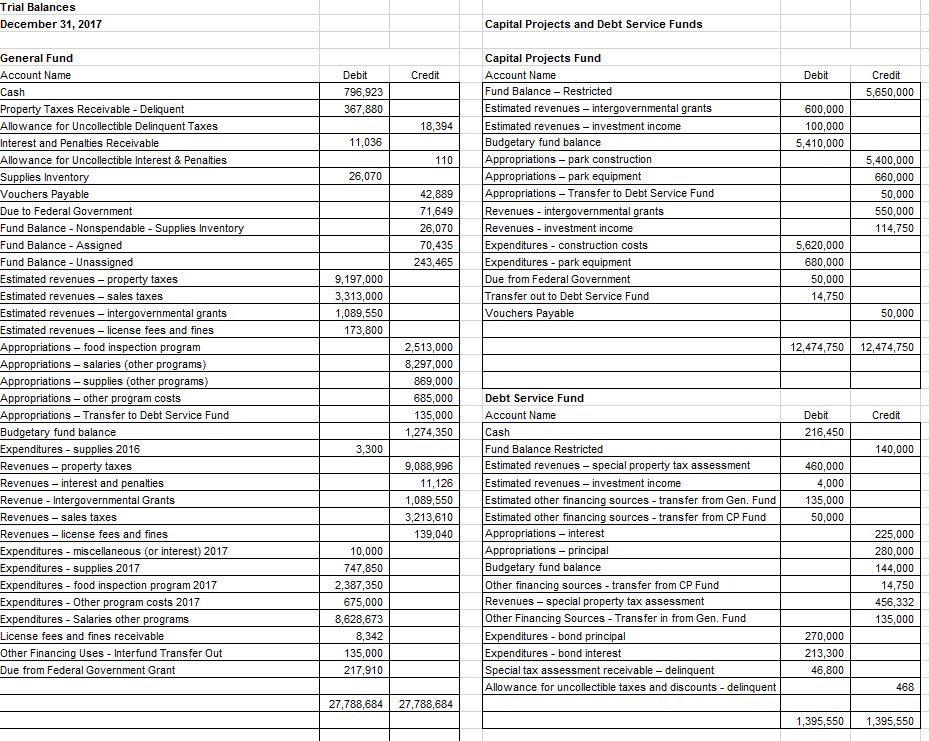

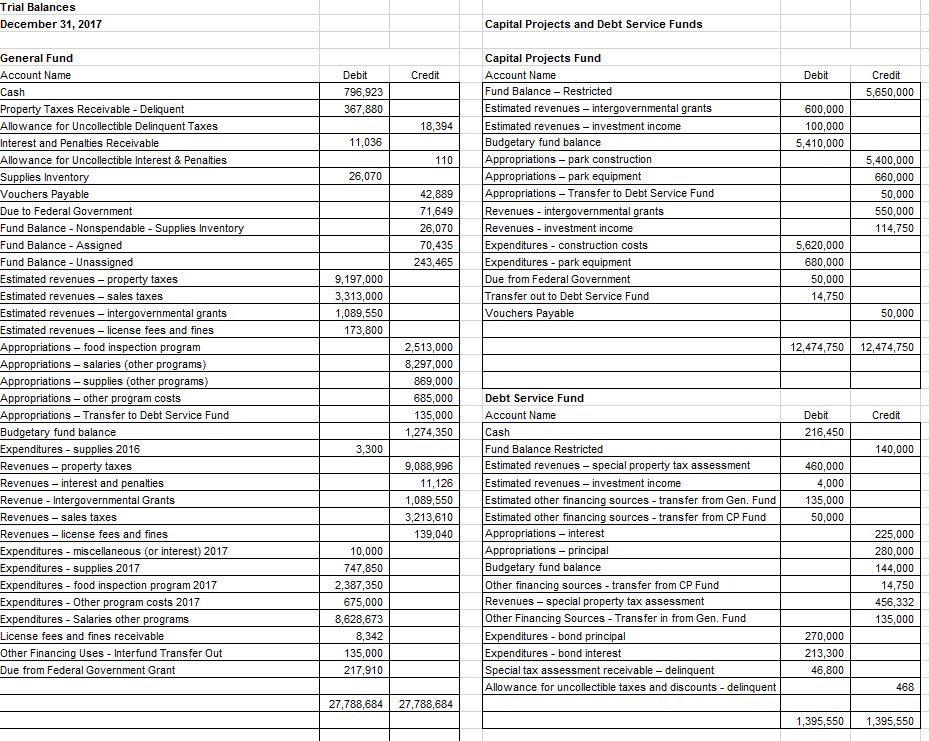

Prepare Balance Sheet based on the following trial balances:

Trial Balances December 31, 2017 Capital Projects and Debt Service Funds Account Name Credit Debit Credit 5,650,000 Debit Account Name Fund Balance Restricted Estimated revenues- intergovernmental grants Estimated revenues investment income Budgetary fund balance 796,923 Property Taxes Receivable Deliquent Allowance for Uncollectible Delinquent Taxes Interest and Penalties Receivable Allowance for Uncollectible Interest & Penalties Supplies Invento Vouchers Payable Due to Federal Government Fund Balance Nonspendable Supplies Invento Fund Balance Assigned Fund Balance Unassigned Estimated revenues-p Estimated revenues sales taxes Estimated revenues inter Estimated revenues - license fees and fines 600,000 5,410,000 ark constr 5,400,000 660,000 26,070 Appropriations - park equipment Appropriations Transfer to Debt Service Fund 550,000 114,750 Revenues investment income Expenditures construction costs Expenditures park equipment Due from Federal Government Transfer out to Debt Service Fund Vouchers Payable 26,070 70,435 243,465 5,620,000 680,000 50,000 9,197,000 3,313,000 1,089,550 es 2,513,000 8,297,000 869,000 685,000 12,474,750 12,474,750 ns - salaries ( Appropriations- supplies (other p Appropriations- other p Appropriations - Transfer to Debt Service Fund Budgetary fund balance Expenditures supplies 2016 Revenues Revenues-interest and penalties Revenue Revenues - sales taxes Revenues -license fees and fines Expenditures miscellaneous (or interest) 2017 Expenditures supplies 2017 Expenditures food inspection program 2017 Expenditures Other p Expenditures Salaries other programs License fees and fines receivable Other Financing Uses Interfund Transfer Out Due from Federal Government Grant ram costs Debt Service Fund Account Name Debit Credit 216,450 Fund Balance Restricted Estimated revenues - special property tax assessment Estimated revenues investment income Estimated other financing sources transfer from Gen. Fund Estimated other financing sources transfer from CP Fund Appropriations interest taxes 9,088,996 460,000 1,089,550 3,213,610 139,040 225,000 280,000 Budgetary fund balance Other financing sources transfer from CP Fund Revenues - special property tax assessment Other Financing Sources Transfer in from Gen. Fund Expenditures-bond Expenditures - bond interest Special tax assessment receivable delinquent Allowance for uncollectible taxes and discounts - delinquent 747,850 2,387,350 675,000 8,628,673 ram costs 2017 456,332 principal 270,000 468 27,788,684 27,788,684 1,395,550 1,395,550