Question

Prepare cash flow statement of Rays and Rise Corporation using the indirect method. Rays Additional Information: Net income for the year amounted to $604,000. Net

Prepare cash flow statement of Rays and Rise Corporation using the indirect method.

Rays Additional Information:

Net income for the year amounted to $604,000. Net sales are $1,100,000, dividends revenue are $10,000, interest revenue is $9,000, Cost of goods sold are $292,000, operating expenses are 320,000 including depreciation expense of $60,000, interest expense is $119,000 and tax expense is $136,000.

Purchased $600,000 in plant assets, paying $460,000 cash and issuing a long term note payable for the $140,000 balance. Plant asset sold for $413,000 with a book value of $311,000.

Moreover Market securities account shows debit entries of $365,000 representing the cost of securities purchased. It also shows a credit entry of $234,000 representing the cost of securities sold.

Furthermore, Notes Receivable accounts shows $417,000 in debt entries represent cash loaned by Rays Corporation to borrower during the year and $615,000 in credit entry represents collections of notes receivable.

During the year, Rays Corporation borrowed $819,000 cash by issuing short term notes payable to banks. Also, the company repaid $917,000 in principle amount due on these loans. The company issued 6,000 shares of $20 par value capital stock for cash at a price of $117 per share.

Market securities costing $370,000 were sold for $466,000 resulting in non operating gain.

Rise Additional Information:

Net income for the year amounted to $450,000. Net sales are $1,100,000, dividends revenue are $10,000, interest revenue is $9,000, Cost of goods sold are $392,000, operating expenses are 220,000 including depreciation expense of $60,000, interest expense is $41,000 and tax expense is $41,000.

Purchased $600,000 in plant assets, paying $460,000 cash and issuing a long term note payable for the $140,000 balance. Plant asset sold for $413,000 with a book value of $311,000.

Moreover Market securities account shows debit entries of $365,000 representing the cost of securities purchased. It also shows a credit entry of $234,000 representing the cost of securities sold.

Furthermore, Notes Receivable accounts shows $417,000 in debt entries represent cash loaned by Rise Corporation to borrower during the year and $915,000 in credit entry represents collections of notes receivable.

During the year, Rise Corporation borrowed $776,000 cash by issuing short term notes payable to banks. Also, the company repaid $917,000 in principle amount due on these loans. The company issued 3,000 shares of $40 par value capital stock for cash at a price of $58 per share.

Market securities costing $476,000 were sold for $399,000 resulting in non operating loss.

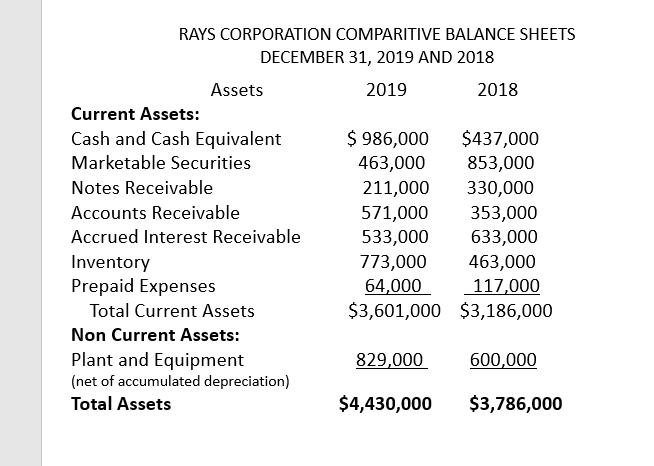

RAYS CORPORATION COMPARITIVE BALANCE SHEETS DECEMBER 31, 2019 AND 2018 Assets 2019 2018 Current Assets: Cash and Cash Equivalent Marketable Securities $ 986,000 $437,000 853,000 463,000 Notes Receivable 211,000 571,000 533,000 330,000 Accounts Receivable 353,000 633,000 Accrued Interest Receivable 773,000 Inventory Prepaid Expenses 463,000 117,000 $3,601,000 $3,186,000 64,000 Total Current Assets Non Current Assets: Plant and Equipment 829,000 600,000 (net of accumulated depreciation) Total Assets $4,430,000 $3,786,000

Step by Step Solution

3.44 Rating (179 Votes )

There are 3 Steps involved in it

Step: 1

Answere PARTICULARS A CASH FLOW FROM OPERATING ACTIVITIES NET IN...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started