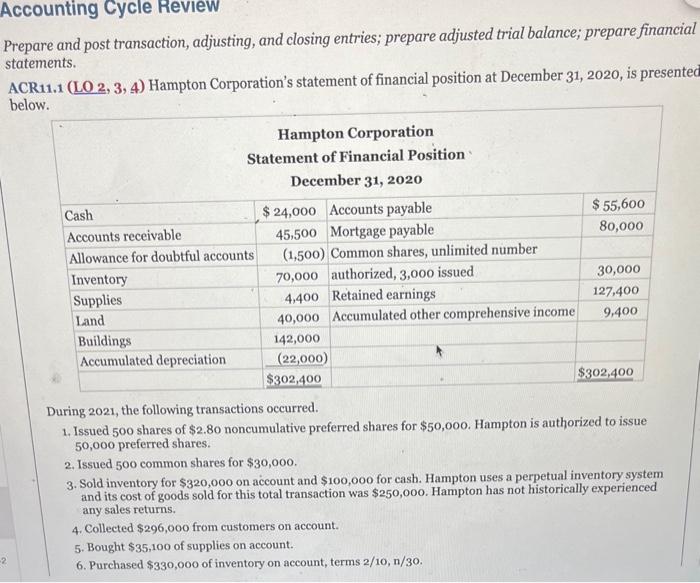

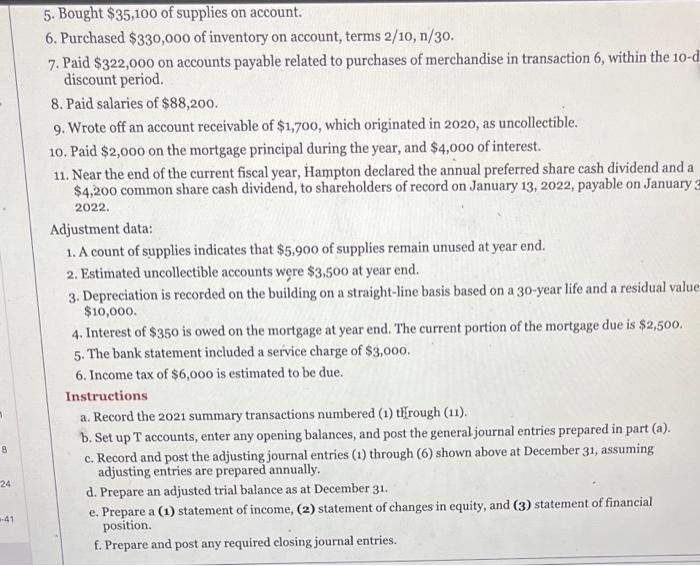

Prepare and post transaction, adjusting, and closing entries; prepare adjusted trial balance; prepare financial statements. ACR11.1 ( LO2,3,4 ) Hampton Corporation's statement of financial position at December 31, 2020, is presentec below. During 2021, the following transactions occurred. 1. Issued 500 shares of $2.80 noncumulative preferred shares for $50,000. Hampton is authorized to issue 50,000 preferred shares. 2. Issued 500 common shares for $30,000. 3. Sold inventory for $320,000 on account and $100,000 for cash. Hampton uses a perpetual inventory system and its cost of goods sold for this total transaction was $250,000. Hampton has not historically experienced any sales returns. 4. Collected $296,000 from customers on account. 5. Bought $35,100 of supplies on account. 6. Purchased $330,000 of inventory on account, terms 2/10,n/30. 5. Bought $35,100 of supplies on account. 6. Purchased $330,000 of inventory on account, terms 2/10, n/30. 7. Paid $322,000 on accounts payable related to purchases of merchandise in transaction 6 , within the 10-1 discount period. 8. Paid salaries of $88,200. 9. Wrote off an account receivable of $1,700, which originated in 2020 , as uncollectible. 10. Paid $2,000 on the mortgage principal during the year, and $4,000 of interest. 11. Near the end of the current fiscal year, Hampton declared the annual preferred share cash dividend and a $4,200 common share cash dividend, to shareholders of record on January 13,2022 , payable on January: 2022. Adjustment data: 1. A count of supplies indicates that $5,900 of supplies remain unused at year end. 2. Estimated uncollectible accounts were $3,500 at year end. 3. Depreciation is recorded on the building on a straight-line basis based on a 30 -year life and a residual valuc $10,000. 4. Interest of $350 is owed on the mortgage at year end. The current portion of the mortgage due is $2,500. 5. The bank statement included a service charge of $3,000. 6 . Income tax of $6,000 is estimated to be due. Instructions a. Record the 2021 summary transactions numbered (1) through (11). b. Set up T accounts, enter any opening balances, and post the general journal entries prepared in part (a). c. Record and post the adjusting journal entries (1) through (6) shown above at December 31 , assuming adjusting entries are prepared annually. d. Prepare an adjusted trial balance as at December 31 . e. Prepare a (1) statement of income, (2) statement of changes in equity, and (3) statement of financial position. f. Prepare and post any required closing journal entries