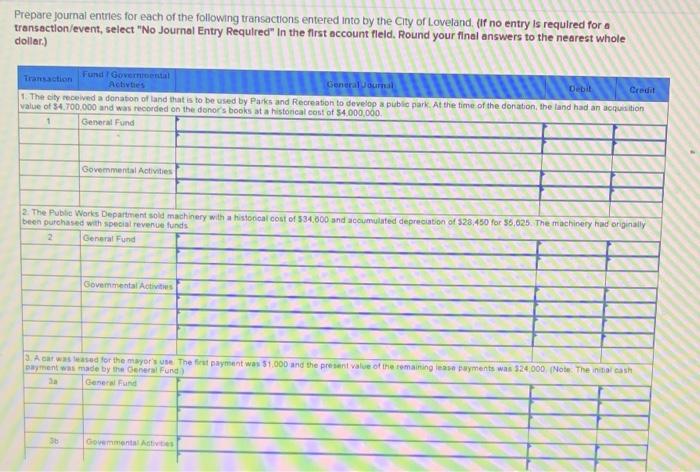

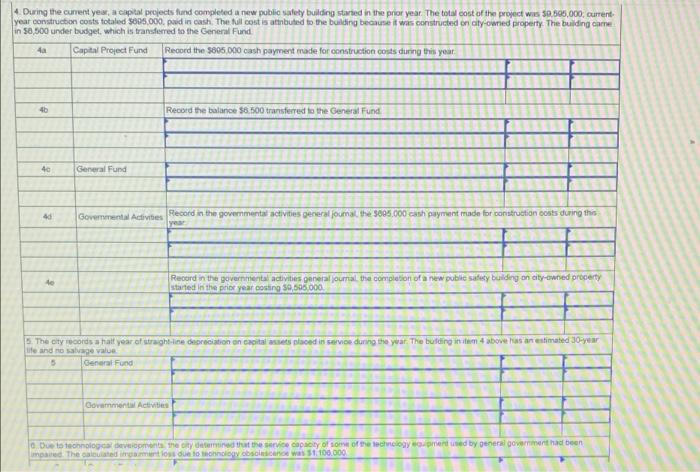

Prepare journal entries for each of the following transactions entered into by the City of Loveland. (If no entry is required for a transaction/event, select "No Journal Entry Required" In the first account fleld. Round your final answers to the nearest whole dollar.) Debit Fund Governmental Transaction Achives General Journal Credit 1 The city received a donation of land that is to be used by Parks and Recreation to develop a public park. At the time of the donation, the land had an acquisition value of $4.700.000 and was recorded on the donor's books at a historical cost of $4,000,000 1 General Fund Governmental Activities 2. The Public Works Department sold machinery with a histoocal cost of 534,000 and accumulated depreciation of $28.450 for $5,025. The machinery had originally been purchased with special revenue funds 2 General Fund Govermental Activities 3. Acar wassed for the mayor's use the first payment was $1,000 and the present value of the remaining less payments was 524 000. (Note: The initial cash payment was made by the General Fund) 3a General Fund 36 Governmental Activities 4. During the current year, a capital projects fund completed a new public safety building started in the prior year. The total cost of the project was 50.595,000, current year construction costs totaled 5005.000. paid in cash The Mil cost is attbuted to the building because it was constructed on city-owned property. The building came in $8,500 under budget, which is transferred to the General Fund Capital Project Fund Record the 3805.000 cash payment made for construction costs during this year 46 Record the balance $6.500 transferred to the General Fund 40 General Fund 40 Government Activities Record in the governmental activities general journal the 300.000 cash payment made for construction costs during this yes 40 Record in the governmental activities general journal the completion of a new public safety building on city-owned property started in the prix year costing 59,595.000 The city records a half year of straight-line depreciation on capital assets placed in service during the year. The building itatum 4 above us an estimated 30-year ufe and no salge value 5 General Fund Government Activities Due to technologies the city cented the capacity of some of technology womended by general government had been more. The calculated artist due to any one was 51.100.000