Answered step by step

Verified Expert Solution

Question

1 Approved Answer

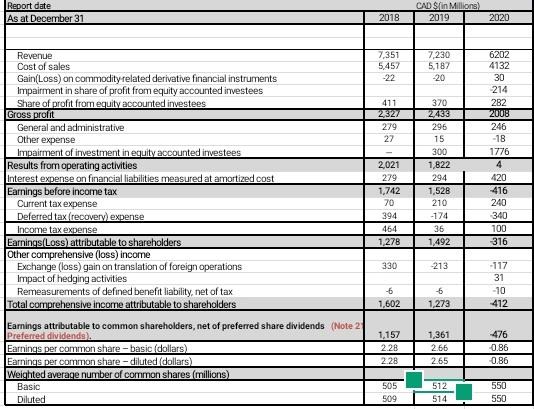

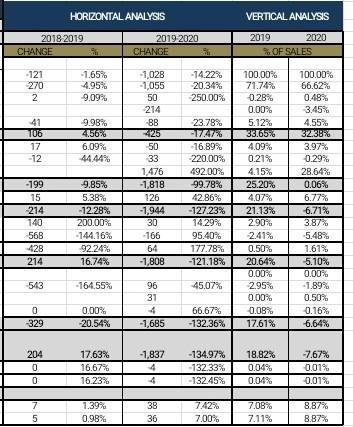

prepare financial swot analysis on the basis o f horizontal and vertical analysis Report date As at December 31 CAD Sin Millions) 2019 2018 2020

prepare financial swot analysis on the basis of horizontal and vertical analysis

Report date As at December 31 CAD Sin Millions) 2019 2018 2020 7,351 5,452 -22 7,230 5,182 -20 370 411 2327 279 22 6202 4132 30 214 282 2008 246 -18 1776 4 420 416 240 340 2021 279 1,742 70 295 15 300 1,822 294 1,528 210 -174 36 1,492 Revenue Cost of sales Gain(Loss) on commodity related derivative financial instruments Impairment in share of profit from equity accounted investees Share of profit from equity accounted investees Gross profit General and administrative Other expense Impairment of investment in equity accounted investees Results from operating activities Interest expense on financial liabilities measured at amortized cost Earnings before income tax Current tax expense Deferred tax (recovery) expense Income tax expense Earnings(Loss) attributable to shareholders Other comprehensive (loss) income Exchange (loss) gain on translation of foreign operations Impact of hedging activities Remeasurements of defined benefit liability, net of tax Total comprehensive income attributable to shareholders Earnings attributable to common shareholders, net of preferred share dividends (Note 2 Preferred dividends. Earnings per common share-basic (dollars) Earnings per common share-diluted dollars) Weighted average number of common shares (millions) Basic Diluted 394 464 100 1278 316 330 -213 -117 31 -10 -6 1,602 -6 1,273 412 1,157 2.28 2.28 1,361 2.66 2.65 476 0.86 0.86 505 509 512 514 550 550 HORIZONTAL ANALYSIS VERTICAL ANALYSIS 2018 2019 CHANGE 2019 2020 CHANGE 2019 2020 OF SALES -121 270 2 -1.65% 4.95% -9.09% -14.22% 20.34% 250.00% 41 T06 17 9.98% 4.56% 6.09% -12 -1,028 - 1,055 50 214 BB 423 50 33 1.476 -1,818 126 -1,944 30 -166 64 -1,808 -199 23.78% 17.47% -16.89% 220.00% 492.00% 99.78% 42.86% -127.23% 14.29% 95.40% 177.78% -121.18% 15 9.85% 5.38% -12.28% 200.00% -144.16% 92.24% 16.74% 100.00% 71.74% 0.28% 0.00% 5.12% 33.65% 4.09% 0.21% 4.15% 25.20% 4.07% 21.13% 2.90% 2.41% 0.50% 20.64% 0.00% 2.95% 0.00% 0.08% 17.61% 100.00% 66.62% 0.48% 3.45% 4.55% 32.38% 3.97% 0.29% 28.64% 0.06% 6.77% 6.71% 3.87% 5.48% 1.61% 5.10% % 0.00% -1.89% 0.50% 0.16% 6.64% 214 568 428 214 -543 -164.55% 45.07% 0 -329 0.00% 20.54% 96 31 4 -1,685 66.67% -132.36% 204 0 0 17.63% 16.67% 16.23% -1,837 4 -134.97% -132.33% -132.45% 18.82% 0.04% 0.04%. -7.67% 0.01% 0.01% 7 5 1.39% 0.98% 38 36 7.42% 7.00% 7.08% 7.11% 8.87% 8.87%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started