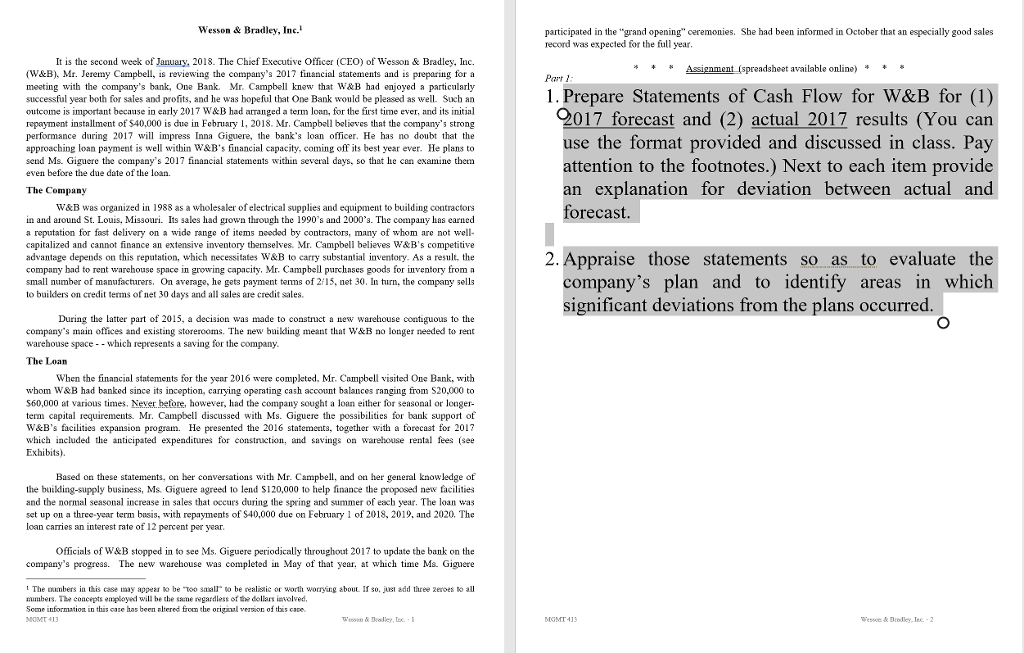

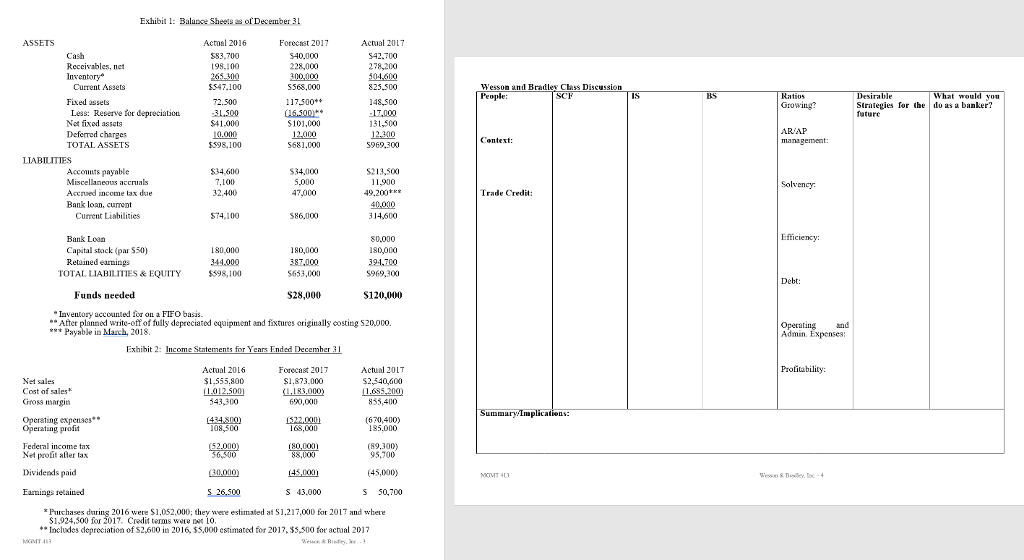

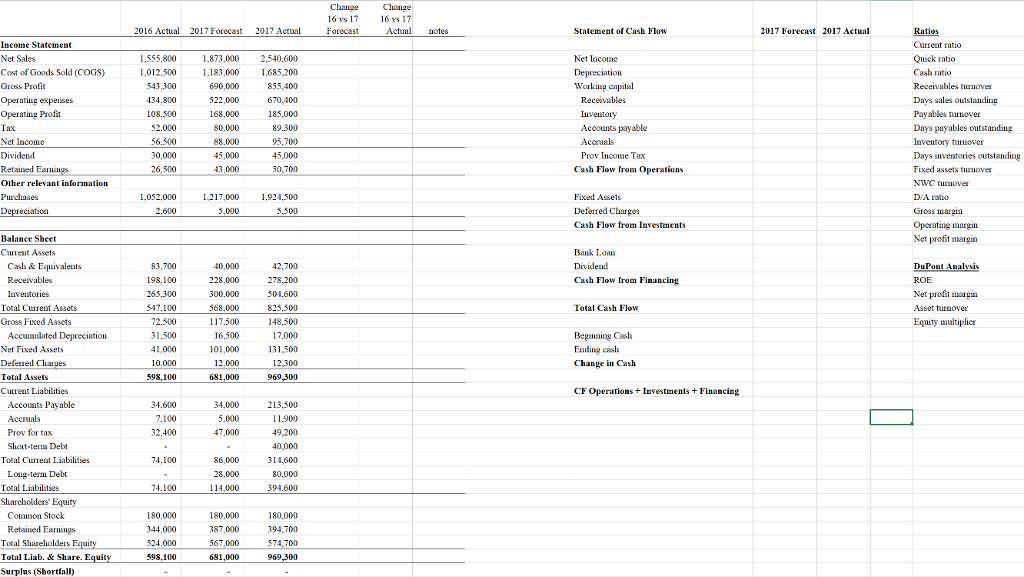

- Prepare Statements of Cash Flow for W&B for (1) 2017 forecast and (2) actual 2017 results (You can use the format provided and discussed in class. Pay attention to the footnotes.) Next to each item provide an explanation for deviation between actual and forecast.

- Appraise those statements so as to evaluate the companys plan and to identify areas in which significant deviations from the plans occurred.

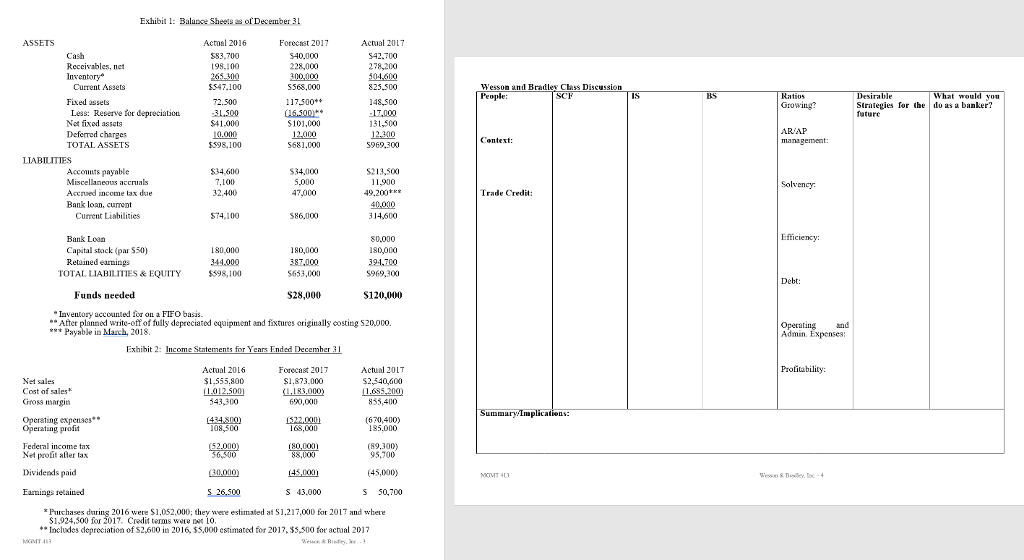

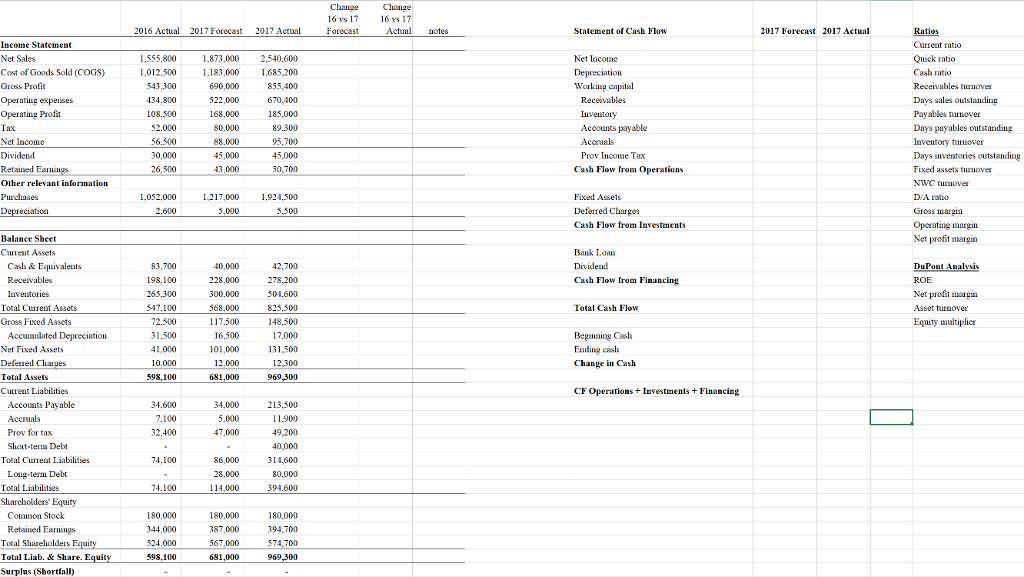

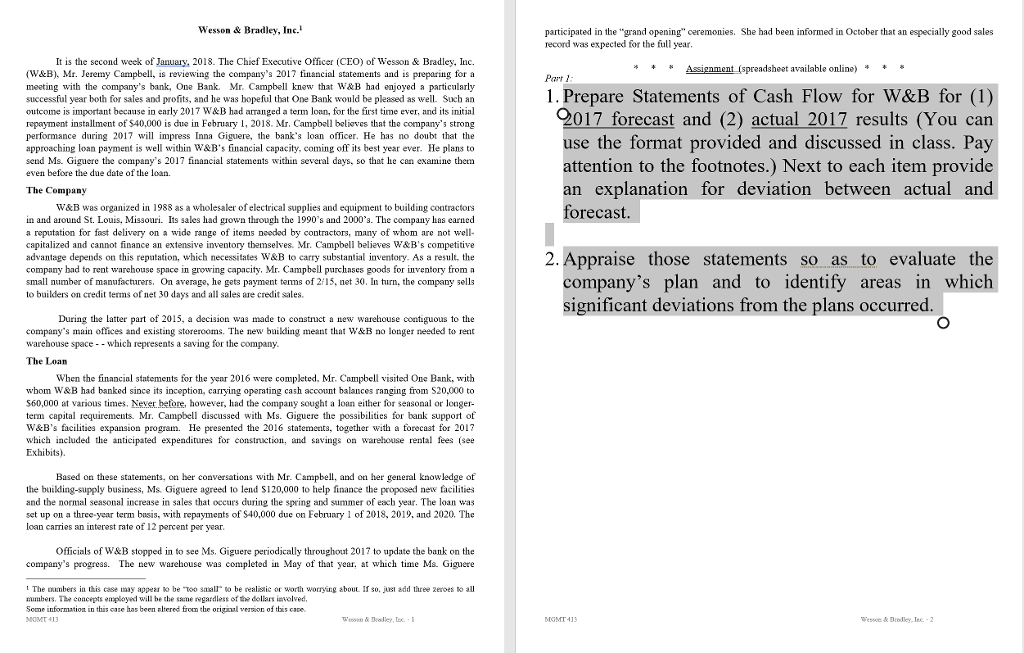

Wesson & Bradley, Inc. participated in the "grand opening" ceremonies. She had been informed in October that an especially good sales record was expected for the full year It is the second week of January, 2018. The Chief Executive Officer (CEO) of Wesson & Bradley, Inc. *4* Assignment (spreadsheet available online) ** (W&B), Mr. Jeremy Campbell, is reviewing the company's 2017 financial statements and is preparing for a meeting with the company's bank, One Bank Mr. Campbell knew that W&B had enjoyed a particularly successful year both for sales and profits, and he was bopeful that One Bank would be pleased as well. Such an outcome is important because in early 2017 W&B had arranged a term loan, for the first time ever, and its initial repayment installment of $40,000 is due in February 1, 2018. Mr. Campbell believes that the company's strong performance during 2017 ll impress Inna Giguere, the bank's loan officer. He has no doubt that the approaching loan payment is well within W&B's financial capacity, coming off its best year ever. He plans to send Ms. Giguere the company's 2017 financial statements within several days, so that he can examine them even before the due date of the loan Part 1. Prepare Statements of Cash Flow for W&B for (1) 2017 forecast and (2) actual 2017 results (You can use the format provided and discussed in class. Pay attention to the footnotes.) Next to each item provide an explanation for deviation between actual and The Company W&B was organized in 1988 as a wholesaler of electrical supplies and equipment to building contractors forecast in and around St. Louis, Missouri. Its sales had grown through the 1990's and 2000 s. The company has earned a reputation for fast delivery on wide range of items needed by contractors, many of whom are not well- capitalized and cannot finance an extensive inventory thamselves. Mr. Campbell believes W&B's competitive advantage depends on this reputation, which necessitates W&B to carry substantial inventory. As a result, the company bad to rent warehouse space in growing capacity. Mr. Campbell purchases goods for inventory from a small number of manufacturers. On average, he gets paymant tenns of 2 15,net 30 In tu, the company sells to builders on credit tems of net 30 days and al sales are credit sales. 2. Appraise those statements so as to evaluate the company's plan and to identify areas in which significant deviations from the plans occurred During the latter part of 2015, a decision was made to construct a new warehouse coatiguous to the company's main offices and existing storerooms. The new building meant tat W&B no longer needed to rent warehouse spacewhich represents a saving for the company. The Loan When the financial statements for the year 2016 were completed, Mr. Campbell visited One Bank, with wbom W&B had banked since its inception, carrying operating cash account balances ranging from S20,000 to S60,000 at various times. Never betore, however, had the company sought a loan either for seasonal or longer term capital requirements. Mr. Campbell discussed with Ms. Giguere the possibilities for bank support ot W&B's facilities expansion program. He presented the 2016 statements, together with a forecast for 2017 which included the anticipated expenditures for construction, an savings on warehouse rental fees (see Exhibits) Based on these statements, on ber conversations with Mr. Campbel, and on her general knowledge of the buikding-supply business, Ms. Giguere agreed to lend S120,000 to help finance the proposed new facilities and the normal seasonal increase in sales that occurs during the spring and summer of each year. The loan was set up on a three-year term basis, with repayments of S40,000 due on February 1 of 2018, 2019, and 2020. The s an interest rate of 12 percent par year Officials of W&B stopped in to see Ms. Giguere periodically throughout 2017 to update the bank on the company's progress. The new warehouse was completed in May of that year, at which time Ms. Giguere t The ambers in this case may appear to be Too slo be realisic or worth worrying about If so, jusl add three zeroes to all mumbers The concepts employed will be the same regardless of h dellars involved, Sone informatioa in this case has been altered froen the origil version of this ce Exhibi Balance Sheets as of December 3L ASSETS Acmal 2016 583,700 198,100 Forocnst 2017 Cash Receivables, net Inventory Actual 2OLT 542.700 278,200 504,600 228,000 300,000 5563,000 Current Assets $547.100 72.500 31 500 $41.000 Wesson and Bradler Class Discus Pe 148,500 31,500 5969.300 Fixed assets 117.500 $101,000 5681,00 Strategies for the do as a banker? fature Less: Reserve for depreciation Net fixed assets Deferred charges TOTAL ASSETS AR AP Context: $598,100 Miscellaneous accruals Accrved income tax due Bank loan, current 34,000 5.000 47,000 S213,500 11,900 49.200 t K 40.000 314,600 32.400 Trade Credit: Current Liabilities ST4,100 Efficiency: Bank Loon Capatal stock (par $50) Retained earnings 80,000 344.000 398,100 80,000 80,000 180,000 TOTAL LIABILITIES & EQUITY $633.000 S969,300 Debt: Funds needed $28,000 S120,000 Iave entory accounted for on a FIFO basis After planned write-off of fully depreciated equipment and fixtures origially costing S20,000. Payable in March, 2018 Opetating and Admin. Expenses: Exhibit 2: Income Statements for Years Ended December 31 Actual 20L6 1,555,800 Forecast 2017 $1,873,000 Actual 20LT Net sales Cost of sales Gross magin 43,300 630,000 833,400 Operating expenses Operating proft (670,400 185.000 108,500 8,000 Federal income tax Net profit aller tax (89,300) 83,00 Dividends paid (45,000) S 43.000 50,700 2016 were $1,052,000; they were estimated at S1,217,000 for 201T and where S1,924,300 for 2017. Credit terms wete pet io. Includes depreciation of S2,600 in 2016, $5,000 estimated for 2017, 35,500 for actual 2017 Change Change 2016 Actual 2017 Forecast 2017 Acrual Actual otes Statement of Cash Flovw 2017 Forecast 2017 Actual 1,555,800 Operating expenses Prov Income Tax Cash Flow from Operations Deferred Charges Cash Flow from Investments Cash & Equivalents Total Cash Flow Gross Fixed Assets Cmrent Liabilities CF Operations+Investments+Financing Retained Earnings Total Liab. & Share. Surplus (Shortfall) Wesson & Bradley, Inc. participated in the "grand opening" ceremonies. She had been informed in October that an especially good sales record was expected for the full year It is the second week of January, 2018. The Chief Executive Officer (CEO) of Wesson & Bradley, Inc. *4* Assignment (spreadsheet available online) ** (W&B), Mr. Jeremy Campbell, is reviewing the company's 2017 financial statements and is preparing for a meeting with the company's bank, One Bank Mr. Campbell knew that W&B had enjoyed a particularly successful year both for sales and profits, and he was bopeful that One Bank would be pleased as well. Such an outcome is important because in early 2017 W&B had arranged a term loan, for the first time ever, and its initial repayment installment of $40,000 is due in February 1, 2018. Mr. Campbell believes that the company's strong performance during 2017 ll impress Inna Giguere, the bank's loan officer. He has no doubt that the approaching loan payment is well within W&B's financial capacity, coming off its best year ever. He plans to send Ms. Giguere the company's 2017 financial statements within several days, so that he can examine them even before the due date of the loan Part 1. Prepare Statements of Cash Flow for W&B for (1) 2017 forecast and (2) actual 2017 results (You can use the format provided and discussed in class. Pay attention to the footnotes.) Next to each item provide an explanation for deviation between actual and The Company W&B was organized in 1988 as a wholesaler of electrical supplies and equipment to building contractors forecast in and around St. Louis, Missouri. Its sales had grown through the 1990's and 2000 s. The company has earned a reputation for fast delivery on wide range of items needed by contractors, many of whom are not well- capitalized and cannot finance an extensive inventory thamselves. Mr. Campbell believes W&B's competitive advantage depends on this reputation, which necessitates W&B to carry substantial inventory. As a result, the company bad to rent warehouse space in growing capacity. Mr. Campbell purchases goods for inventory from a small number of manufacturers. On average, he gets paymant tenns of 2 15,net 30 In tu, the company sells to builders on credit tems of net 30 days and al sales are credit sales. 2. Appraise those statements so as to evaluate the company's plan and to identify areas in which significant deviations from the plans occurred During the latter part of 2015, a decision was made to construct a new warehouse coatiguous to the company's main offices and existing storerooms. The new building meant tat W&B no longer needed to rent warehouse spacewhich represents a saving for the company. The Loan When the financial statements for the year 2016 were completed, Mr. Campbell visited One Bank, with wbom W&B had banked since its inception, carrying operating cash account balances ranging from S20,000 to S60,000 at various times. Never betore, however, had the company sought a loan either for seasonal or longer term capital requirements. Mr. Campbell discussed with Ms. Giguere the possibilities for bank support ot W&B's facilities expansion program. He presented the 2016 statements, together with a forecast for 2017 which included the anticipated expenditures for construction, an savings on warehouse rental fees (see Exhibits) Based on these statements, on ber conversations with Mr. Campbel, and on her general knowledge of the buikding-supply business, Ms. Giguere agreed to lend S120,000 to help finance the proposed new facilities and the normal seasonal increase in sales that occurs during the spring and summer of each year. The loan was set up on a three-year term basis, with repayments of S40,000 due on February 1 of 2018, 2019, and 2020. The s an interest rate of 12 percent par year Officials of W&B stopped in to see Ms. Giguere periodically throughout 2017 to update the bank on the company's progress. The new warehouse was completed in May of that year, at which time Ms. Giguere t The ambers in this case may appear to be Too slo be realisic or worth worrying about If so, jusl add three zeroes to all mumbers The concepts employed will be the same regardless of h dellars involved, Sone informatioa in this case has been altered froen the origil version of this ce Exhibi Balance Sheets as of December 3L ASSETS Acmal 2016 583,700 198,100 Forocnst 2017 Cash Receivables, net Inventory Actual 2OLT 542.700 278,200 504,600 228,000 300,000 5563,000 Current Assets $547.100 72.500 31 500 $41.000 Wesson and Bradler Class Discus Pe 148,500 31,500 5969.300 Fixed assets 117.500 $101,000 5681,00 Strategies for the do as a banker? fature Less: Reserve for depreciation Net fixed assets Deferred charges TOTAL ASSETS AR AP Context: $598,100 Miscellaneous accruals Accrved income tax due Bank loan, current 34,000 5.000 47,000 S213,500 11,900 49.200 t K 40.000 314,600 32.400 Trade Credit: Current Liabilities ST4,100 Efficiency: Bank Loon Capatal stock (par $50) Retained earnings 80,000 344.000 398,100 80,000 80,000 180,000 TOTAL LIABILITIES & EQUITY $633.000 S969,300 Debt: Funds needed $28,000 S120,000 Iave entory accounted for on a FIFO basis After planned write-off of fully depreciated equipment and fixtures origially costing S20,000. Payable in March, 2018 Opetating and Admin. Expenses: Exhibit 2: Income Statements for Years Ended December 31 Actual 20L6 1,555,800 Forecast 2017 $1,873,000 Actual 20LT Net sales Cost of sales Gross magin 43,300 630,000 833,400 Operating expenses Operating proft (670,400 185.000 108,500 8,000 Federal income tax Net profit aller tax (89,300) 83,00 Dividends paid (45,000) S 43.000 50,700 2016 were $1,052,000; they were estimated at S1,217,000 for 201T and where S1,924,300 for 2017. Credit terms wete pet io. Includes depreciation of S2,600 in 2016, $5,000 estimated for 2017, 35,500 for actual 2017 Change Change 2016 Actual 2017 Forecast 2017 Acrual Actual otes Statement of Cash Flovw 2017 Forecast 2017 Actual 1,555,800 Operating expenses Prov Income Tax Cash Flow from Operations Deferred Charges Cash Flow from Investments Cash & Equivalents Total Cash Flow Gross Fixed Assets Cmrent Liabilities CF Operations+Investments+Financing Retained Earnings Total Liab. & Share. Surplus (Shortfall)