Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare Journal entries with short description, T Accounts ,Trial balance and adjusting entries. 1. On July 31, 2020, Happy Kanin paid 49,200 amount of advanced

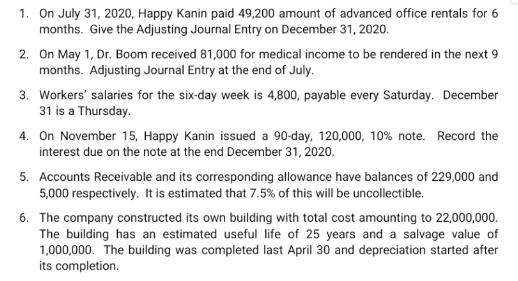

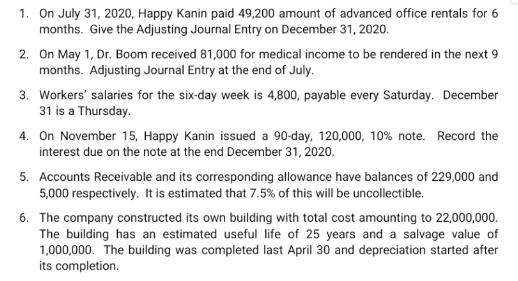

Prepare Journal entries with short description, T Accounts ,Trial balance and adjusting entries.

1. On July 31, 2020, Happy Kanin paid 49,200 amount of advanced office rentals for 6 months. Give the Adjusting Journal Entry on December 31, 2020. 2. On May 1, Dr. Boom received 81,000 for medical income to be rendered in the next 9 months. Adjusting Journal Entry at the end of July. 3. Workers' salaries for the six-day week is 4,800, payable every Saturday, December 31 is a Thursday. 4. On November 15, Happy Kanin issued a 90-day, 120,000, 10% note. Record the interest due on the note at the end December 31, 2020. 5. Accounts Receivable and its corresponding allowance have balances of 229,000 and 5,000 respectively. It is estimated that 7.5% of this will be uncollectible. 6. The company constructed its own building with total cost amounting to 22,000,000. The building has an estimated useful life of 25 years and a salvage value of 1,000,000. The building was completed last April 30 and depreciation started after its completion.

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Here are the journal entries T accounts trial balance and adjusting entries for the given transactions 1 On July 31 2020 Happy Kanin paid 49200 amount ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started