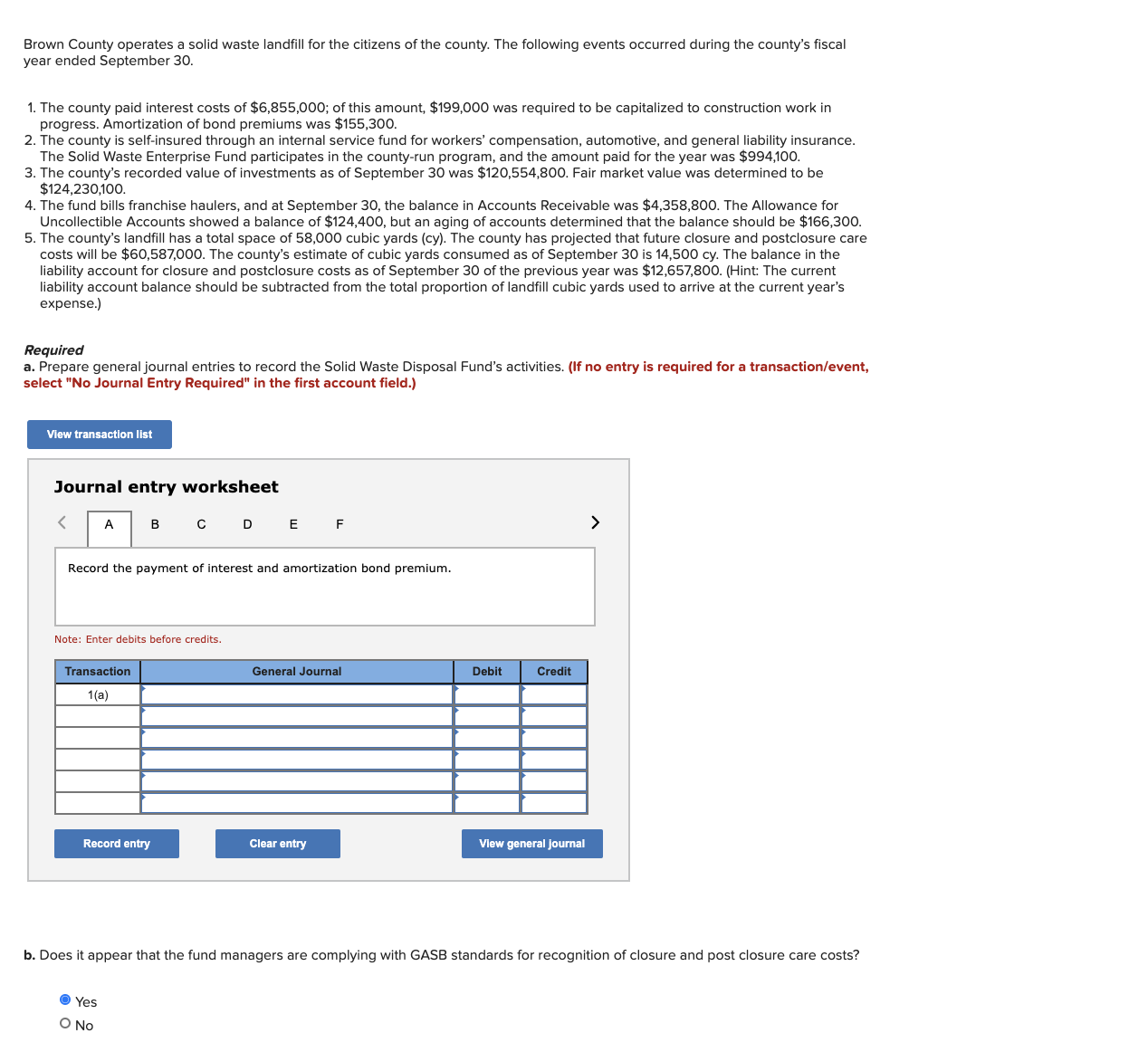

Prepare general journal entries

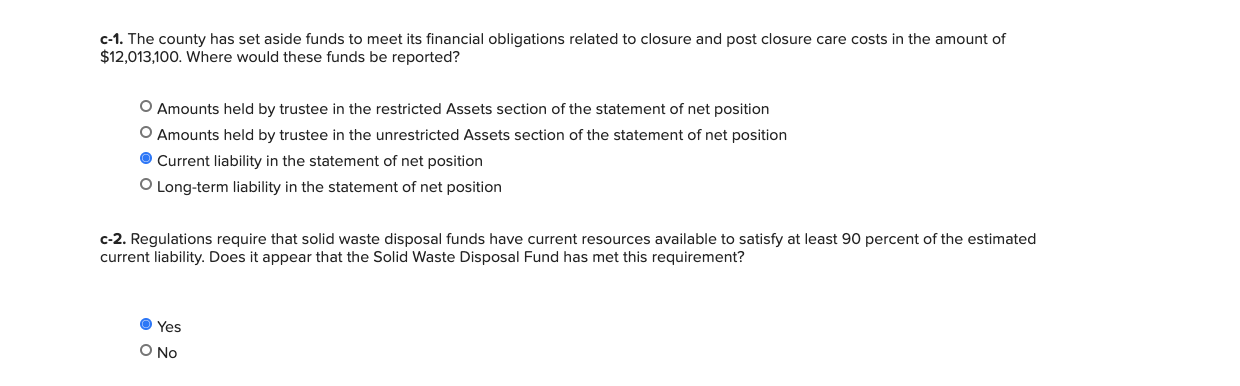

Brown County operates a solid waste landll for the citizens of the county. The following events occurred during the county's scal year ended September 30. 1. The county paid interest costs of $6,855,000; of this amount, $199,000 was required to be capitalized to construction work in progress. Amortization of bond premiums was $155,300. 2. The county is self-insured through an internal service fund for workers' compensation, automotive, and general liability insurance. The Solid Waste Enterprise Fund participates in the county-run program, and the amount paid for the year was $994,100. 3. The county's recorded value of investments as of September 30 was $120,554,800. Fair market value was determined to be $124,230,100. 4. The fund bills franchise haulers, and at September 30, the balance in Accounts Receivable was $4,358,800. The Allowance for Uncollectible Accounts showed a balance of $124,400, but an aging of accounts determined that the balance should be $166,300. 5. The county's landfill has a total space of 58,000 cubic yards (ch. The county has projected that future closure and postclosure care costs will be $60,587,000. The county's estimate of cubic yards consumed as of September 30 is 14,500 cy. The balance in the liability account for closure and postclosure costs as of September 30 of the previous year was $12,657,800. [Hint The current liability account balance should be subtracted from the total proportion of landll cubic yards used to arrive at the current year's expense.) Required a. Prepare generaljournal entries to record the Solid Waste Disposal Fund's activities. (If no entry is required for a transactionfevent, select 'No Journal Entry Required\" in the rst account eld.) View "in saotlon "it Journal entry worksheet Record the payment of Interest and amortization bond premium. Note: Enter debits before credits. View general journal b. Does it appear that the fund managers are complying with GASE standards for recognition of closure and post closure care costs? .Yes 0ND c1. The count}:r has set aside funds to meet its financial obligations related to closure and post closure care costs in the amount of $12,013,100. Where would these funds be reported? 0 Amounts held by trustee in the restricted Assets section of the statement of net position 0 Amounts held by trustee in the unrestricted Assets section of the statement of net position . Current liability in the statement of net position 0 Long-term liability in the statement of net position c2. Regulations require that solid waste disposal funds have current resources available to satisfy at least 90 percent of the estimated current liability. Does it appear that the Solid Waste Disposal Fund has met this requirement? .Yes 0No