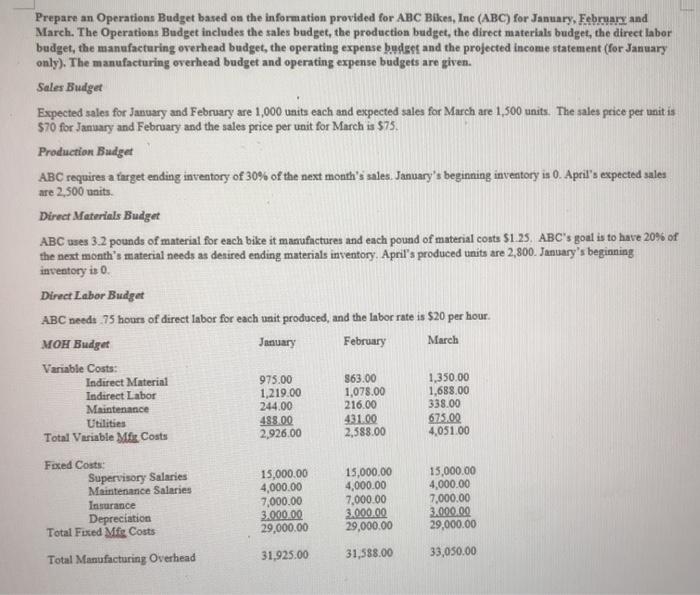

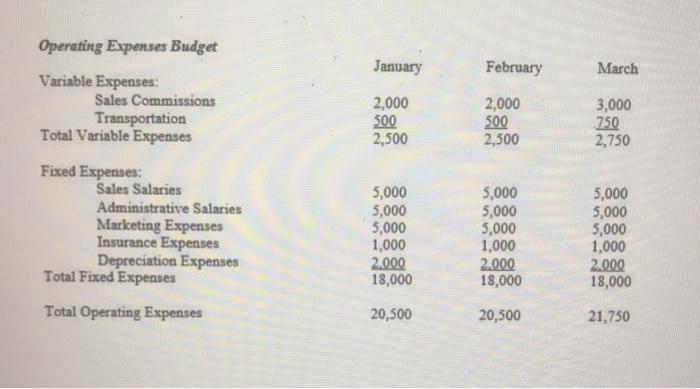

Prepare an Operations Budget based on the information provided for ABC Bikes, Ine (ABC) for January, February and March. The Operations Budget includes the sales budget, the production budget, the direct materials budget, the direct labor budget, the manufacturing overhead budget, the operating expense budget and the projected income statement (for January only). The manufacturing overhead budget and operating expense budgets are given. Sales Budget Expected sales for January and February are 1,000 units each and expected sales for March are 1,500 units. The sales price per unit is 570 for January and February and the sales price per unit for March is $75. Production Budget ABC requires a target ending inventory of 30% of the next month's sales. January's beginning inventory is 0. April's expected sales are 2,500 units Direct Materials Budget ABC uses 3.2 pounds of material for each bike it manufactures and each pound of material costs $1.25. ABC's goal is to have 20% of the next month's material needs as desired ending materials inventory. April's produced units are 2,800. January's beginning inventory in 0. Direct Labor Budget ABC needs 75 hours of direct labor for each unit produced, and the Inbor rate is $20 per hour. MOH Budget January February March Variable Costs: Indirect Material 563.00 1,350.00 1,219.00 1,078.00 1,688.00 Maintenance 244.00 216.00 Utilities 675.00 Total Variable Mix Costs 2,926.00 2,588.00 4,051.00 975.00 Indirect Labor 338.00 488.00 431.00 Foxed Costs: Supervisory Salaries Maintenance Salaries Insurance Depreciation Total Fixed Me Costs 15,000.00 4,000.00 7,000.00 3.000.00 29,000.00 15,000.00 4,000.00 7,000.00 3.000.00 29,000.00 15,000.00 4,000.00 7.000.00 3.000.00 29,000.00 31,925.00 Total Manufacturing Overhead 31,588.00 33,050.00 January February March Operating Expenses Budget Variable Expenses: Sales Commissions Transportation Total Variable Expenses 2,000 300 2,500 2,000 500 2,500 3,000 750 2,750 Fixed Expenses: Sales Salaries Administrative Salaries Marketing Expenses Insurance Expenses Depreciation Expenses Total Fixed Expenses 5,000 5,000 5,000 1,000 2.000 18,000 5,000 5,000 5,000 1,000 2.000 18,000 5,000 5,000 5,000 1,000 2.000 18,000 Total Operating Expenses 20,500 20,500 21,750