Answered step by step

Verified Expert Solution

Question

1 Approved Answer

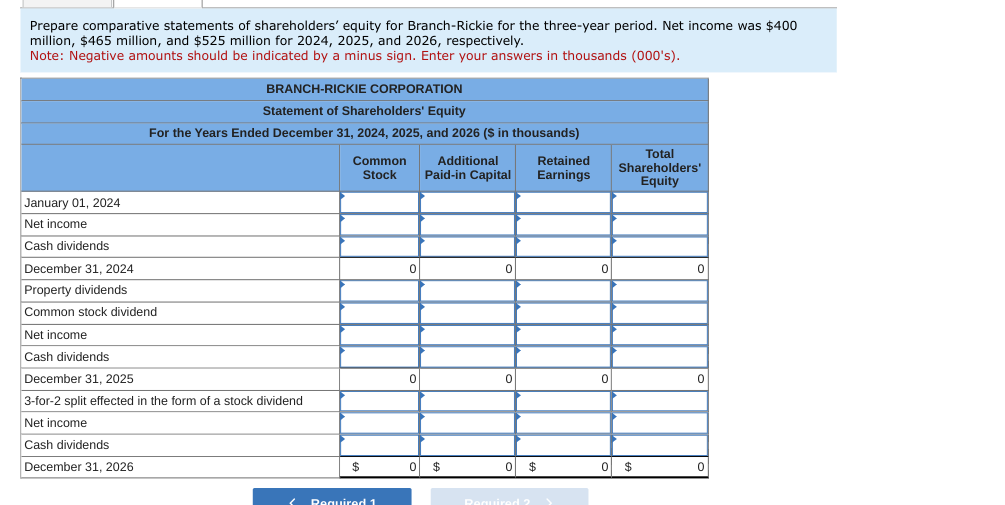

Prepare comparative statements of shareholders' equity for Branch-Rickie for the three-year period. Net income was $400 million, $465 million, and $525 million for 2024, 2025,

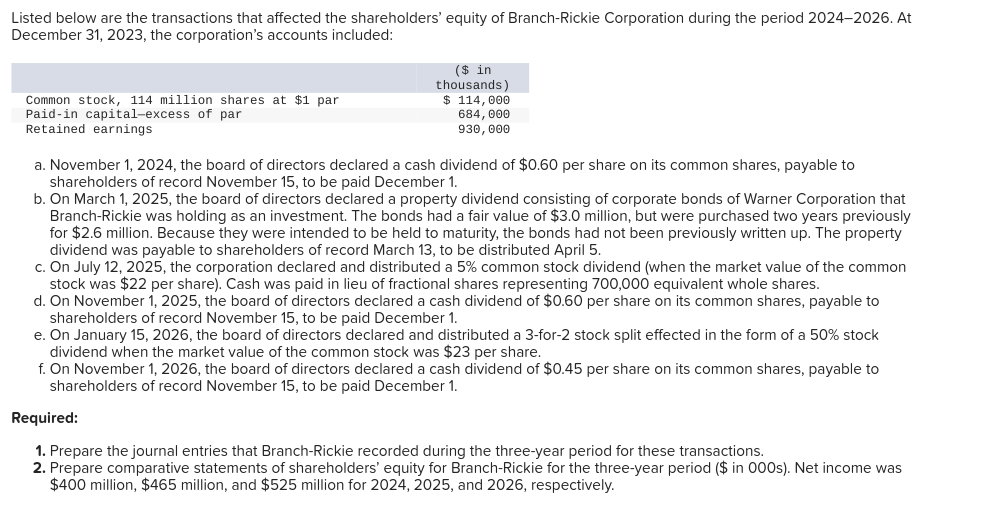

Prepare comparative statements of shareholders' equity for Branch-Rickie for the three-year period. Net income was $400 million, $465 million, and $525 million for 2024, 2025, and 2026, respectively. Note: Negative amounts should be indicated by a minus sign. Enter your answers in thousands (000's). Listed below are the transactions that affected the shareholders' equity of Branch-Rickie Corporation during the period 2024-2026. At December 31, 2023, the corporation's accounts included: a. November 1, 2024, the board of directors declared a cash dividend of $0.60 per share on its common shares, payable to shareholders of record November 15 , to be paid December 1. b. On March 1, 2025, the board of directors declared a property dividend consisting of corporate bonds of Warner Corporation that Branch-Rickie was holding as an investment. The bonds had a fair value of $3.0 million, but were purchased two years previously for $2.6 million. Because they were intended to be held to maturity, the bonds had not been previously written up. The property dividend was payable to shareholders of record March 13 , to be distributed April 5 . c. On July 12, 2025, the corporation declared and distributed a 5% common stock dividend (when the market value of the common stock was $22 per share). Cash was paid in lieu of fractional shares representing 700,000 equivalent whole shares. d. On November 1, 2025, the board of directors declared a cash dividend of $0.60 per share on its common shares, payable to shareholders of record November 15 , to be paid December 1. e. On January 15, 2026, the board of directors declared and distributed a 3-for-2 stock split effected in the form of a 50% stock dividend when the market value of the common stock was $23 per share. f. On November 1, 2026, the board of directors declared a cash dividend of $0.45 per share on its common shares, payable to shareholders of record November 15 , to be paid December 1 . Required: 1. Prepare the journal entries that Branch-Rickie recorded during the three-year period for these transactions. 2. Prepare comparative statements of shareholders' equity for Branch-Rickie for the three-year period (\$ in 000s). Net income was $400 million, $465 million, and $525 million for 2024,2025 , and 2026 , respectively. Prepare comparative statements of shareholders' equity for Branch-Rickie for the three-year period. Net income was $400 million, $465 million, and $525 million for 2024, 2025, and 2026, respectively. Note: Negative amounts should be indicated by a minus sign. Enter your answers in thousands (000's). Listed below are the transactions that affected the shareholders' equity of Branch-Rickie Corporation during the period 2024-2026. At December 31, 2023, the corporation's accounts included: a. November 1, 2024, the board of directors declared a cash dividend of $0.60 per share on its common shares, payable to shareholders of record November 15 , to be paid December 1. b. On March 1, 2025, the board of directors declared a property dividend consisting of corporate bonds of Warner Corporation that Branch-Rickie was holding as an investment. The bonds had a fair value of $3.0 million, but were purchased two years previously for $2.6 million. Because they were intended to be held to maturity, the bonds had not been previously written up. The property dividend was payable to shareholders of record March 13 , to be distributed April 5 . c. On July 12, 2025, the corporation declared and distributed a 5% common stock dividend (when the market value of the common stock was $22 per share). Cash was paid in lieu of fractional shares representing 700,000 equivalent whole shares. d. On November 1, 2025, the board of directors declared a cash dividend of $0.60 per share on its common shares, payable to shareholders of record November 15 , to be paid December 1. e. On January 15, 2026, the board of directors declared and distributed a 3-for-2 stock split effected in the form of a 50% stock dividend when the market value of the common stock was $23 per share. f. On November 1, 2026, the board of directors declared a cash dividend of $0.45 per share on its common shares, payable to shareholders of record November 15 , to be paid December 1 . Required: 1. Prepare the journal entries that Branch-Rickie recorded during the three-year period for these transactions. 2. Prepare comparative statements of shareholders' equity for Branch-Rickie for the three-year period (\$ in 000s). Net income was $400 million, $465 million, and $525 million for 2024,2025 , and 2026 , respectively

Prepare comparative statements of shareholders' equity for Branch-Rickie for the three-year period. Net income was $400 million, $465 million, and $525 million for 2024, 2025, and 2026, respectively. Note: Negative amounts should be indicated by a minus sign. Enter your answers in thousands (000's). Listed below are the transactions that affected the shareholders' equity of Branch-Rickie Corporation during the period 2024-2026. At December 31, 2023, the corporation's accounts included: a. November 1, 2024, the board of directors declared a cash dividend of $0.60 per share on its common shares, payable to shareholders of record November 15 , to be paid December 1. b. On March 1, 2025, the board of directors declared a property dividend consisting of corporate bonds of Warner Corporation that Branch-Rickie was holding as an investment. The bonds had a fair value of $3.0 million, but were purchased two years previously for $2.6 million. Because they were intended to be held to maturity, the bonds had not been previously written up. The property dividend was payable to shareholders of record March 13 , to be distributed April 5 . c. On July 12, 2025, the corporation declared and distributed a 5% common stock dividend (when the market value of the common stock was $22 per share). Cash was paid in lieu of fractional shares representing 700,000 equivalent whole shares. d. On November 1, 2025, the board of directors declared a cash dividend of $0.60 per share on its common shares, payable to shareholders of record November 15 , to be paid December 1. e. On January 15, 2026, the board of directors declared and distributed a 3-for-2 stock split effected in the form of a 50% stock dividend when the market value of the common stock was $23 per share. f. On November 1, 2026, the board of directors declared a cash dividend of $0.45 per share on its common shares, payable to shareholders of record November 15 , to be paid December 1 . Required: 1. Prepare the journal entries that Branch-Rickie recorded during the three-year period for these transactions. 2. Prepare comparative statements of shareholders' equity for Branch-Rickie for the three-year period (\$ in 000s). Net income was $400 million, $465 million, and $525 million for 2024,2025 , and 2026 , respectively. Prepare comparative statements of shareholders' equity for Branch-Rickie for the three-year period. Net income was $400 million, $465 million, and $525 million for 2024, 2025, and 2026, respectively. Note: Negative amounts should be indicated by a minus sign. Enter your answers in thousands (000's). Listed below are the transactions that affected the shareholders' equity of Branch-Rickie Corporation during the period 2024-2026. At December 31, 2023, the corporation's accounts included: a. November 1, 2024, the board of directors declared a cash dividend of $0.60 per share on its common shares, payable to shareholders of record November 15 , to be paid December 1. b. On March 1, 2025, the board of directors declared a property dividend consisting of corporate bonds of Warner Corporation that Branch-Rickie was holding as an investment. The bonds had a fair value of $3.0 million, but were purchased two years previously for $2.6 million. Because they were intended to be held to maturity, the bonds had not been previously written up. The property dividend was payable to shareholders of record March 13 , to be distributed April 5 . c. On July 12, 2025, the corporation declared and distributed a 5% common stock dividend (when the market value of the common stock was $22 per share). Cash was paid in lieu of fractional shares representing 700,000 equivalent whole shares. d. On November 1, 2025, the board of directors declared a cash dividend of $0.60 per share on its common shares, payable to shareholders of record November 15 , to be paid December 1. e. On January 15, 2026, the board of directors declared and distributed a 3-for-2 stock split effected in the form of a 50% stock dividend when the market value of the common stock was $23 per share. f. On November 1, 2026, the board of directors declared a cash dividend of $0.45 per share on its common shares, payable to shareholders of record November 15 , to be paid December 1 . Required: 1. Prepare the journal entries that Branch-Rickie recorded during the three-year period for these transactions. 2. Prepare comparative statements of shareholders' equity for Branch-Rickie for the three-year period (\$ in 000s). Net income was $400 million, $465 million, and $525 million for 2024,2025 , and 2026 , respectively Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started