Question

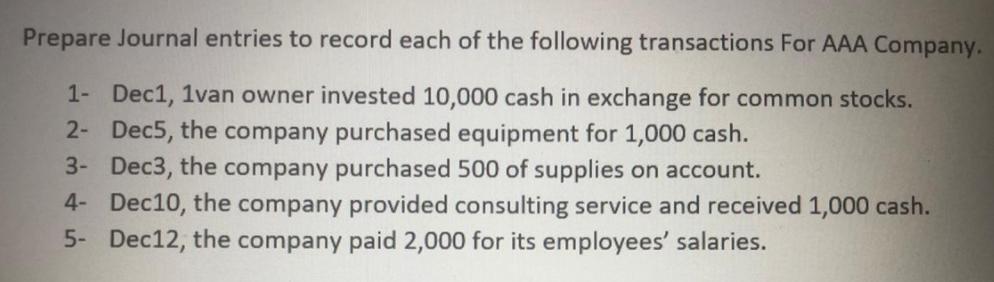

Prepare Journal entries to record each of the following transactions For AAA Company. 1- Dec1, 1van owner invested 10,000 cash in exchange for common

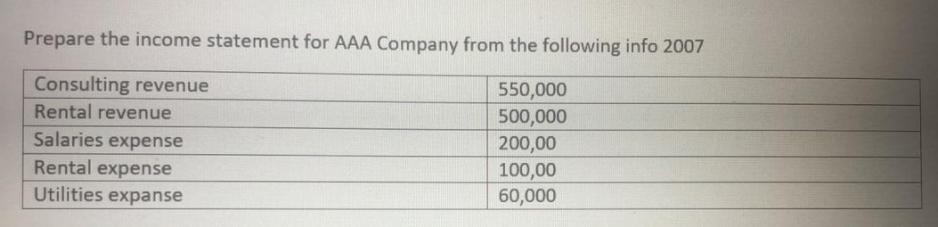

Prepare Journal entries to record each of the following transactions For AAA Company. 1- Dec1, 1van owner invested 10,000 cash in exchange for common stocks. 2- Dec5, the company purchased equipment for 1,000 cash. 3- Dec3, the company purchased 500 of supplies on account. 4- Dec10, the company provided consulting service and received 1,000 cash. 5- Dec12, the company paid 2,000 for its employees' salaries. Prepare the income statement for AAA Company from the following info 2007 Consulting revenue 550,000 Rental revenue 500,000 200,00 Salaries expense Rental expense 100,00 60,000 Utilities expanse

Step by Step Solution

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Date Account title explanation Debit Credit Dec 1 Common stock 10000 Cash 10000 Dec 5 Equipment 1000 Cash 1000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting Information for Decisions

Authors: John J. Wild

9th edition

1259917045, 978-1259917042

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App