Question

Prepare, in good form, for the proprietary funds accounted for in Parts 1 and 2, the following: (1) A Statement of Revenues, Expenses, and Changes

(1) A Statement of Revenues, Expenses, and Changes in Fund Net position for the Year Ended December 31, 2017.

(2) A Statement of Net position, as of December 31, 2017.

(3) A Statement of Cash Flows for the Year Ended December 31, 2017. Include restricted assets as a part of cash and cash equivalents for this statement. (Assume any materials and labor attributable to construction in process were paid by year end).

PREVIOUS INFORMATION:

The Stores and Service Fund of the City of Monroe had the following account balances as of January 1, 2017:

Debits | Credits | |

Cash | $28,000 | |

Due from other funds | 27,000 | |

Inventory of supplies | 27,500 | |

Land | 18,000 | |

Buildings | 84,000 | |

Accumulated depreciation—buildings | $30,000 | |

Equipment | 46,000 | |

Accumulated depreciation—equipment | 25,000 | |

Accounts payable | 19,000 | |

Advance from water utility fund | 30,000 | |

Net position | 126,500 | |

Totals | $230,500 | $230,500 |

Required:

a. Open a general journal for the City of Monroe Stores and Service Fund and record the following transactions.

(1) A budget was prepared for FY 2017. It was estimated that the price charged other departments for supplies should be 1.25% of cost to achieve the desired breakeven for the year.

(2) The amount due from other funds as of January 1, 2017, was collected in full.

(3) During the year, supplies were ordered and received in the amount of $307,000. This amount was posted to accounts payable.

(4) $15,000 of the advance from the Water Utility Fund, originally provided for construction, was repaid. No interest is charged.

(5) During the year, supplies costing $250,560 were issued to the General Fund, and supplies costing $46,400 were issued to the Water Utility Fund. These funds were charged based on the previously determined markup ($ 313,200 to General Fund and 58,000 to the Water Utility Fund).

(6) Operating expenses, exclusive of depreciation, were recorded in accounts payable as follows: Purchasing, $15,000; Warehousing, $16,900; Delivery, $17,500; and Administrative, $9,000.

(7) Cash was received from the General Fund in the amount of $310,000 and from the Water Utility Fund in the amount of $50,000.

(8) Accounts payable were paid in the amount of $365,000.

(9) Depreciation in the amount of $10,000 was recorded for buildings and $4,600 for equipment.

b. Post the entries to the Stores and Service Fund ledger (t-accounts).

c. Prepare and post an entry closing all nominal accounts to Net position. Compute the balance in the net position accounts, assuming there are no Restricted Net position.

6–C. Part 2. Enterprise Fund Transactions

The City of Monroe maintains a Water and Sewer Fund to provide utility services to its citizens. As of January 1, 2017, the City of Monroe Water and Sewer Fund had the following account balances:

Debits | Credits | |

Cash | $ 98,000 | |

Customer Accounts Receivable | 84,000 | |

Estimated Uncollectible Accounts Receivable | $4,000 | |

Materials and Supplies | 28,000 | |

Advance to Stores and Services Fund | 30,000 | |

Restricted Assets | 117,000 | |

Water Treatment Plant in Service | 4,200,000 | |

Construction Work in Progress | 203,000 | |

Accumulated Depreciation - Utility Plant | 1,200,000 | |

Accounts Payable | 97,000 | |

Revenue Bonds Payable | 2,500,000 | |

Net position | 959,000 | |

Totals | $4,760,000 | $4,760,000 |

Required:

a. Open a general journal for the City of Monroe Water and Sewer Utility Fund and record the following transactions.

(1) During the year, sales of water to non-government customers amounted to $1,018,000 and sales of water to the General Fund amounted to $37,000.

(2) Collections from non-government customers amounted to $976,000.

(3) The Stores and Services Fund repaid $15,000 of the long-term advance to the Water and Sewer Fund.

(4) Materials and supplies in the amount of $261,000 were received. A liability in that amount was recorded.

(5) Materials and supplies were issued and were charged to the following accounts: cost of sales and services, $169,500; selling, $15,000; administration, $18,000; construction work in progress, $50,000.

(6) Payroll costs for the year totaled $416,200 plus $34,200 for the employer’s share of payroll taxes. Of that amount, $351,900 was paid in cash, and the remainder was withheld for taxes. The $450,400 (416,200 + 34,200) was distributed as follows: cost of sales and services, $265,800; sales, $43,900; administration, $91,400; construction work in progress, $49,300.

(7) Bond interest (6½%) in the amount of $162,500 was paid.

(8) Interest in the amount of $17,000 (included in 7 above) was reclassified to Construction Work in Progress.

(9) Construction projects at the water treatment plant (reflected in the beginning balance of construction in process) were completed in the amount of $203,000, and the assets were placed in service. Payments for these amounts were made in the previous year (no effect on 2017 Statement of Cash Flows).

(10) Collection efforts were discontinued on bills totaling $2,890. The unpaid receivables were written off.

(11) An analysis of customer receivable balances indicated the Estimated Uncollectible Accounts needed to be increased by $5,500.

(12) Payment of accounts payable amounted to $302,000. Payments of payroll taxes totaled $95,200.

(13) Supplies transferred from the Stores and Services Fund amounted to $58,000. Cash in the amount of $50,000 was paid to the Stores and Services Fund for supplies.

(14) Depreciation expense for the year was computed to be $282,000.

(15) In accord with the revenue bond indenture, $25,000 cash was transferred from operating cash to restricted assets.

b. Post the entries to the Water and Sewer Fund ledger (t-accounts).

c. Prepare and post an entry closing all nominal accounts to Net position. Compute the balance in the net position accounts, assuming the only restricted assets are those identified with the bond indenture and the outstanding bonds are associated with the purchase of capital assets.

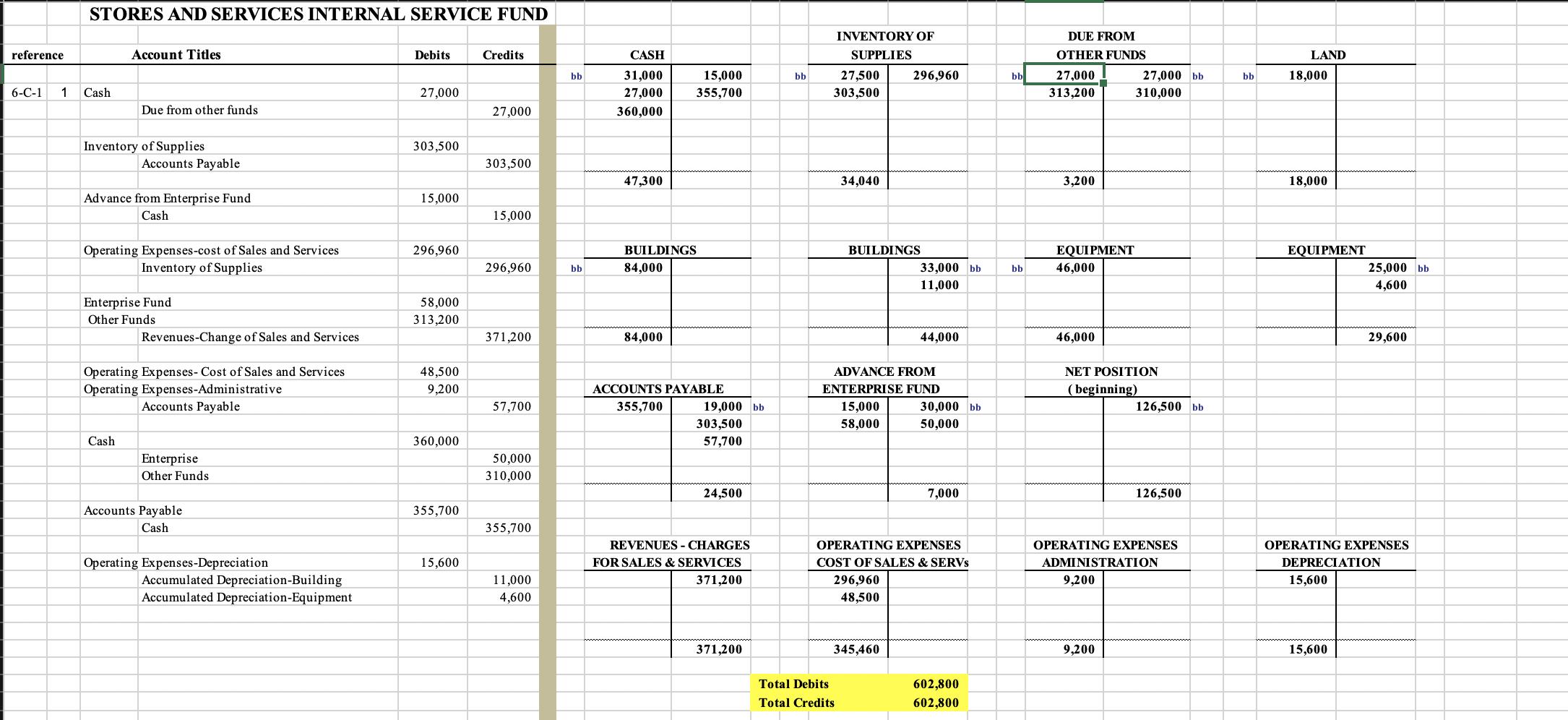

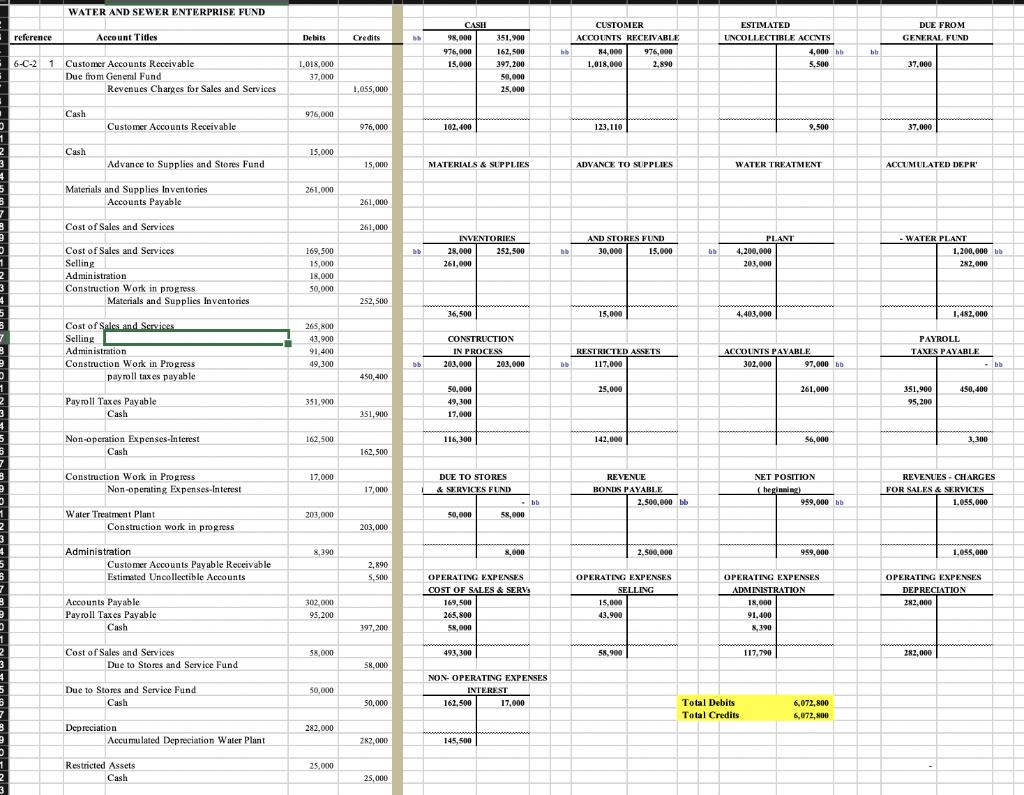

STORES AND SERVICES INTERNAL SERVICE FUND INVENTORY OF DUE FROM reference Account Titles Debits Credits CASH SUPPLIES OTHER FUNDS LAND 27,500 303,500 bb 31,000 15,000 bb 296,960 bb 27,000 27,000 bb bb 18,000 6-C-1 1 Cash 27,000 27,000 355,700 313,200 310,000 Due from other funds 27,000 360,000 Inventory of Supplies Accounts Payable 303,500 303,500 47,300 34,040 3,200 18,000 Advance from Enterprise Fund 15,000 Cash 15,000 Operating Expenses-cost of Sales and Services Inventory of Supplies 296,960 BUILDINGS BUILDINGS EQUIPMENT 46,000 EQUIPMNT 296,960 bb 84,000 33,000 bb 25,000 bb 11,000 4,600 58,000 313,200 Enterprise Fund Other Funds Revenues-Change of Sales and Services 371,200 84,000 44,000 46,000 29,600 Operating Expenses- Cost of Sales and Services Operating Expenses-Administrative Accounts Payable 48,500 ADVANCE FROM NET POSITION 9,200 ACCOUNTS PAYABLE ENTERPRISE FUND ( beginning) 57,700 355,700 19,000 bb 15,000 30,000 bb 126,500 bb 303,500 58,000 50,000 Cash 360,000 57,700 Enterprise 50,000 310,000 Other Funds 24,500 7,000 126,500 Accounts Payable 355,700 Cash 355,700 REVENUES - CHARGES OPERATING EXPENSES OPERATING EXPENSES OPERATING EXPENSES Operating Expenses-Depreciation 15,600 FOR SALES & SERVICES COST OF SALES & SERVS ADMINISTRATION DEPRECIATION Accumulated Depreciation-Building Accumulated Depreciation-Equipment 11,000 371,200 296,960 48,500 9,200 15,600 4,600 371,200 345,460 9,200 15,600 Total Debits 602,800 Total Credits 602,800

Step by Step Solution

3.60 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Open general Journal for the City of Monroe stores and Service fun...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started