prepare income statement and balance sheet

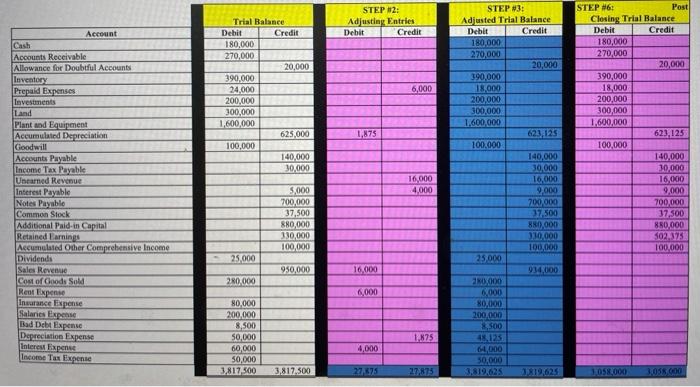

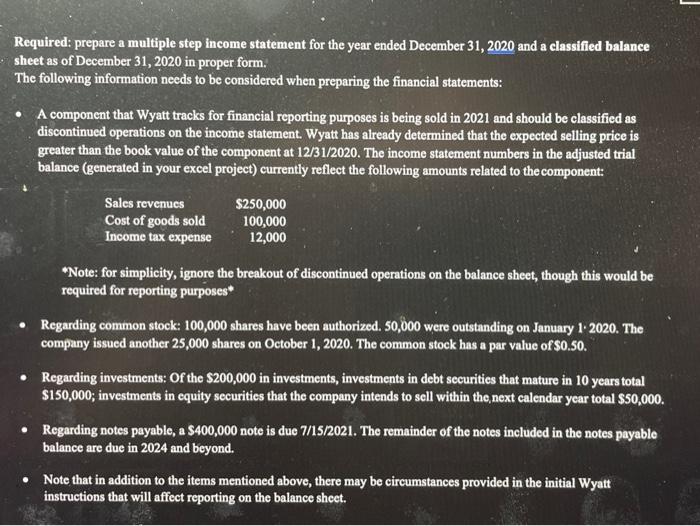

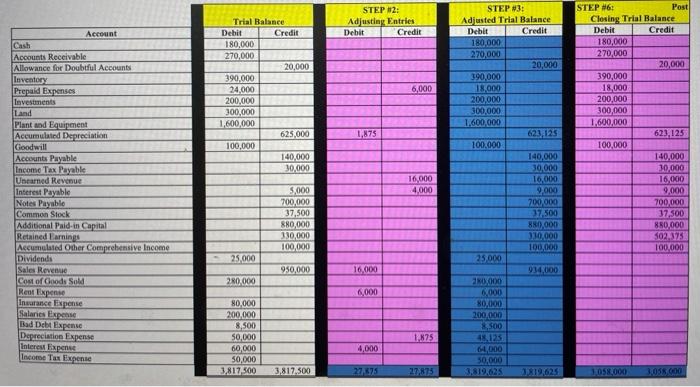

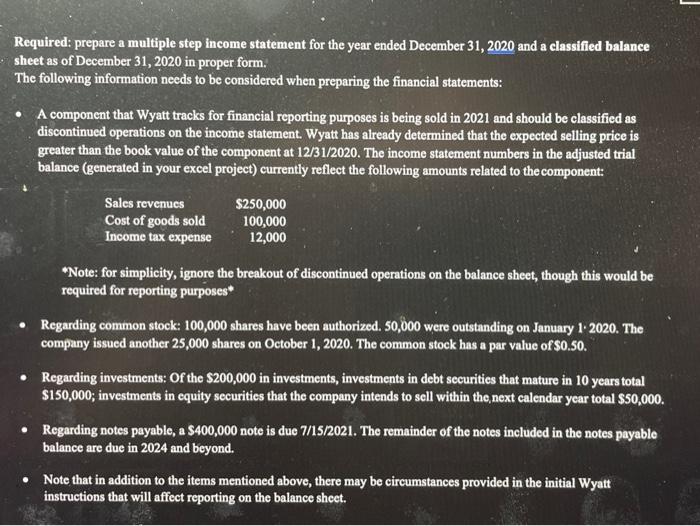

STEP 2: Adjusting Entries Debit Credit 6,000 Trial Balance Debit Credit 180,000 270.000 20,000 390,000 24,000 200.000 300,000 1,600,000 625.000 100,000 140,000 30.000 1,875 STEP #6: Post Closing Trial Balance Debit Credit 180,000 270,000 20,000 390,000 18,000 200,000 300,000 1,600,000 623,125 100,000 140.000 30.000 16,000 9,000 700,000 37,500 880.000 102.375 100.000 Account Cash Accounts Receivable Allowance for Doubtful Accounts leventory Prepaid Expenses Investments Land Plant and Equipment Accumulated Depreciation Goodwill Accounts Payable Income Tax Payable Unearned Revenue Interest Payable Notes Payable Common Stock Additional Paid in Capital Retained Earnings Accumulated Other Comprehensive Income Dividends Sales Revenue Cost of Goods Som Rent Exp Insurance Expense Salaries Expense Bad Det Expert Depreciation Expense Interest Expense Income Tax Expense 16,000 4,000 STEP 3: Adjusted Trial Balance Debit Credit 180,000 270,000 20,000 390,000 18.000 200.000 300.000 1.600.000 623 125 100.000 140,000 30,000 16,000 9,000 700.000 27.500 880,000 310,000 100,000 25.000 914,000 20.000 6.000 80,000 200,000 500 48.125 0,000 30.000 3X19,625 5,000 700,000 37,500 880,000 330,000 100,000 25.000 950,000 16.000 280.000 6,000 80,000 200,000 8,500 50,000 60,000 50,000 3,817,500 1.875 4,000 3.817.500 27.375 27875 1058.000 3.038 000 Required: prepare a multiple step income statement for the year ended December 31, 2020 and a classified balance sheet as of December 31, 2020 in proper form. The following information needs to be considered when preparing the financial statements: A component that Wyatt tracks for financial reporting purposes is being sold in 2021 and should be classified as discontinued operations on the income statement. Wyatt has already determined that the expected selling price is greater than the book value of the component at 12/31/2020. The income statement numbers in the adjusted trial balance (generated in your excel project) currently reflect the following amounts related to the component: Sales revenues Cost of goods sold Income tax expense $250,000 100,000 12,000 *Note: for simplicity, ignore the breakout of discontinued operations on the balance sheet, though this would be required for reporting purposes Regarding common stock: 100,000 shares have been authorized. 50,000 were outstanding on January 1-2020. The company issued another 25,000 shares on October 1, 2020. The common stock has a par value of $0.50. Regarding investments: Of the $200,000 in investments, investments in debt securities that mature in 10 years total $150,000; investments in equity securities that the company intends to sell within the next calendar year total $50,000. Regarding notes payable, a $400,000 note is due 7/15/2021. The remainder of the notes included in the notes payable balance are due in 2024 and beyond. Note that in addition to the items mentioned above, there may be circumstances provided in the initial Wyatt instructions that will affect reporting on the balance sheet