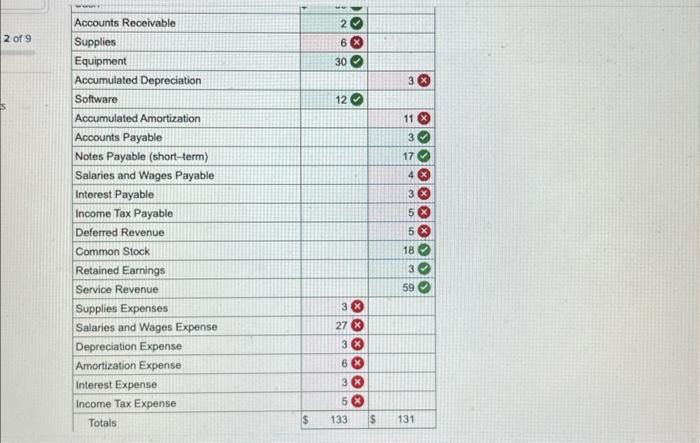

prepare an unadjusted trial balance.

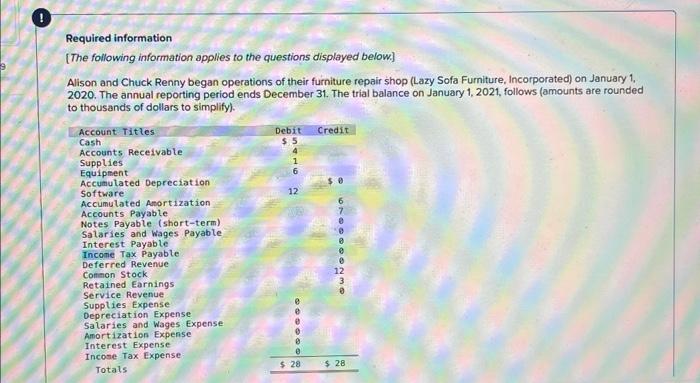

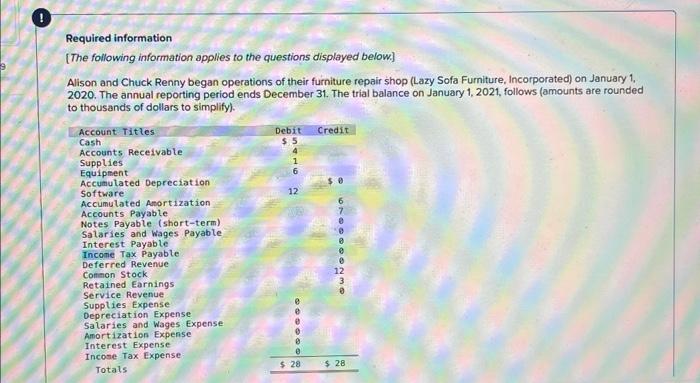

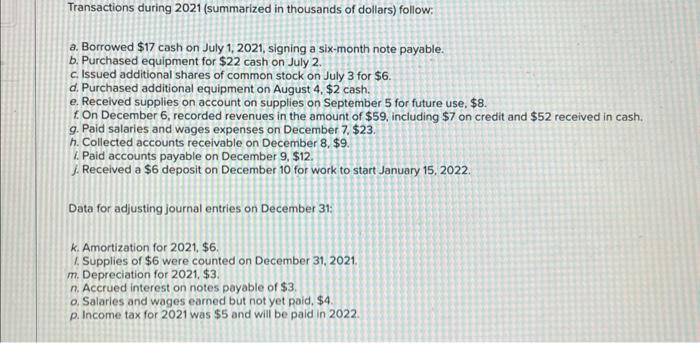

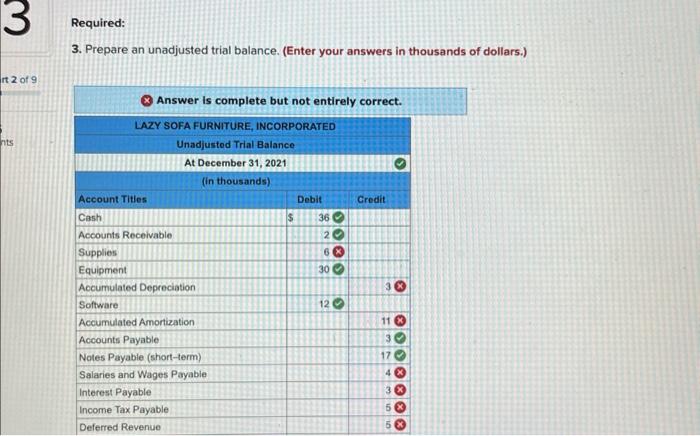

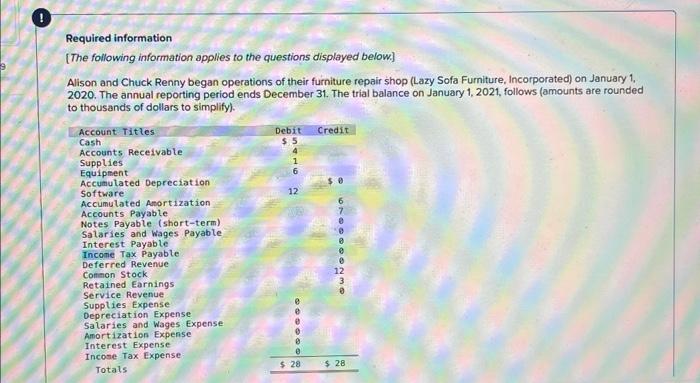

Required information [The following information applies to the questions displayed below] Alison and Chuck Renny began operations of their furniture repair shop (Lazy Sofa Furniture, Incorporated) on January 1. 2020. The annual reporting period ends December 31 . The trial balance on January 1,2021, follows (amounts are rounded to thousands of dollars to simplify). Transactions during 2021 (summarized in thousands of dollars) follow: a. Borrowed $17 cash on July 1,2021, signing a six-month note payable. b. Purchased equipment for $22 cash on July 2 . c. Issued additional shares of common stock on July 3 for $6. d. Purchased additional equipment on August 4, \$2 cash. e. Received supplies on account on supplies on September 5 for future use, $8. f. On December 6 , recorded revenues in the amount of $59, including $7 on credit and $52 received in cash. g. Paid salaries and wages expenses on December 7,$23. h. Collected accounts receivable on December 8,$9. 1. Paid accounts payable on December 9,$12. 7. Received a $6 deposit on December 10 for work to start January 15, 2022. Data for adjusting journal entries on December 31: k. Amortization for 2021,$6. 1. Supplies of $6 were counted on December 31, 2021. m. Depreciation for 2021, \$3. n. Accrued interest on notes payable of $3. o, Salaries and wages earned but not yet paid, \$4 p. Income tax for 2021 was $5 and will be paid in 2022 . 3. Prepare an unadjusted trial balance. (Enter your answers in thousands of dollars.) 2 of 9 \begin{tabular}{|c|c|c|} \hline Accounts Receivable & 20 & \\ \hline Supplies & 6 & \\ \hline Equipment & 300 & \\ \hline Accumulated Depreciation & & 3 \\ \hline Software & 120 & \\ \hline Accumulated Amortization & & 11 \\ \hline Accounts Payable & & 30 \\ \hline Notes Payable (short-term) & & 170 \\ \hline Salaries and Wages Payable & & 4 \\ \hline Interest Payable & & 3 \\ \hline Income Tax Payable & & 5 \\ \hline Deferred Revenue & & 5 \\ \hline Common Stock & & 180 \\ \hline Retained Earnings & & 30 \\ \hline Service Revenue & & 590 \\ \hline Supplies Expenses & 3 & \\ \hline Salaries and Wages Expense & 27 & \\ \hline Depreciation Expense & 38 & \\ \hline Amortization Expense & 68 & \\ \hline Interest Expense & 38 & \\ \hline Income Tax Expense & 5 & \\ \hline Totals & 133 & 131 \\ \hline \end{tabular}