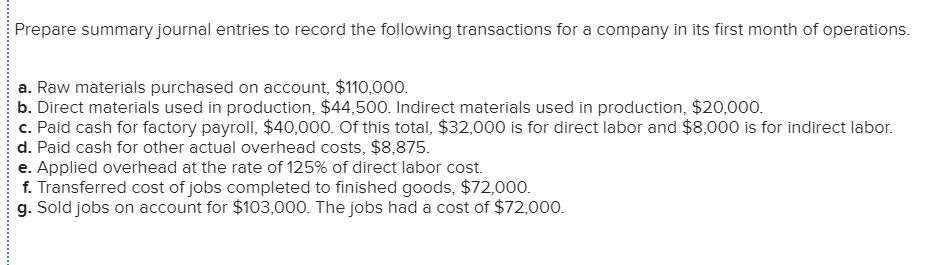

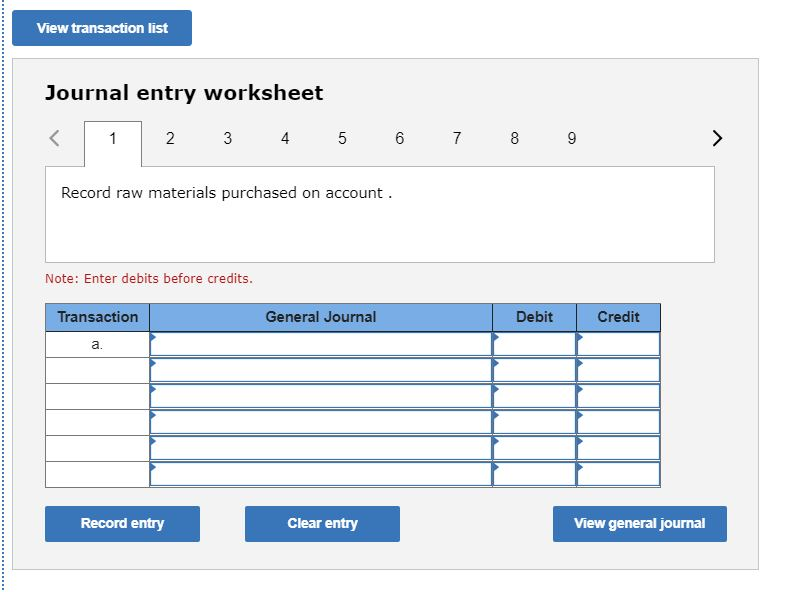

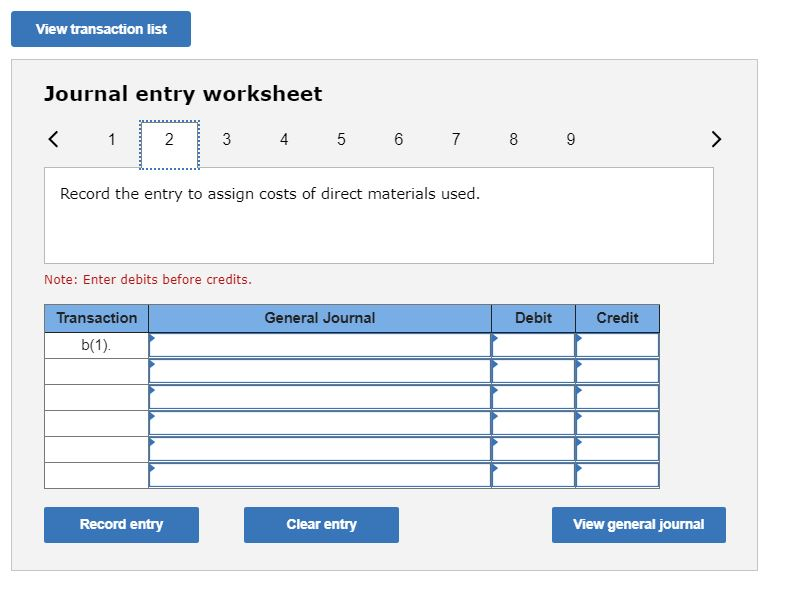

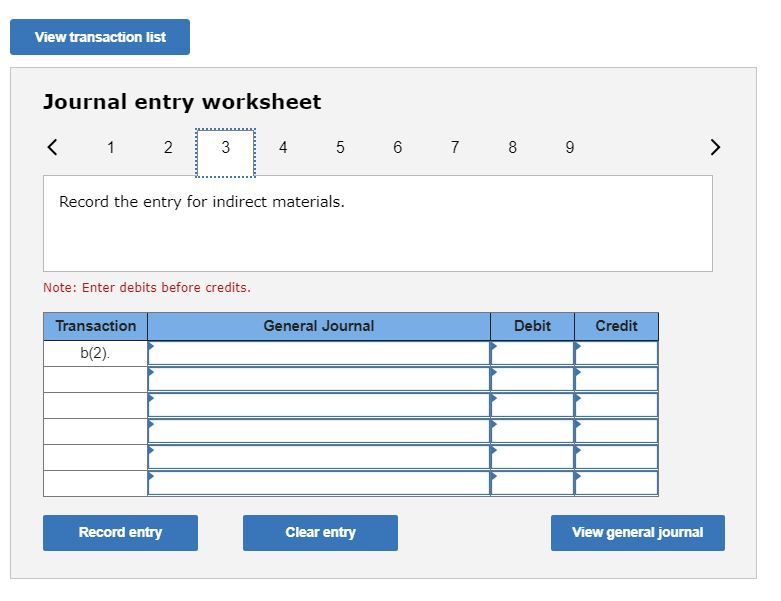

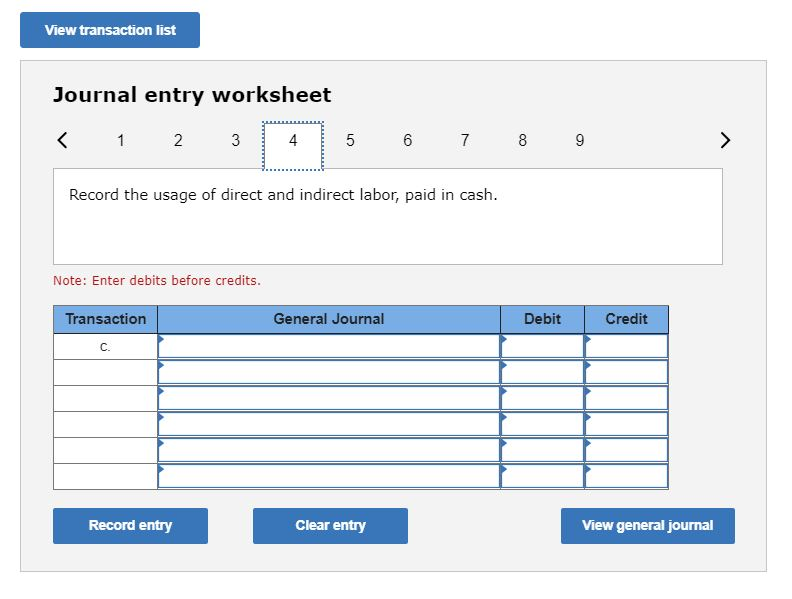

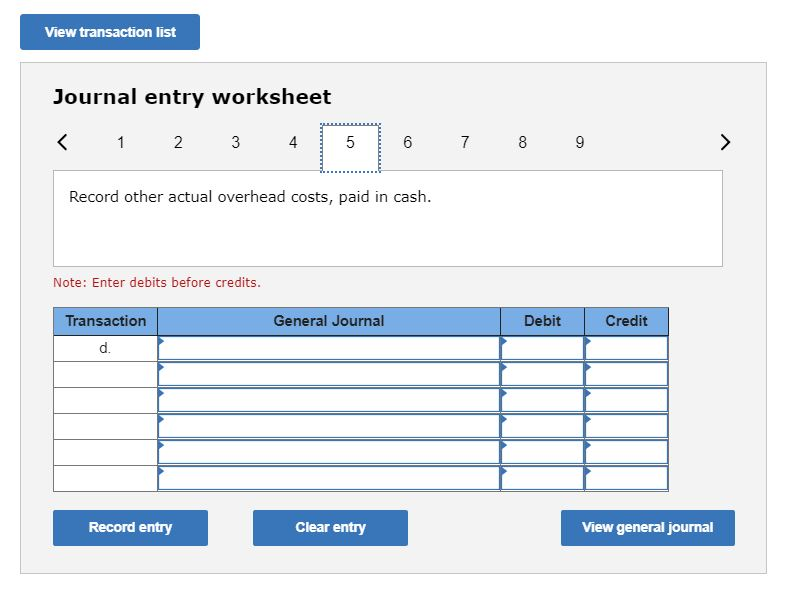

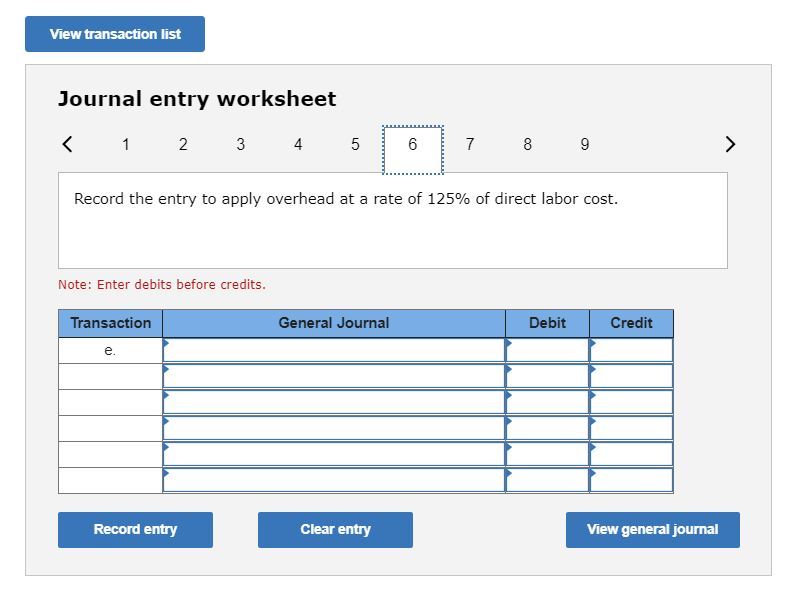

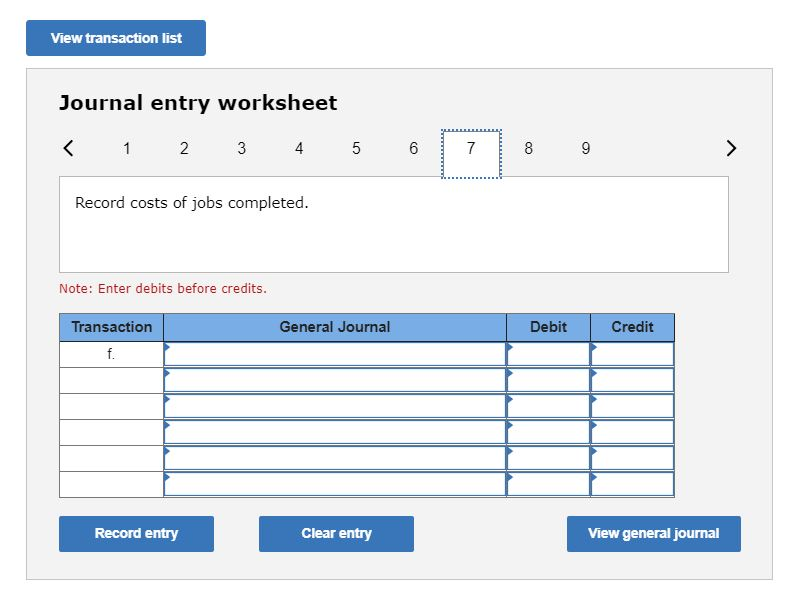

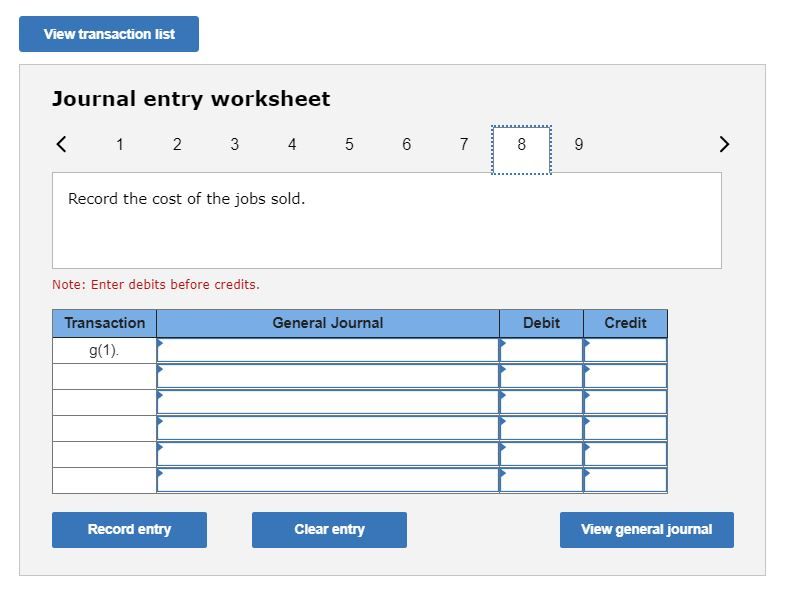

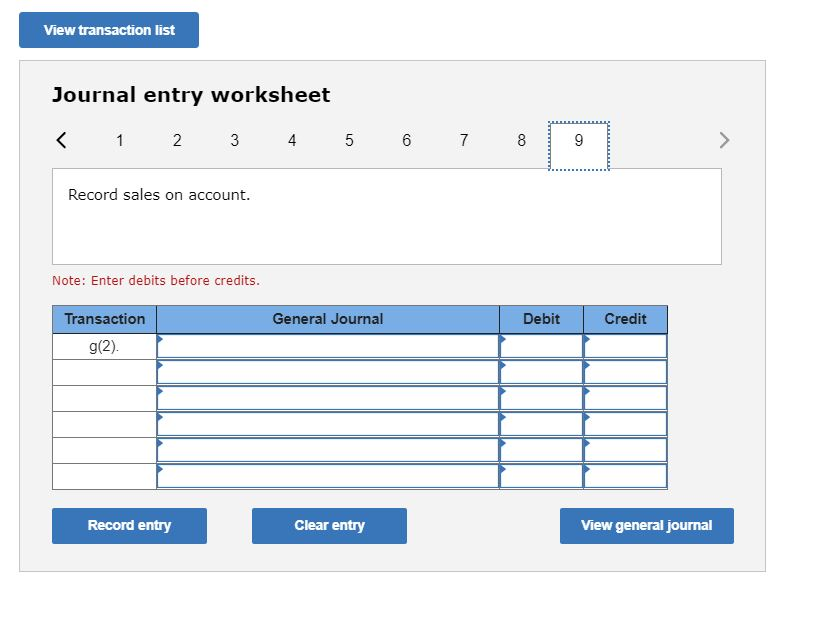

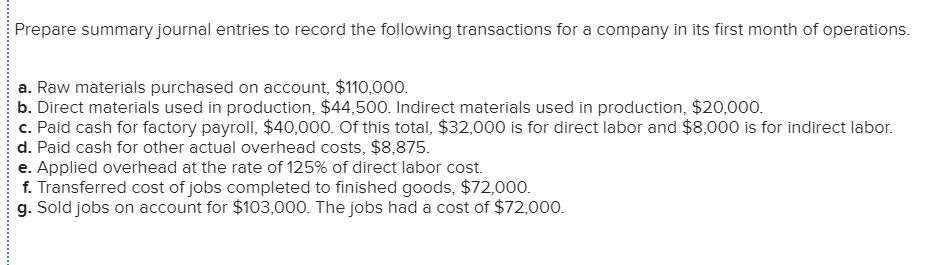

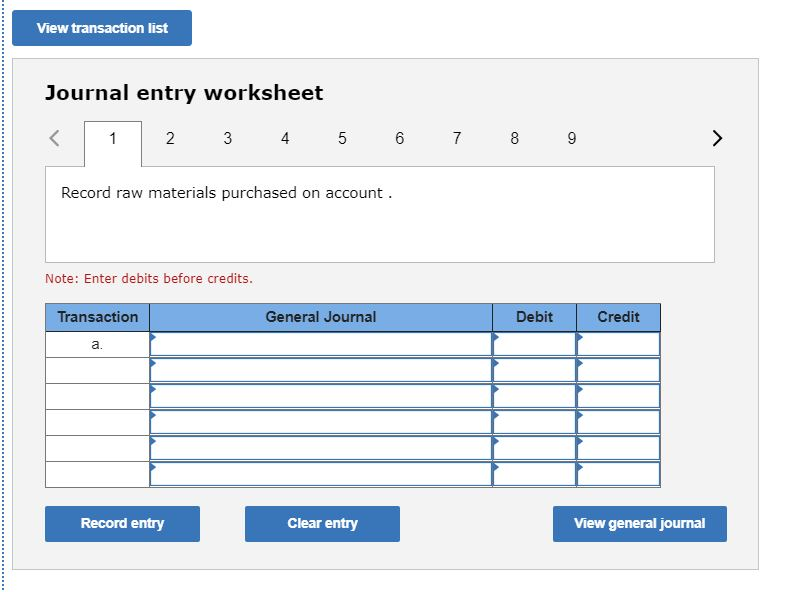

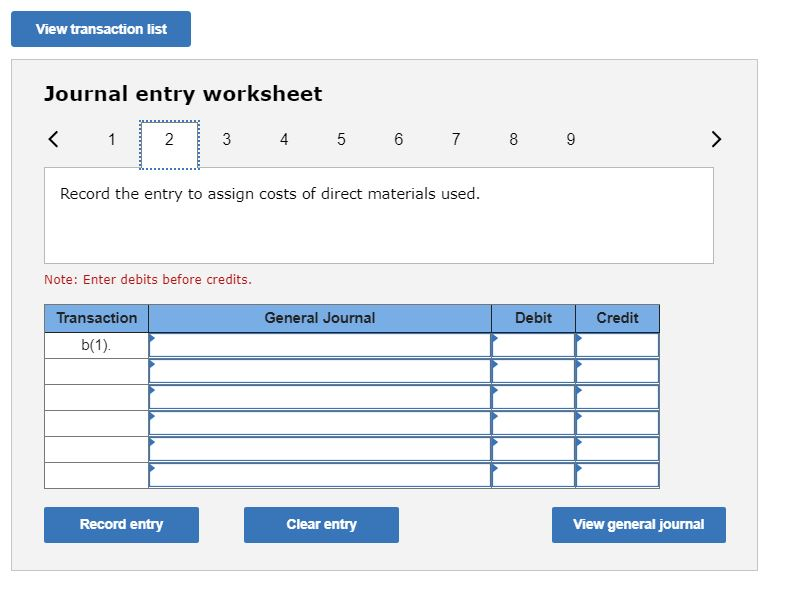

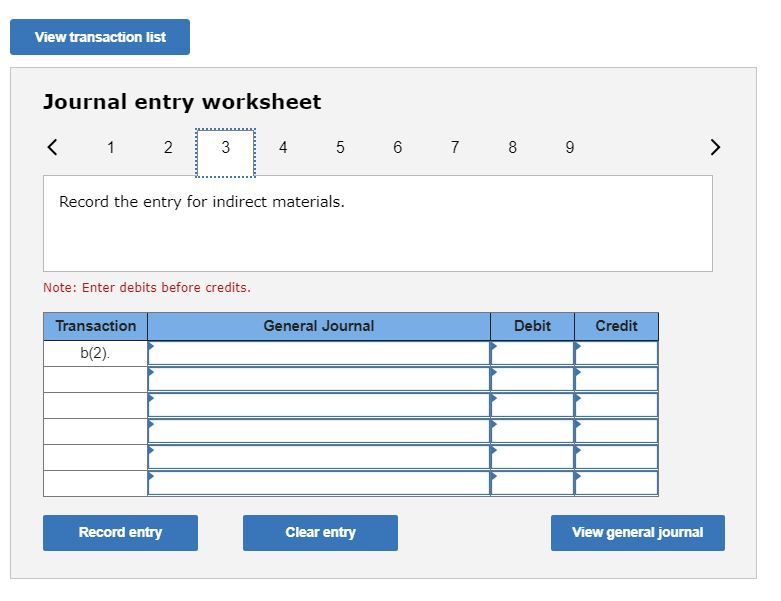

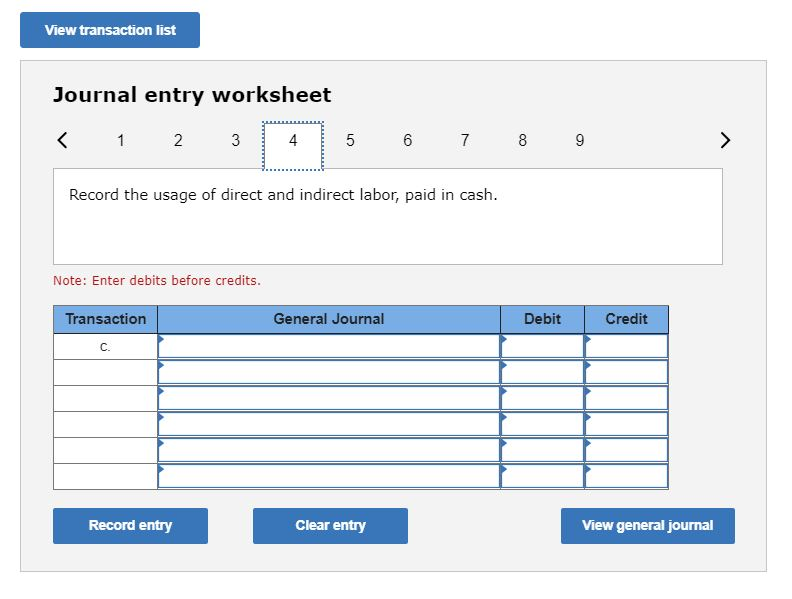

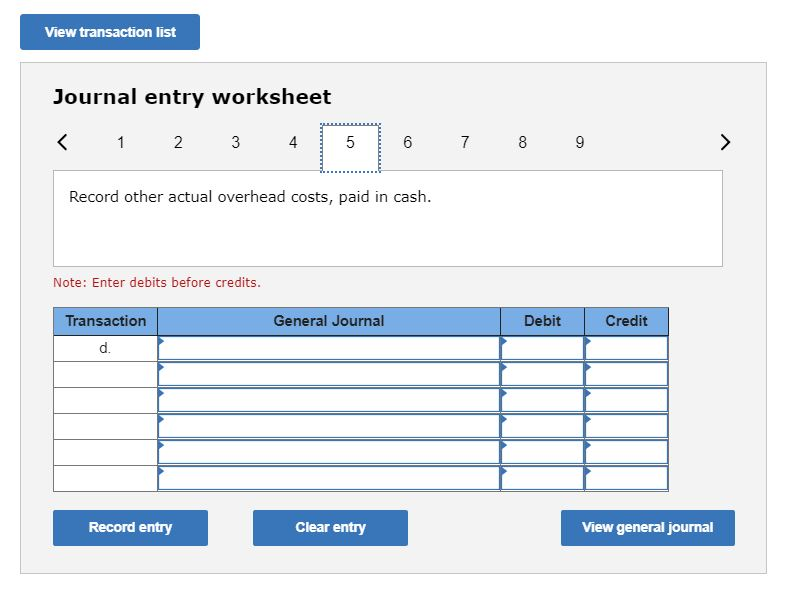

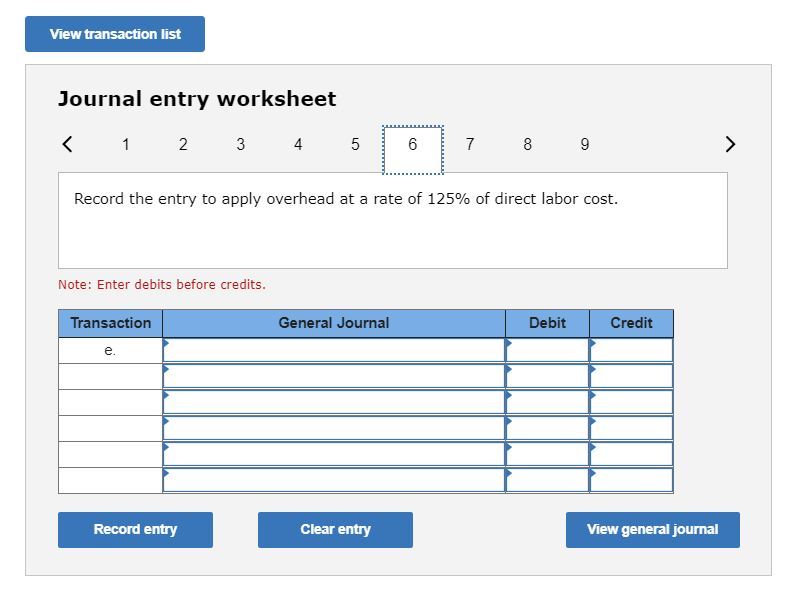

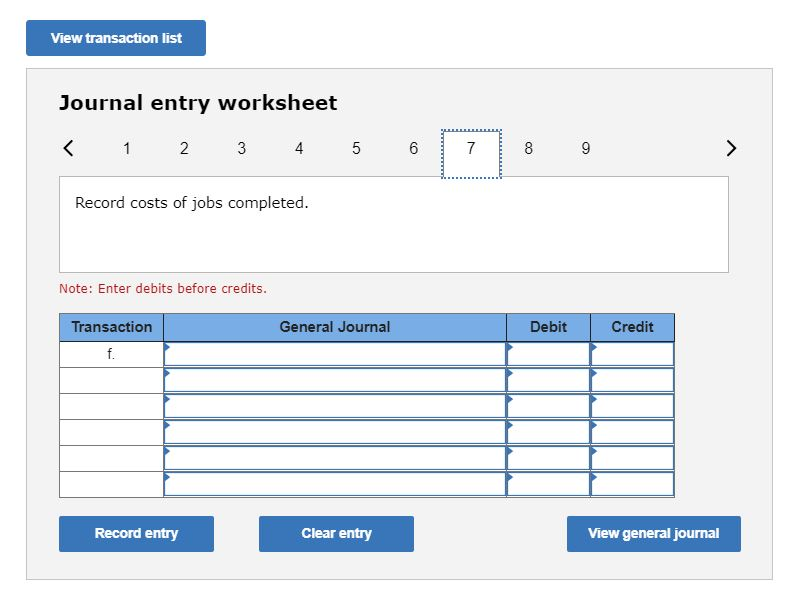

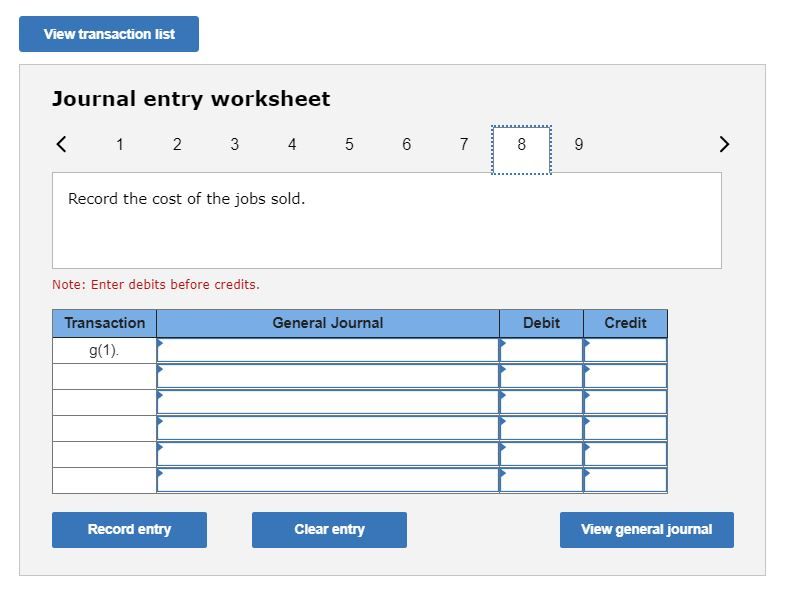

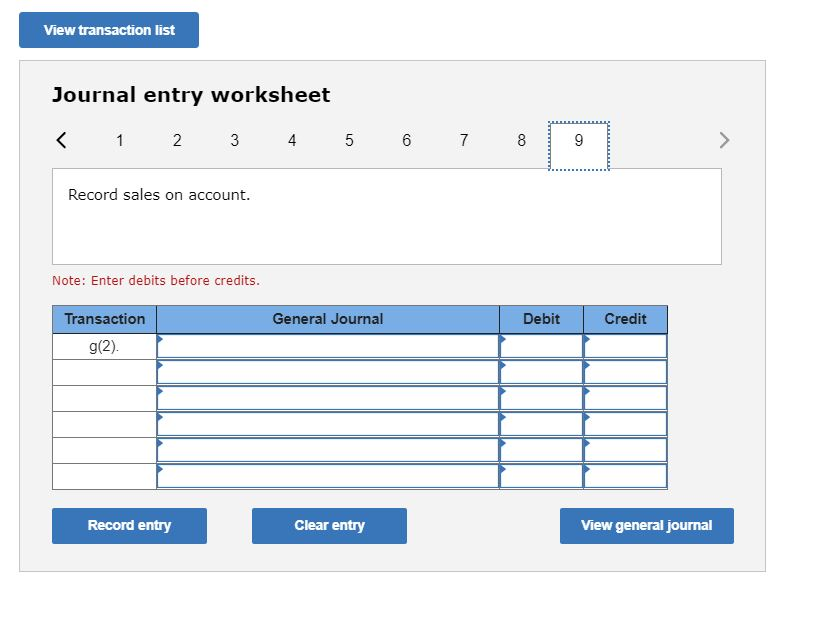

Prepare summary journal entries to record the following transactions for a company in its first month of operations. a. Raw materials purchased on account, $110,000. b. Direct materials used in production, $44,500. Indirect materials used in production, $20,000. c. Paid cash for factory payroll, $40,000. Of this total, $32,000 is for direct labor and $8,000 is for indirect labor. d. Paid cash for other actual overhead costs, $8,875. e. Applied overhead at the rate of 125% of direct labor cost. f. Transferred cost of jobs completed to finished goods. $72,000. g. Sold jobs on account for $103,000. The jobs had a cost of $72,000. View transaction list Journal entry worksheet Record raw materials purchased on account. Note: Enter debits before credits. General Journal Debit Credit Transaction a. Record entry Clear entry View general journal View transaction list Journal entry worksheet N Record the entry to assign costs of direct materials used. Note: Enter debits before credits. General Journal Debit Credit Transaction b(1). Record entry Clear entry View general journal View transaction list Journal entry worksheet Record the entry for indirect materials. Note: Enter debits before credits. General Journal Debit Credit Transaction (2) Record entry Clear entry View general journal View transaction list Journal entry worksheet Record the usage of direct and indirect labor, paid in cash. Note: Enter debits before credits. Transaction General Journal Debit Credit C. Record entry Clear entry View general journal View transaction list Journal entry worksheet Record other actual overhead costs, paid in cash. Note: Enter debits before credits. General Journal Debit Credit Transaction d. Record entry Clear entry View general journal View transaction list Journal entry worksheet Record the entry to apply overhead at a rate of 125% of direct labor cost. Note: Enter debits before credits. General Journal Debit Credit Transaction e. Record entry Clear entry View general journal View transaction list Journal entry worksheet Record costs of jobs completed. Note: Enter debits before credits. Transaction General Journal Debit Credit f. Record entry Clear entry View general journal View transaction list Journal entry worksheet Record sales on account. Note: Enter debits before credits. General Journal Debit Credit Transaction g(2) Record entry Clear entry View general journal