Answered step by step

Verified Expert Solution

Question

1 Approved Answer

prepare cash flow statement The following figures have been extracted from the books of X Limited for the year ended on 31.3.2019. You are required

prepare cash flow statement

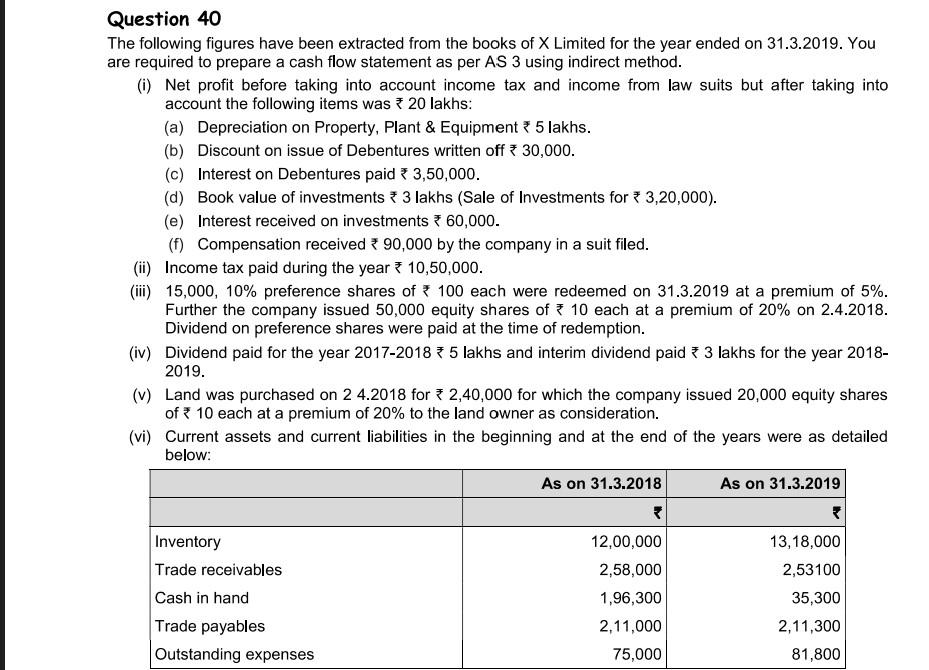

The following figures have been extracted from the books of X Limited for the year ended on 31.3.2019. You are required to prepare a cash flow statement as per AS 3 using indirect method. (i) Net profit before taking into account income tax and income from law suits but after taking into account the following items was 20 lakhs: (a) Depreciation on Property, Plant \& Equipment 5 lakhs. (b) Discount on issue of Debentures written off 30,000 . (c) Interest on Debentures paid 3,50,000. (d) Book value of investments 3 lakhs (Sale of Investments for 3,20,000). (e) Interest received on investments 60,000. (f) Compensation received 90,000 by the company in a suit filed. (ii) Income tax paid during the year 10,50,000. (iii) 15,000,10% preference shares of 100 each were redeemed on 31.3 .2019 at a premium of 5%. Further the company issued 50,000 equity shares of 10 each at a premium of 20% on 2.4 .2018 . Dividend on preference shares were paid at the time of redemption. (iv) Dividend paid for the year 2017-2018 5 lakhs and interim dividend paid 3 lakhs for the year 20182019. (v) Land was purchased on 24.2018 for 2,40,000 for which the company issued 20,000 equity shares of 10 each at a premium of 20% to the land owner as consideration. (vi) Current assets and current liabilities in the beginning and at the end of the years were as detailedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started