Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare and post adjusted journal entries. Dec 31, 2016 post-closing trial balance Record the following adjusted journal entries The entry F is refering to a

Prepare and post adjusted journal entries.

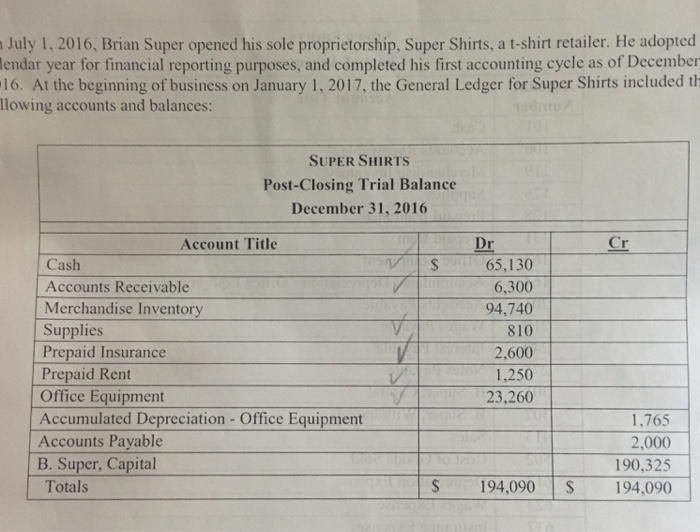

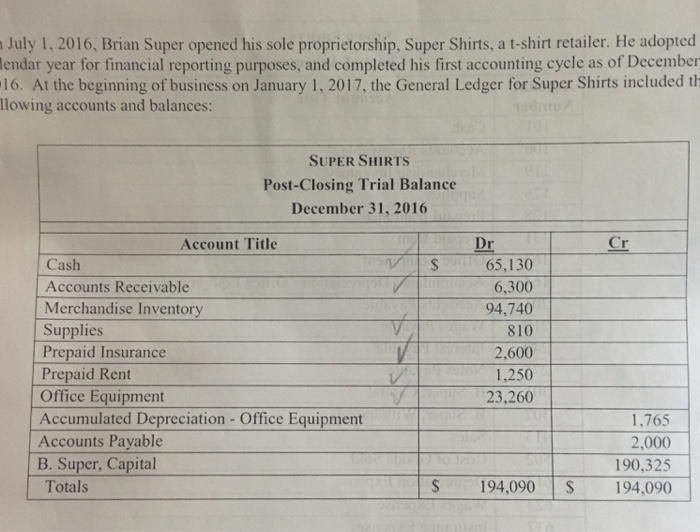

July 1, 2016, Brian Super opened his sole proprietorship, Super Shirts, a t-shirt retailer. He adopted lendar year for financial reporting purposes, and completed his first accounting cycle as of December 16. At the beginning of business on January 1, 2017, the General Ledger for Super Shirts included th llowing accounts and balances: SUPER SHIRTS Post-Closing Trial Balance December 31, 2016 Account Title Dr Cr Cash Accounts Receivable Merchandise Inventory Supplies Prepaid Insurance Prepaid Rent Office Equipment Accumulated Depreciation - Office Equipment Accounts Payable B. Super, Capital Totals 65,130 6,300 94,740 810 2,600 1,250 23,260 1.765 2,000 190,325 S 194,090 S 194,090 Dec 31, 2016 post-closing trial balance

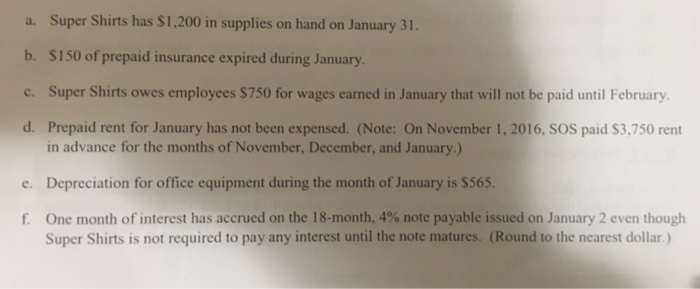

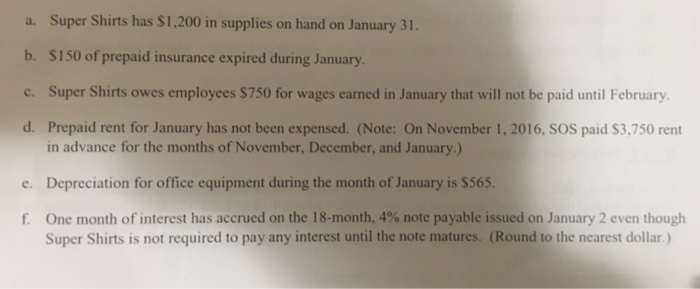

Record the following adjusted journal entries

The entry F is refering to a previous entry on Jan 2 that read Super Shirts purchased new office equipment at a cost of $10,500. The purchase was financed through a local bank by issuing an 18-month, 4% note payable. Interest will be paid at the maturity date

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started