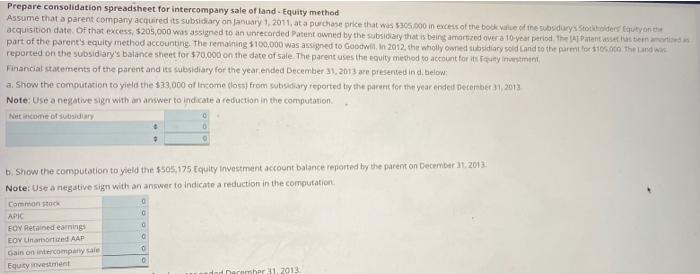

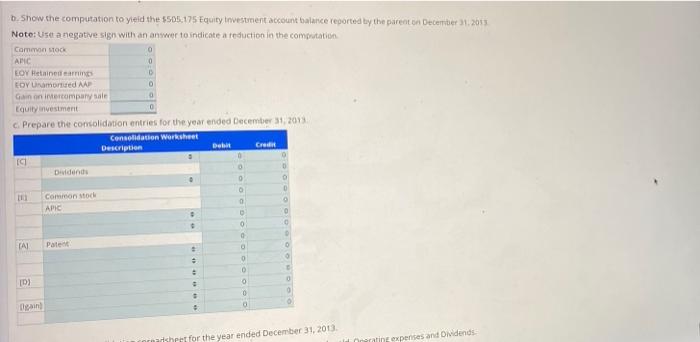

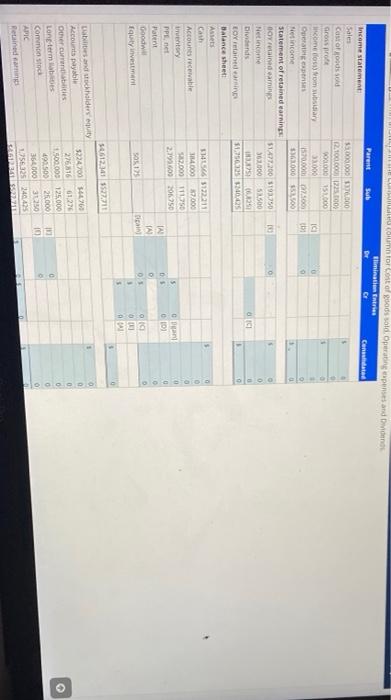

Prepare consolidation spreadsheet for intercompany sale of land - Equity method Assume that a parent company acquired its subsidiary on January 1, 2011 at a purchase price that was 5305.000 in excess of the book of the wodurys Stockholders out on the acquisition date of that excess, 5205,000 was assigned to an unrecorded Patent owned by the subsidiary that is being amortred over a 10-year period. The laten tema part of the parents equity method accounting. The remaining $100,000 was assigned to Goodwil in 2012, the wholly owned subsidiary old and to the parent for 10.000 The Land reported on the subsidiary's balance sheet for $70,000 on the date of sale The parent uses the equity method to account for its fat investment Financial statements of the parent and its subsidiary for the year ended December 31, 2013 are presented ind below: a. Show the computation to yield the $33,000 of Income (los) from subsidiary reported by the parent for the year ended December 2013 Note: Use a negative sign with an answer to indicate a reduction in the computation. Net income outsidary b. Show the computation to yield the $505,175 Equity Investment account balance reported by the parent on December 31, 2013 Note: Use a negative sign with an answer to indicate a reduction in the computation Common to APIC EOY Retained earnings EOV Untud AAP 0 Gain on intercompany sale Equity investment nerember 31, 2013 o C 6. Show the computation to yield the 5505 175 Equity Investment account balance reported by the parent on December 2013 Note: Use a negative sign with an answer to indicate a reduction in the computation Carmen stock 0 Alic 0 EOV Htainers EOV Unamored 0 Gain an intercompany Equity investment 0 c. Prepare the consolidation entries for the year ended December 31, 2013 Consolidation Worksheet Description Crew Deldende 0 Commons APC 0 0 0 CAL Palet 0 O 0 . D 0 0 10) . 0 0 Dean 5 het for the year ended December 31, 2013 rating expenses and Dividends Domotor contegods sold Operating purses and Divino Parent Sub Elimination Entries DE CE Camarindiatai 100 000 2.100001225.000 OLO 15.000 38000 57000 $36000151500 ICI 0 9 E 10 0 Income statement Sales Castoods (Gross prota come vom subsidiary Operating Net incorne statement of retained earnings o retained earnings Netcome Dividends Linda Balance sheet Assets Car Accounts recewable wentory PPE, net Patent Goodw fuly investment 51427.200 193.750 362000 51500 125 6.36 51.750225 20.0 0 0 s 114065172211 14.000 700 2009 171.750 2.936 2005 rni 100 0 IA D 0 10 3 OG O sigan SOK. 123 0 0 0 6122341 3527.711 bles and stockholders equity Accounts payable 52270060 Other currenties 276 816 612 Long terms 1.500.000 125.000 Common stock 49050D 26.000 AMC 360,000 31250 Retained in 1.7563240435 TRESS 0 0 10