Answered step by step

Verified Expert Solution

Question

1 Approved Answer

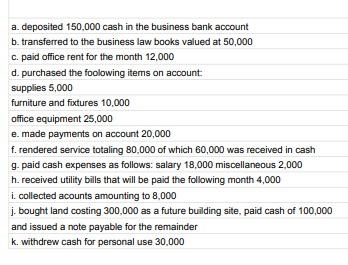

Prepare journal entries, General ledger, Balance sheet and Income statement a. deposited 150,000 cash in the business bank account b. transferred to the business law

Prepare journal entries, General ledger, Balance sheet and Income statement

a. deposited 150,000 cash in the business bank account b. transferred to the business law books valued at 50,000 c. paid office rent for the month 12,000 d. purchased the foolowing items on account: supplies 5,000 furniture and fixtures 10,000 office equipment 25,000 e. made payments on account 20,000 f. rendered service totaling 80,000 of which 60,000 was received in cash g. paid cash expenses as follows: salary 18,000 miscellaneous 2,000 h. received utility bills that will be paid the following month 4,000 i. collected acounts amounting to 8,000 j. bought land costing 300,000 as a future building site, paid cash of 100,000 and issued a note payable for the remainder k. withdrew cash for personal use 30,000

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Deposited cash in the business bank account Journal Entry Cash 150000 Owners Equity Capital 150000 Transferred business law books valued at 60000 Jour...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started