Question

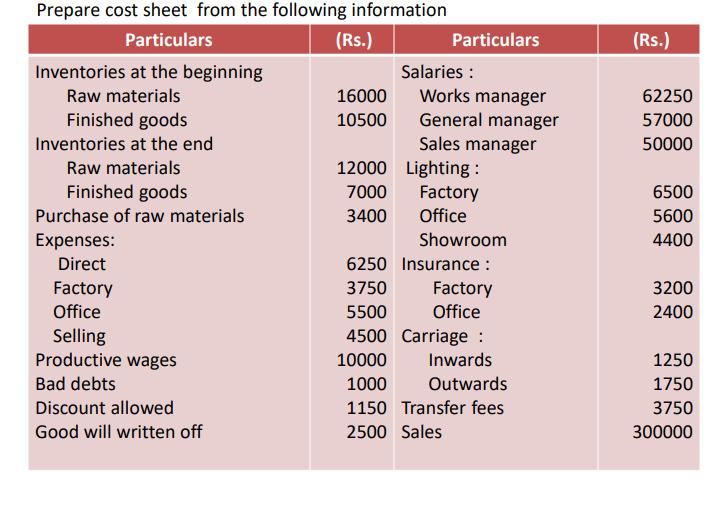

Prepare cost sheet from the following information Particulars Inventories at the beginning Raw materials Finished goods Inventories at the end Raw materials Finished goods

Prepare cost sheet from the following information Particulars Inventories at the beginning Raw materials Finished goods Inventories at the end Raw materials Finished goods Purchase of raw materials Expenses: Direct Factory Office Selling Productive wages Bad debts Discount allowed Good will written off (Rs.) 16000 10500 12000 7000 3400 Particulars Salaries : Works manager General manager Sales manager Lighting: Factory Office Showroom 6250 Insurance : 3750 5500 4500 Carriage : 10000 Inwards Factory Office Outwards 1000 1150 Transfer fees 2500 Sales (Rs.) 62250 57000 50000 6500 5600 4400 3200 2400 1250 1750 3750 300000

Step by Step Solution

3.57 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Horngrens Financial and Managerial Accounting

Authors: Tracie L. Nobles, Brenda L. Mattison, Ella Mae Matsumura

5th edition

9780133851281, 013385129x, 9780134077321, 133866297, 133851281, 9780133851298, 134077326, 978-0133866292

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App