Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare journal entries to record the following transactions and post any entries that affect the Unearned Revenue T-account (assume Unearned Revenue beginning balance of

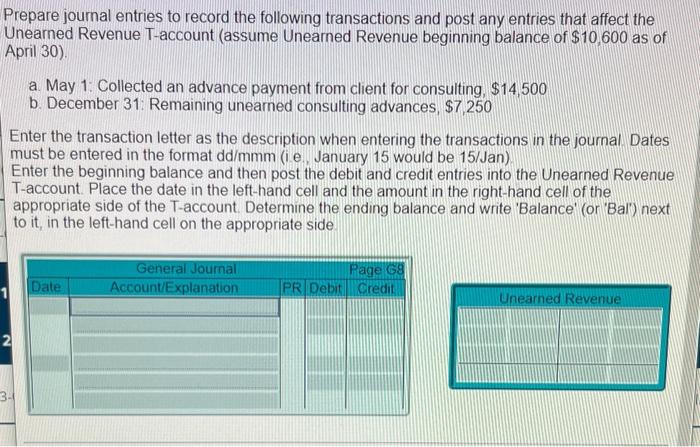

Prepare journal entries to record the following transactions and post any entries that affect the Unearned Revenue T-account (assume Unearned Revenue beginning balance of $10,600 as of April 30). Enter the transaction letter as the description when entering the transactions in the journal Dates must be entered in the format dd/mmm (i.e., January 15 would be 15/Jan) Enter the beginning balance and then post the debit and credit entries into the Unearned Revenue T-account. Place the date in the left-hand cell and the amount in the right-hand cell of the appropriate side of the T-account. Determine the ending balance and write Balance' (or 'Bal') next to it, in the left-hand cell on the appropriate side. 2 a. May 1: Collected an advance payment from client for consulting, $14,500 b. December 31: Remaining unearned consulting advances, $7,250 3- Date General Journal Account/Explanation Page G& PR Debit Credit Unearned Revenue

Step by Step Solution

★★★★★

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Unearned Revenue TAccount Date Debit Credit Bal 10600 31De...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started