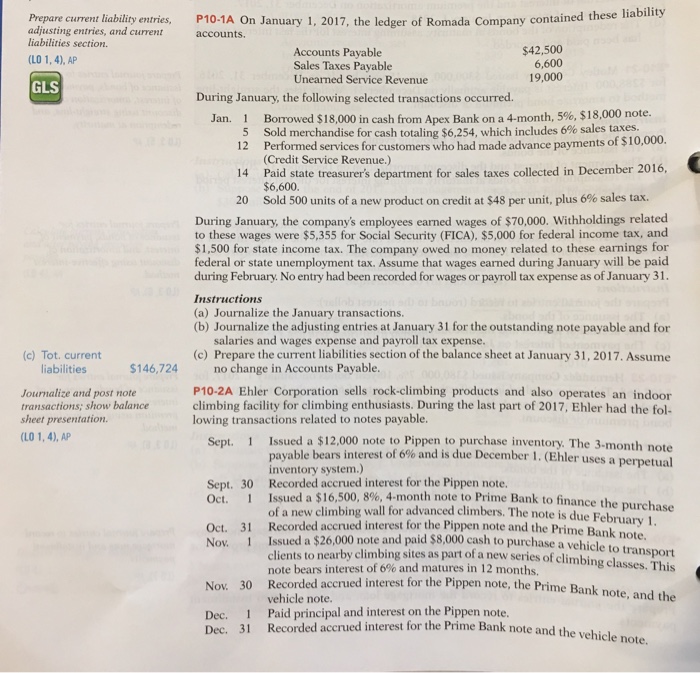

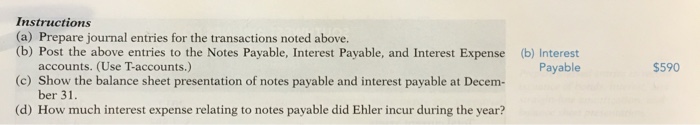

Prepare current liabilty entries, P10-1A On January 1, 2017, the ledger of Romada Company contained these lia adjusting entries, and current liabilities section. (LO 1, 4), AP accounts. Accounts Payable Sales Taxes Payable Unearned Service Revenue $42,500 6,600 19,000 GLS During January, the following selected transactions occurred Borrowed $18,000 in cash from Apex Bank on a 4-month, 5%, $18,000 note. Sold merchandise for cash totaling $6,254, which includes 6% sales taxes. Performed services for customers who had made advance payments o (Credit Service Revenue.) Jan. 1 5 12 f $10,000 14 Paid state treasurer's department for sales taxes collected in December 2016, $6,600 Sold 500 units of a new product on credit at $48 per unit, plus 6% sales tax 20 During January, the company's employees earned wages of $70,000. Withholdings related to these wages were $5,355 for Social Security (FICA), $5,000 for federal income tax, and $1,500 for state income tax. The company owed no money related to these earnings for federal or state unemployment tax. Assume that wages earned during January will be paid during February. No entry had been recorded for wages or payroll tax expense as of January 31 Instructions (a) Journalize the January transactions. (b) Journalize the adjusting entries at January 31 for the outstanding note payable and for (c) Prepare the current liabilities section of the balance sheet at January 31, 2017. Assume P10-2A Ehler Corporation sells rock-climbing products and also operates an indoor salaries and wages expense and payroll tax expense. (c) Tot. current liabilities $146,724 no change in Accounts Payable. Jourmalite an s how balancelowing transactions; show balance sheet presentation. (LO 1, 4), AP climbing facility for climbing enthusiasts. During the last part of 2017, Ehler had the fol lowing transactions related to notes payable. Issued a $12,000 note to Pippen to purchase inventory. The 3-month not payable bears interest of 6% and is due December 1, (Ehl inventory system.) Recorded accrued interest for the Pippen note Issued a $16,500, 8%,4-month note to Prime of a new climbing wall for advanced climbers. The note is due February 1 Sept. 1 er uses a perpetual Sept. 30 Oct. 1 Ban k to finance the purchase Oct. 31 Recorded accrued interest for the Pippen note and the Prime Bank Nov. 1 Issued a $26,000 note and paid $8,000 cash note. to purchase a vehicle to tran clients to nearby climbing sites as part of a new series of climbin note bears interest of 6% and matures in 12 months. sport g classes. Thi ecorded accrued interest for the Pippen note, the Prime Bank note, and the vehicle note. Paid principal and interest on the Pippen note Recorded Nov. 30 R Dec. Dec. 1 31 accrued interest for the Prime Bank note and the vehicle