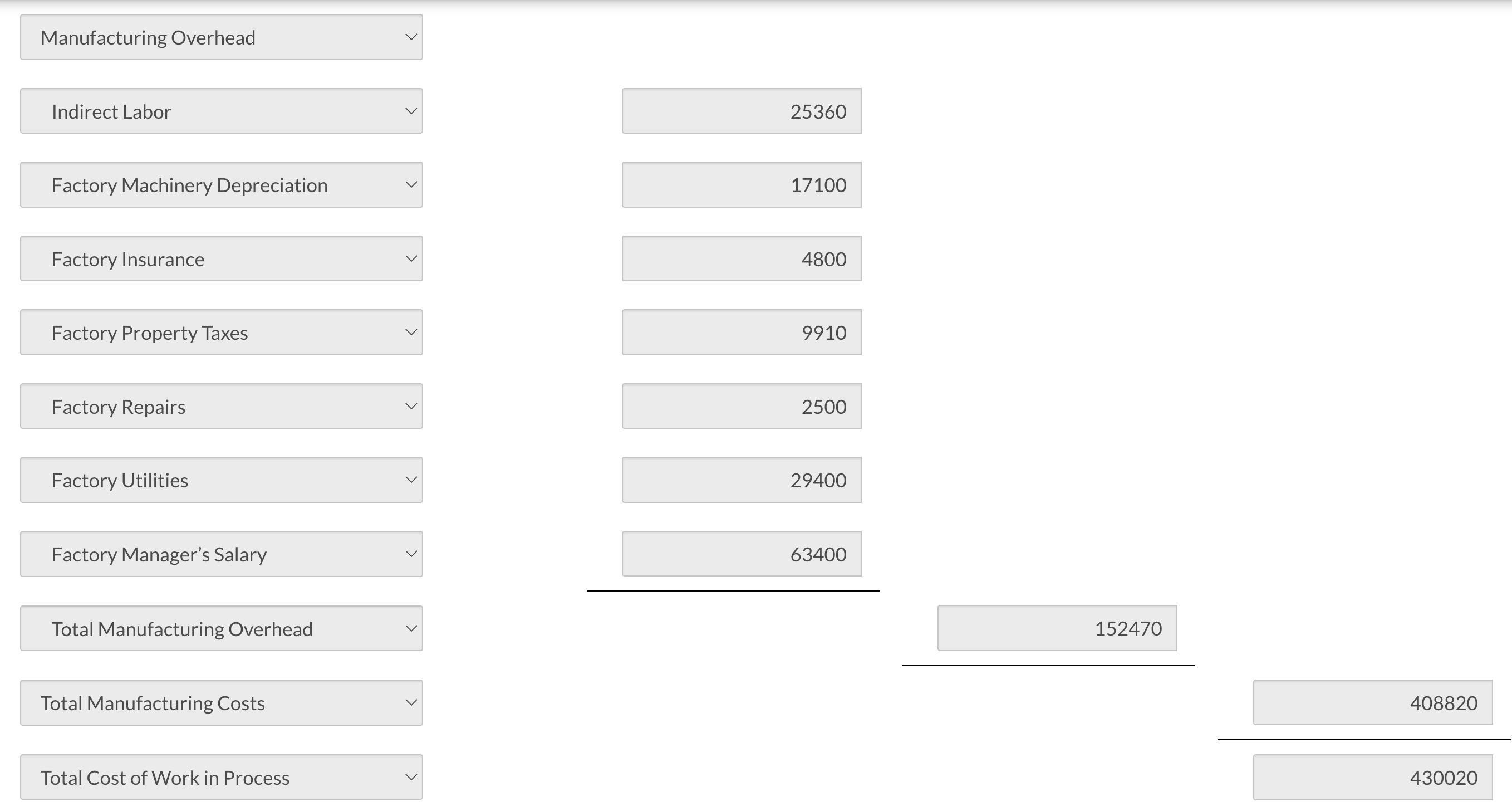

Prepare an income statement through gross profit. SPLISH BROTHERS COMPANY Income Statement (Partial) $ $ The following data were taken from the records of Splish Brothers Company for the fiscal year ended June 30, 2022. Raw Materials Inventory 7/1/21 $58,100 Accounts Receivable $28,000 Raw Materials Inventory 6/30/22 46,600 Factory Insurance 4,800 Finished Goods Inventory 7/1/21 99,700 Factory Machinery Depreciation 17,100 Finished Goods Inventory 6/30/22 21,900 Factory Utilities 29,400 Work in Process Inventory 7/1/21 21,200 Office Utilities Expense 9,350 Work in Process Inventory 6/30/22 29,400 Sales Revenue 560,500 Direct Labor 147,550 Sales Discounts 4,700 Indirect Labor 25,360 Factory Manager's Salary 63,400 Factory Property Taxes 9,910 Factory Repairs 2,500 Raw Materials Purchases 97,300 Prepare a cost of goods manufactured schedule. (Assume that all raw materials used were direct materials.) Work in Process, July 1, 2021 Direct Materials Raw Materials Inventory, July 1, 2021 Raw Materials Purchases Total Raw Materials Available for Use > SPLISH BROTHERS COMPANY Cost of Goods Manufactured Schedule For the Year Ended June 30, 2022 A 58100 97300 155400 Less Raw Materials Inventory, June 30, 2022 46600 Direct Materials Used Direct Labor $ 108800 147550 $ AA 21200 Manufacturing Overhead Indirect Labor Factory Machinery Depreciation Factory Insurance Factory Property Taxes Factory Repairs Factory Utilities Factory Manager's Salary Total Manufacturing Overhead Total Manufacturing Costs Total Cost of Work in Process > > 25360 17100 4800 9910 2500 29400 63400 152470 408820 430020 Less Work in Process, June 30, 2022 Cost of Goods Manufactured > $ A 29400 400620

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started