Answered step by step

Verified Expert Solution

Question

1 Approved Answer

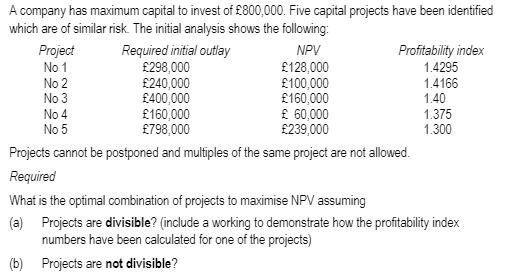

A company has maximum capital to invest of 800,000. Five capital projects have been identified which are of similar risk. The initial analysis shows

A company has maximum capital to invest of 800,000. Five capital projects have been identified which are of similar risk. The initial analysis shows the following: Required initial outlay Project No 1 No 2 No 3 NPV 298,000 128,000 240,000 100,000 400,000 160,000 160,000 60,000 798,000 239,000 Projects cannot be postponed and multiples of the same project are not allowed. Required Profitability index 1.4295 1.4166 No 4 No 5 1.40 1.375 1.300 What is the optimal combination of projects to maximise NPV assuming (a) Projects are divisible? (include a working to demonstrate how the profitability index numbers have been calculated for one of the projects) (b) Projects are not divisible?

Step by Step Solution

★★★★★

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

A company has maximum capital to invest of 1800000 Five capital pro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started