Answered step by step

Verified Expert Solution

Question

1 Approved Answer

prepare journal entries to record omitted adjustments (495,530) is the Acc rec for number 4 A2. A3. A4.- AS. A6. A7. A8. On May 1,

prepare journal entries to record omitted adjustments (495,530) is the Acc rec for number 4

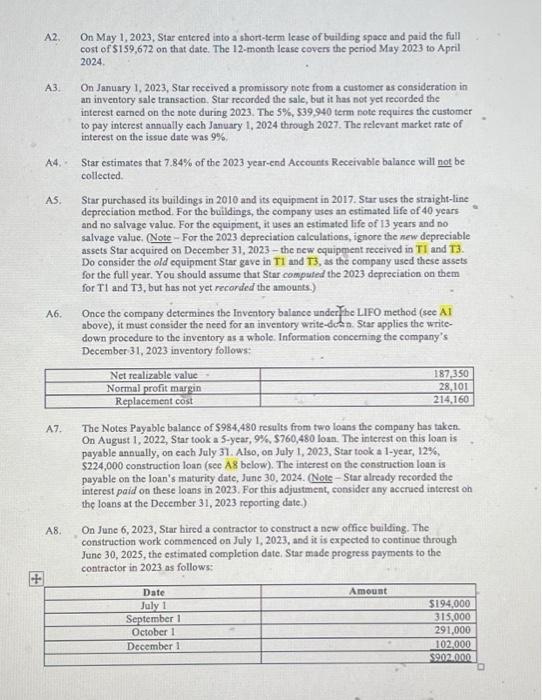

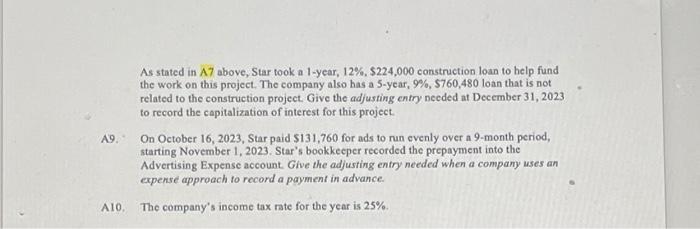

A2. A3. A4.- AS. A6. A7. A8. On May 1, 2023, Star entered into a short-term lease of building space and paid the full cost of $159,672 on that date. The 12-month lease covers the period May 2023 to April 2024. On January 1, 2023, Star received a promissory note from a customer as consideration in an inventory sale transaction. Star recorded the sale, but it has not yet recorded the interest earned on the note during 2023. The 5%, $39,940 term note requires the customer to pay interest annually cach January 1, 2024 through 2027. The relevant market rate of interest on the issue date was 9%, Star estimates that 7.84% of the 2023 year-end Accounts Receivable balance will not be collected. Star purchased its buildings in 2010 and its equipment in 2017. Star uses the straight-line depreciation method. For the buildings, the company uses an estimated life of 40 years and no salvage value. For the equipment, it uses an estimated life of 13 years and no salvage value. (Note - For the 2023 depreciation calculations, ignore the new depreciable assets Star acquired on December 31, 2023-the new equipment received in TI and T3. Do consider the old equipment Star gave in T1 and T3, as the company used these assets for the full year. You should assume that Star computed the 2023 depreciation on them for T1 and T3, but has not yet recorded the amounts.) Once the company determines the Inventory balance under the LIFO method (see A1 above), it must consider the need for an inventory write-down. Star applies the write- down procedure to the inventory as a whole. Information concerning the company's December 31, 2023 inventory follows: Net realizable value Normal profit margin Replacement cost 187,350 28,101 214,160 The Notes Payable balance of $984,480 results from two loans the company has taken. On August 1, 2022, Star took a 5-year, 9%, $760,480 loan. The interest on this loan is payable annually, on each July 31. Also, on July 1, 2023, Star took a 1-year, 12%, $224,000 construction loan (see A8 below). The interest on the construction loan is payable on the loan's maturity date, June 30, 2024. (Note-Star already recorded the interest paid on these loans in 2023. For this adjustment, consider any accrued interest on the loans at the December 31, 2023 reporting date.) On June 6, 2023, Star hired a contractor to construct a new office building. The construction work commenced on July 1, 2023, and it is expected to continue through June 30, 2025, the estimated completion date. Star made progress payments to the contractor in 2023 as follows: Date July 1 September 1 October 1 December 11 Amount $194,000 315,000 291,000 102,000 + $902.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started