Answered step by step

Verified Expert Solution

Question

1 Approved Answer

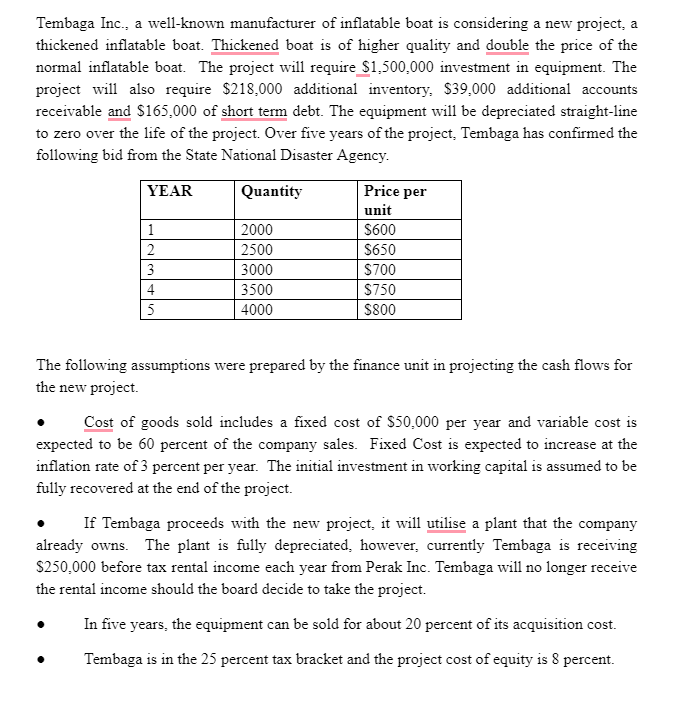

prepare NPV profile for Tembagas new project, briefly analyse the graph. Tembaga Inc., a well-known manufacturer of inflatable boat is considering a new project, a

prepare NPV profile for Tembagas new project, briefly analyse the graph.

Tembaga Inc., a well-known manufacturer of inflatable boat is considering a new project, a thickened inflatable boat. Thickened boat is of higher quality and double the price of the normal inflatable boat. The project will require $1,500,000 investment in equipment. The project will also require $218,000 additional inventory, $39.000 additional accounts receivable and $165,000 of short term debt. The equipment will be depreciated straight-line to zero over the life of the project. Over five years of the project, Tembaga has confirmed the following bid from the State National Disaster Agency. YEAR Quantity Price per unit 1 2000 $600 2 2500 $650 3 3000 $700 4 3500 $750 5 4000 $800 The following assumptions were prepared by the finance unit in projecting the cash flows for the new project. Cost of goods sold includes a fixed cost of $50,000 per year and variable cost is expected to be 60 percent of the company sales. Fixed Cost is expected to increase at the inflation rate of 3 percent per year. The initial investment in working capital is assumed to be fully recovered at the end of the project. If Tembaga proceeds with the new project, it will utilise a plant that the company already owns. The plant is fully depreciated, however, currently Tembaga is receiving $250.000 before tax rental income each year from Perak Inc. Tembaga will no longer receive the rental income should the board decide to take the project. In five years, the equipment can be sold for about 20 percent of its acquisition cost. Tembaga is in the 25 percent tax bracket and the project cost of equity is 8 percent. Tembaga Inc., a well-known manufacturer of inflatable boat is considering a new project, a thickened inflatable boat. Thickened boat is of higher quality and double the price of the normal inflatable boat. The project will require $1,500,000 investment in equipment. The project will also require $218,000 additional inventory, $39.000 additional accounts receivable and $165,000 of short term debt. The equipment will be depreciated straight-line to zero over the life of the project. Over five years of the project, Tembaga has confirmed the following bid from the State National Disaster Agency. YEAR Quantity Price per unit 1 2000 $600 2 2500 $650 3 3000 $700 4 3500 $750 5 4000 $800 The following assumptions were prepared by the finance unit in projecting the cash flows for the new project. Cost of goods sold includes a fixed cost of $50,000 per year and variable cost is expected to be 60 percent of the company sales. Fixed Cost is expected to increase at the inflation rate of 3 percent per year. The initial investment in working capital is assumed to be fully recovered at the end of the project. If Tembaga proceeds with the new project, it will utilise a plant that the company already owns. The plant is fully depreciated, however, currently Tembaga is receiving $250.000 before tax rental income each year from Perak Inc. Tembaga will no longer receive the rental income should the board decide to take the project. In five years, the equipment can be sold for about 20 percent of its acquisition cost. Tembaga is in the 25 percent tax bracket and the project cost of equity is 8 percentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started