Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare statement of income and shares equity and balance sheet. please attach notes to financial statements. The company's head office is located at their flagship

Prepare statement of income and shares equity and balance sheet. please attach notes to financial statements.

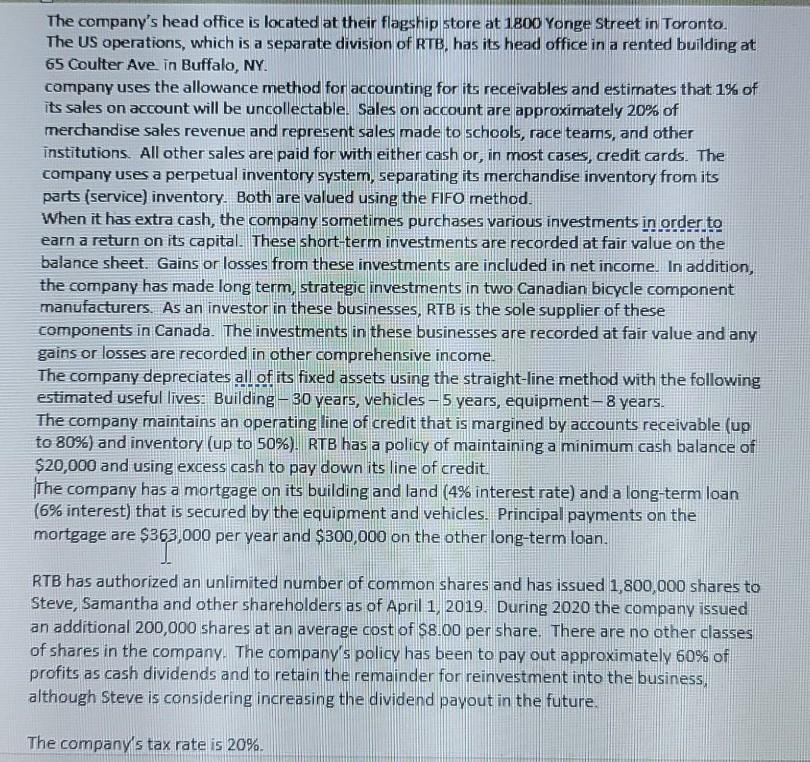

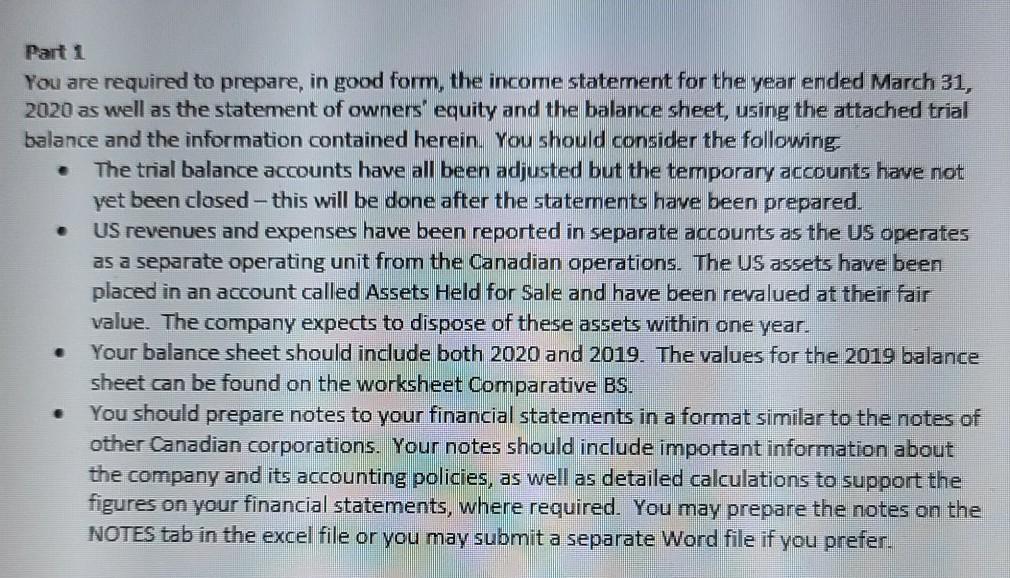

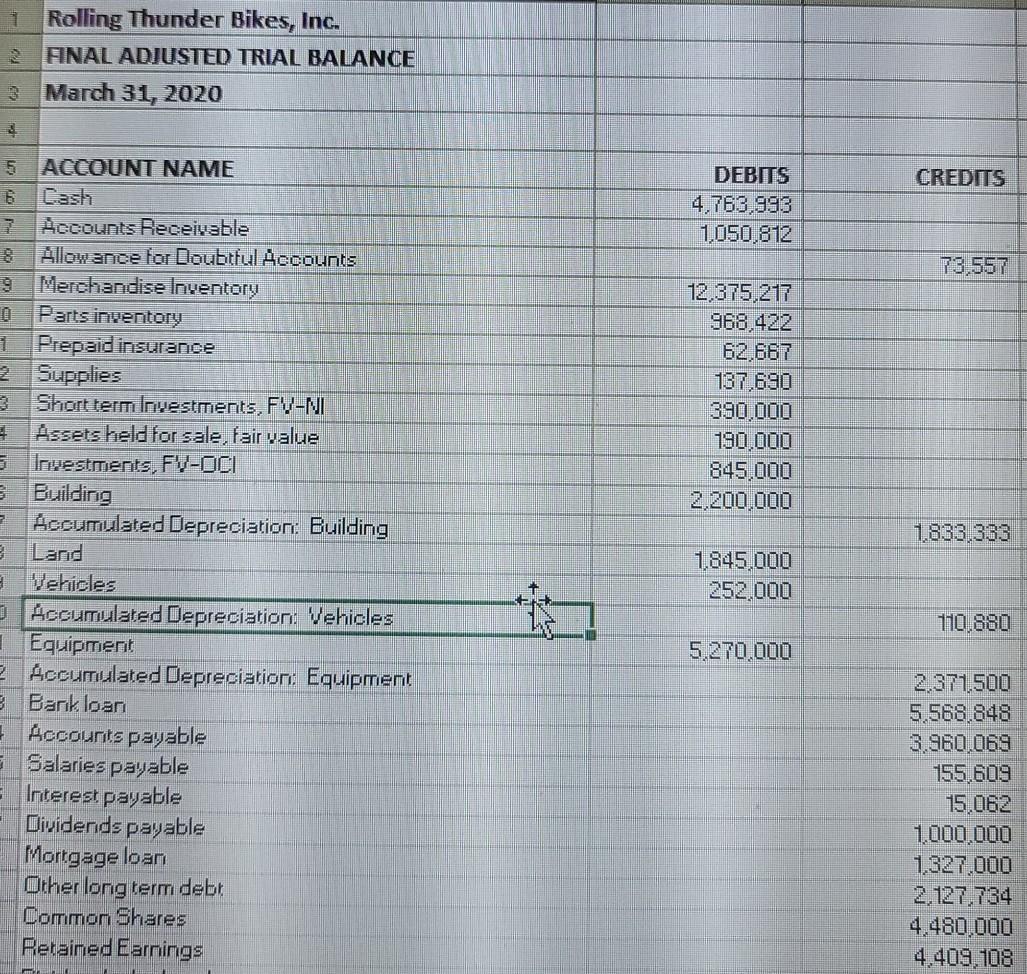

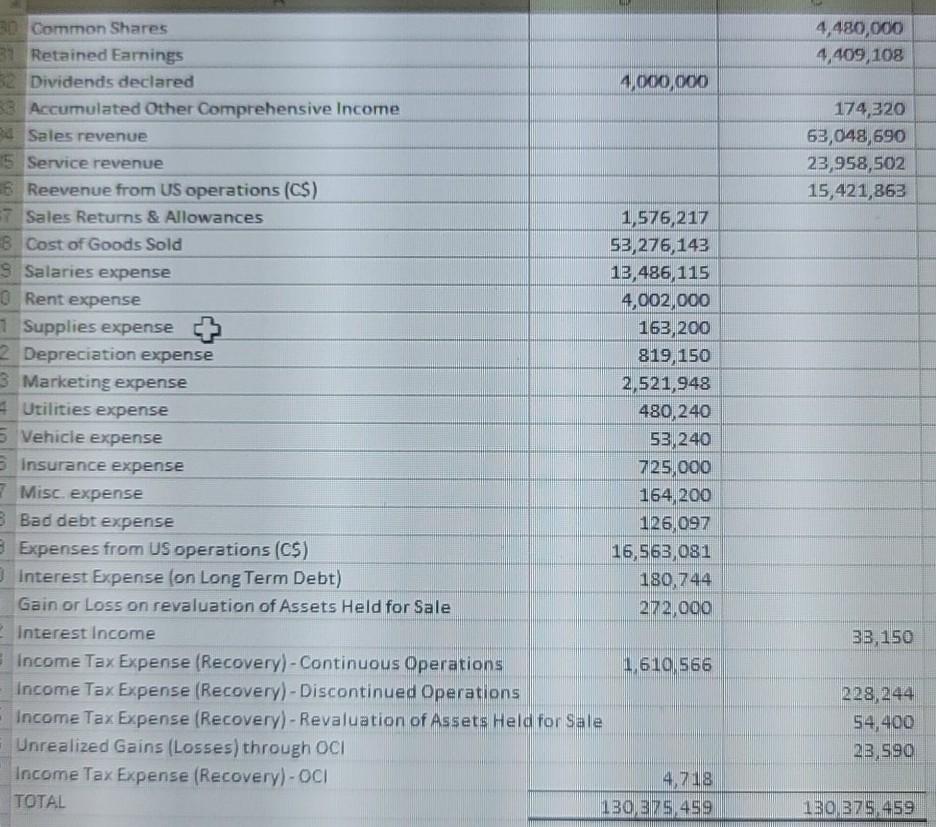

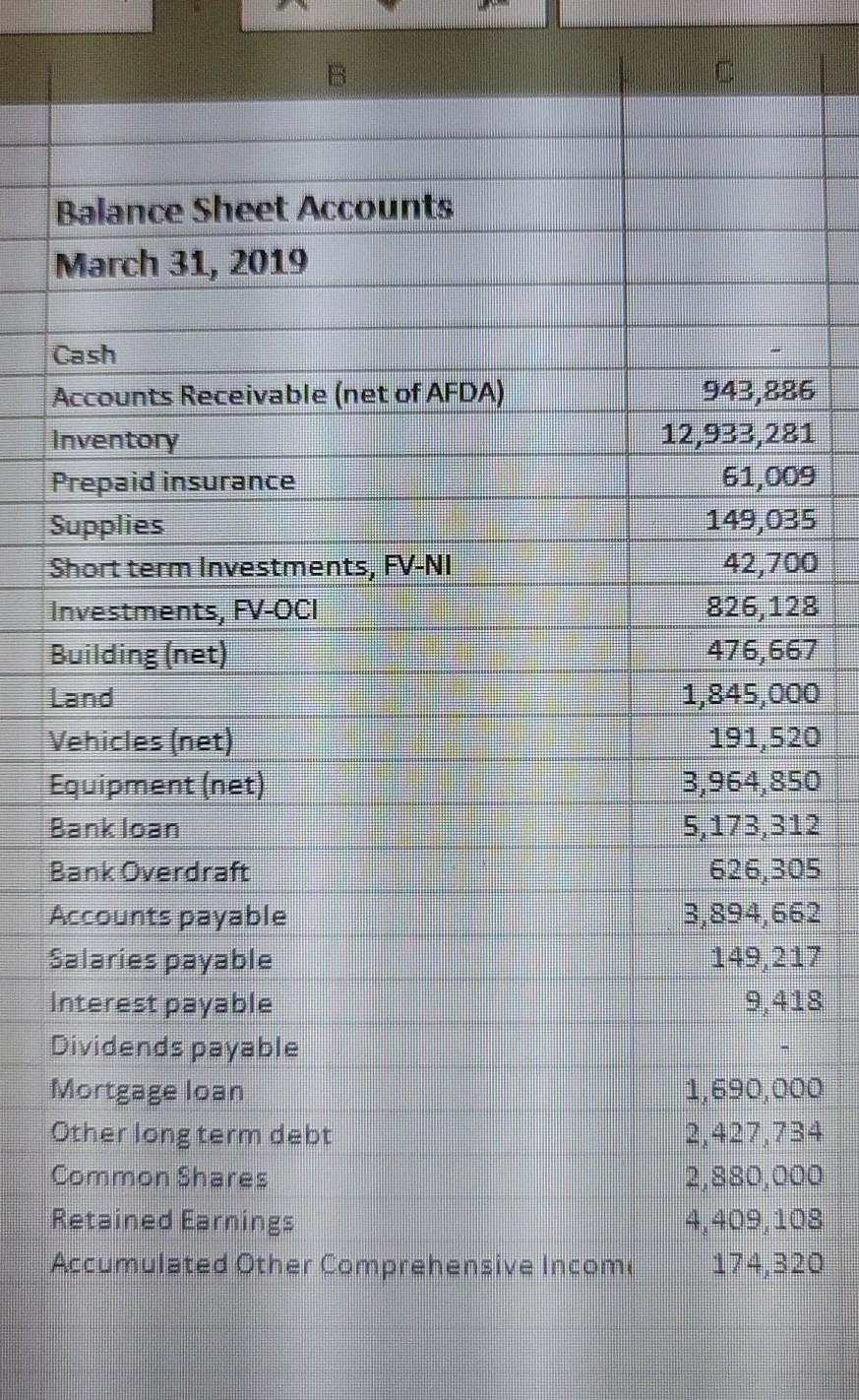

The company's head office is located at their flagship store at 1800 Yonge Street in Toronto. The US operations, which is a separate division of RTB has its head office in a rented building at 65 Coulter Ave in Buffalo, NY. company uses the allowance method for accounting for its receivables and estimates that 1% of its sales on account will be uncollectable. Sales on account are approximately 20% of merchandise sales revenue and represent sales made to schools, race teams, and other institutions. All other sales are paid for with either cash or, in most cases, credit cards. The company uses a perpetual inventory system, separating its merchandise inventory from its parts (service) inventory. Both are valued using the FIFO method. When it has extra cash, the company sometimes purchases various investments in order to earn a return on its capital. These short-term investments are recorded at fair value on the balance sheet. Gains or losses from these investments are included in net income. In addition, the company has made long term, strategic investments in two Canadian bicycle component manufacturers. As an investor in these businesses, RTB is the sole supplier of these components in Canada. The investments in these businesses are recorded at fair value and any gains or losses are recorded in other comprehensive income. The company depreciates all of its fixed assets using the straight-line method with the following estimated useful lives. Building - 30 years, vehicles-5 years, equipment-8 years. The company maintains an operating line of credit that is margined by accounts receivable (up to 80%) and inventory (up to 50%). RTB has a policy of maintaining a minimum cash balance of $20,000 and using excess cash to pay down its line of credit. The company has a mortgage on its building and land (4% interest rate) and a long-term loan (6% interest) that is secured by the equipment and vehicles. Principal payments on the mortgage are $363,000 per year and $300,000 on the other long-term loan. RTB has authorized an unlimited number of common shares and has issued 1,800,000 shares to Steve, Samantha and other shareholders as of April 1, 2019. During 2020 the company issued an additional 200,000 shares at an average cost of $8.00 per share. There are no other classes of shares in the company. The company's policy has been to pay out approximately 60% of profits as cash dividends and to retain the remainder for reinvestment into the business, although Steve is considering increasing the dividend payout in the future. The company's tax rate is 20%. Part 1 You are required to prepare, in good form, the income statement for the year ended March 31, 2020 as well as the statement of owners' equity and the balance sheet, using the attached trial balance and the information contained herein. You should consider the following The trial balance accounts have all been adjusted but the temporary accounts have not yet been closed - this will be done after the statements have been prepared. US revenues and expenses have been reported in separate accounts as the US operates as a separate operating unit from the Canadian operations. The US assets have been placed in an account called Assets Held for Sale and have been revalued at their fair value. The company expects to dispose of these assets within one year. Your balance sheet should include both 2020 and 2019. The values for the 2019 balance sheet can be found on the worksheet Comparative BS. You should prepare notes to your financial statements in a format similar to the notes of other Canadian corporations. Your notes should include important information about the company and its accounting policies, as well as detailed calculations to support the figures on your financial statements, where required. You may prepare the notes on the NOTES tab in the excel file or you may submit a separate Word file if you prefer. Rolling Thunder Bikes, Inc. FINAL ADJUSTED TRIAL BALANCE March 31, 2020 CREDITS DEBITS 4,763.993 1050,812 12.375,217 968.422 62,667 137,690 390.000 190,000 845.000 2,200.000 1.833,333 ACCOUNT NAME Cash Decounts Receivable 8 Allowance for Doubtful Accounts Merchandise Inventory Parts inventory 1 Prepaid insurance 2 Supplies 3 Short term Investments, FV-NI 2 Assets held for sale, fair value Investments, FV-OCI 3 Building = Accumulated Depreciation. Building 3 Vehicles Accumulated Depreciation: Vehicles | Equipment 2 Accumulated Depreciation: Equipment 3 Bank loan Accounts payable Salaries payable e Interest payable Dividends payable Mortgage loan Other long term debt Common Shares Retained Earnings 1.845.000 252.000 110.880 5.270.000 2.371.500 5.568.848 3.960.069 155,609 15,062 1,000,000 1,327,000 2,127,734 4.480,000 4,409,108 4,480,000 4,409, 108 174,320 63,048,690 23,958,502 15,421,863 an Common Shares 31 Retained Earnings 52 Dividends declared 4,000,000 8 Accumulated Other Comprehensive Income 34 Sales revenue 5 Service revenue 6 Reevenue from US operations (CS) 7 Sales Returns & Allowances 1,576,217 8 Cost of Goods Sold 53,276,143 9 Salaries expense 13,486,115 0 Rent expense 4,002,000 7 Supplies expense + 163,200 2 Depreciation expense 819,150 3 Marketing expense 2,521,948 - Utilities expense 480, 240 5 Vehicle expense 53,240 insurance expense 725,000 Misc. expense 164,200 Bad debt expense 126,097 Expenses from US operations (C$) 16,563 081 Interest Expense (on Long Term Debt) 180,744 Gain or Loss on revaluation of Assets Held for Sale 272,000 Interest Income Income Tax Expense (Recovery) - Continuous Operations 1,610,566 Income Tax Expense (Recovery) - Discontinued Operations - Income Tax Expense (Recovery) - Revaluation of Assets Held for Sale Unrealized Gains (Losses) through OCI Income Tax Expense (Recovery) - OCI 4,718 TOTAL 130,375,459 33,150 228, 244 54,400 23,590 130,375,459 Balance Sheet Accounts March 31, 2019 Cash Accounts Receivable (net of AFDA) Inventory Prepaid insurance Supplies Short term Investments, FV-NI Investments, FV-OCI Building (net) 12,933,281 61,009 149,035 42,700 826,128 476,667 1,845,000 191,520 3,964,850 5,173,312 626,305 3,894,662 149,217 9.418 Vehicles (net) Equipment (net) Bank Overdraft Accounts payable Salaries payable Interest payable Dividends payable Mortgage loan Other long term debt Common Shares Retained Earnings Accumulated Other Comprehensive Incom, 1,690,000 2,427,734 || 2.880,000 4,409, 108 Rolling Thunder Bikes, Inc. STATEMENT OF COMPREHENSIVE INCOME Year Ended ENTER NAME OF YOUR COMPANY HERE USING EXCEL FORMULA STATEMENT OF CHANGES IN SHAREHOLDER'S EQUITY ENTER PERIOD END DATE HERE USING EXCEL FORMULA ACCOUNT: BEGINNING OF YEAR BALANCE The company's head office is located at their flagship store at 1800 Yonge Street in Toronto. The US operations, which is a separate division of RTB has its head office in a rented building at 65 Coulter Ave in Buffalo, NY. company uses the allowance method for accounting for its receivables and estimates that 1% of its sales on account will be uncollectable. Sales on account are approximately 20% of merchandise sales revenue and represent sales made to schools, race teams, and other institutions. All other sales are paid for with either cash or, in most cases, credit cards. The company uses a perpetual inventory system, separating its merchandise inventory from its parts (service) inventory. Both are valued using the FIFO method. When it has extra cash, the company sometimes purchases various investments in order to earn a return on its capital. These short-term investments are recorded at fair value on the balance sheet. Gains or losses from these investments are included in net income. In addition, the company has made long term, strategic investments in two Canadian bicycle component manufacturers. As an investor in these businesses, RTB is the sole supplier of these components in Canada. The investments in these businesses are recorded at fair value and any gains or losses are recorded in other comprehensive income. The company depreciates all of its fixed assets using the straight-line method with the following estimated useful lives. Building - 30 years, vehicles-5 years, equipment-8 years. The company maintains an operating line of credit that is margined by accounts receivable (up to 80%) and inventory (up to 50%). RTB has a policy of maintaining a minimum cash balance of $20,000 and using excess cash to pay down its line of credit. The company has a mortgage on its building and land (4% interest rate) and a long-term loan (6% interest) that is secured by the equipment and vehicles. Principal payments on the mortgage are $363,000 per year and $300,000 on the other long-term loan. RTB has authorized an unlimited number of common shares and has issued 1,800,000 shares to Steve, Samantha and other shareholders as of April 1, 2019. During 2020 the company issued an additional 200,000 shares at an average cost of $8.00 per share. There are no other classes of shares in the company. The company's policy has been to pay out approximately 60% of profits as cash dividends and to retain the remainder for reinvestment into the business, although Steve is considering increasing the dividend payout in the future. The company's tax rate is 20%. Part 1 You are required to prepare, in good form, the income statement for the year ended March 31, 2020 as well as the statement of owners' equity and the balance sheet, using the attached trial balance and the information contained herein. You should consider the following The trial balance accounts have all been adjusted but the temporary accounts have not yet been closed - this will be done after the statements have been prepared. US revenues and expenses have been reported in separate accounts as the US operates as a separate operating unit from the Canadian operations. The US assets have been placed in an account called Assets Held for Sale and have been revalued at their fair value. The company expects to dispose of these assets within one year. Your balance sheet should include both 2020 and 2019. The values for the 2019 balance sheet can be found on the worksheet Comparative BS. You should prepare notes to your financial statements in a format similar to the notes of other Canadian corporations. Your notes should include important information about the company and its accounting policies, as well as detailed calculations to support the figures on your financial statements, where required. You may prepare the notes on the NOTES tab in the excel file or you may submit a separate Word file if you prefer. Rolling Thunder Bikes, Inc. FINAL ADJUSTED TRIAL BALANCE March 31, 2020 CREDITS DEBITS 4,763.993 1050,812 12.375,217 968.422 62,667 137,690 390.000 190,000 845.000 2,200.000 1.833,333 ACCOUNT NAME Cash Decounts Receivable 8 Allowance for Doubtful Accounts Merchandise Inventory Parts inventory 1 Prepaid insurance 2 Supplies 3 Short term Investments, FV-NI 2 Assets held for sale, fair value Investments, FV-OCI 3 Building = Accumulated Depreciation. Building 3 Vehicles Accumulated Depreciation: Vehicles | Equipment 2 Accumulated Depreciation: Equipment 3 Bank loan Accounts payable Salaries payable e Interest payable Dividends payable Mortgage loan Other long term debt Common Shares Retained Earnings 1.845.000 252.000 110.880 5.270.000 2.371.500 5.568.848 3.960.069 155,609 15,062 1,000,000 1,327,000 2,127,734 4.480,000 4,409,108 4,480,000 4,409, 108 174,320 63,048,690 23,958,502 15,421,863 an Common Shares 31 Retained Earnings 52 Dividends declared 4,000,000 8 Accumulated Other Comprehensive Income 34 Sales revenue 5 Service revenue 6 Reevenue from US operations (CS) 7 Sales Returns & Allowances 1,576,217 8 Cost of Goods Sold 53,276,143 9 Salaries expense 13,486,115 0 Rent expense 4,002,000 7 Supplies expense + 163,200 2 Depreciation expense 819,150 3 Marketing expense 2,521,948 - Utilities expense 480, 240 5 Vehicle expense 53,240 insurance expense 725,000 Misc. expense 164,200 Bad debt expense 126,097 Expenses from US operations (C$) 16,563 081 Interest Expense (on Long Term Debt) 180,744 Gain or Loss on revaluation of Assets Held for Sale 272,000 Interest Income Income Tax Expense (Recovery) - Continuous Operations 1,610,566 Income Tax Expense (Recovery) - Discontinued Operations - Income Tax Expense (Recovery) - Revaluation of Assets Held for Sale Unrealized Gains (Losses) through OCI Income Tax Expense (Recovery) - OCI 4,718 TOTAL 130,375,459 33,150 228, 244 54,400 23,590 130,375,459 Balance Sheet Accounts March 31, 2019 Cash Accounts Receivable (net of AFDA) Inventory Prepaid insurance Supplies Short term Investments, FV-NI Investments, FV-OCI Building (net) 12,933,281 61,009 149,035 42,700 826,128 476,667 1,845,000 191,520 3,964,850 5,173,312 626,305 3,894,662 149,217 9.418 Vehicles (net) Equipment (net) Bank Overdraft Accounts payable Salaries payable Interest payable Dividends payable Mortgage loan Other long term debt Common Shares Retained Earnings Accumulated Other Comprehensive Incom, 1,690,000 2,427,734 || 2.880,000 4,409, 108 Rolling Thunder Bikes, Inc. STATEMENT OF COMPREHENSIVE INCOME Year Ended ENTER NAME OF YOUR COMPANY HERE USING EXCEL FORMULA STATEMENT OF CHANGES IN SHAREHOLDER'S EQUITY ENTER PERIOD END DATE HERE USING EXCEL FORMULA ACCOUNT: BEGINNING OF YEAR BALANCE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started