Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare income statement and financial position. 1. The Owner Invested $600,000 cash to start A business. 2. A company spends $200,000 for an office

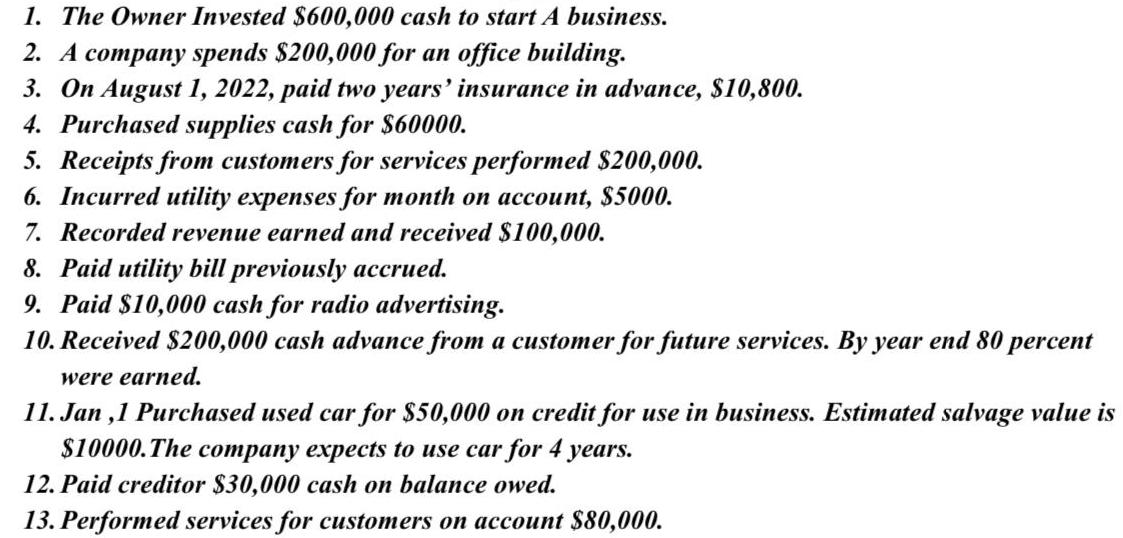

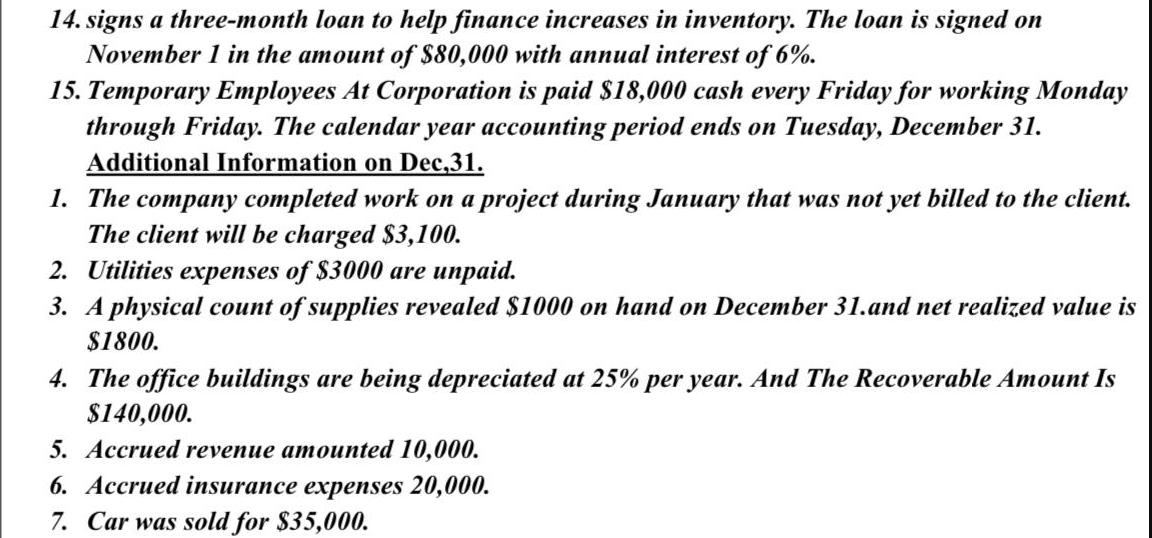

Prepare income statement and financial position. 1. The Owner Invested $600,000 cash to start A business. 2. A company spends $200,000 for an office building. 3. On August 1, 2022, paid two years' insurance in advance, $10,800. 4. Purchased supplies cash for $60000. 5. Receipts from customers for services performed $200,000. 6. Incurred utility expenses for month on account, $5000. 7. Recorded revenue earned and received $100,000. 8. Paid utility bill previously accrued. 9. Paid $10,000 cash for radio advertising. 10. Received $200,000 cash advance from a customer for future services. By year end 80 percent were earned. 11. Jan,1 Purchased used car for $50,000 on credit for use in business. Estimated salvage value is $10000. The company expects to use car for 4 years. 12. Paid creditor $30,000 cash on balance owed. 13. Performed services for customers on account $80,000. 14. signs a three-month loan to help finance increases in inventory. The loan is signed on November 1 in the amount of $80,000 with annual interest of 6%. 15. Temporary Employees At Corporation is paid $18,000 cash every Friday for working Monday through Friday. The calendar year accounting period ends on Tuesday, December 31. Additional Information on Dec,31. 1. The company completed work on a project during January that was not yet billed to the client. The client will be charged $3,100. 2. Utilities expenses of $3000 are unpaid. 3. A physical count of supplies revealed $1000 on hand on December 31.and net realized value is $1800. 4. The office buildings are being depreciated at 25% per year. And The Recoverable Amount Is $140,000. 5. Accrued revenue amounted 10,000. 6. Accrued insurance expenses 20,000. 7. Car was sold for $35,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare an income statement and financial position based on the given information lets go through each transaction and calculate the relevant amounts We will assume that all transactions are for th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started