Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare T-account entries for all appropriate (see tips below) B/S and I/S accounts to obtain a 3,000 debit balance in the C&CEMain T-account. Prepare

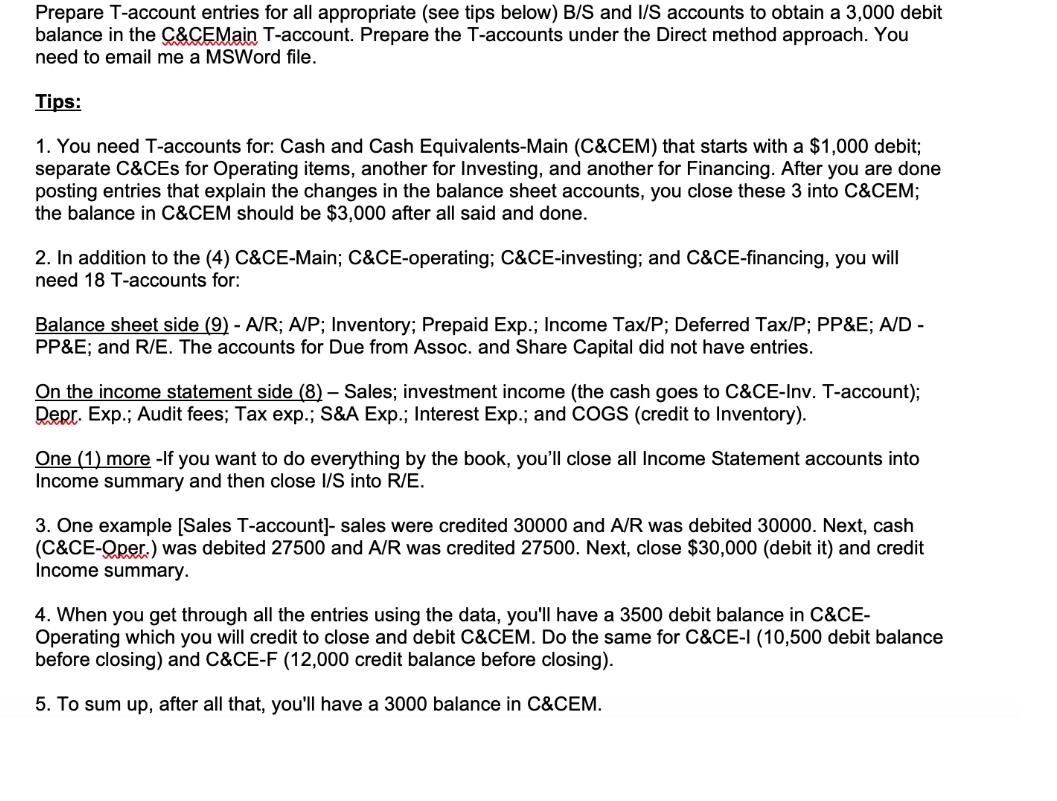

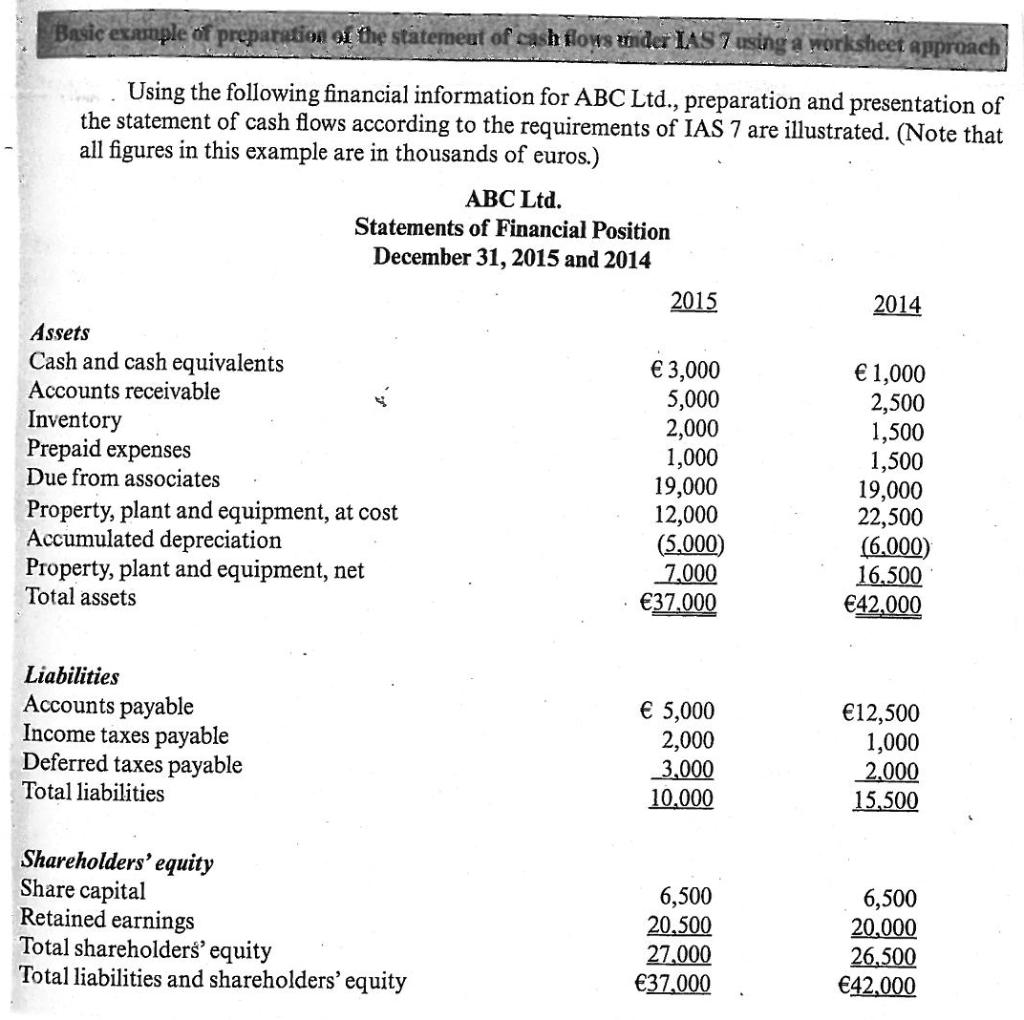

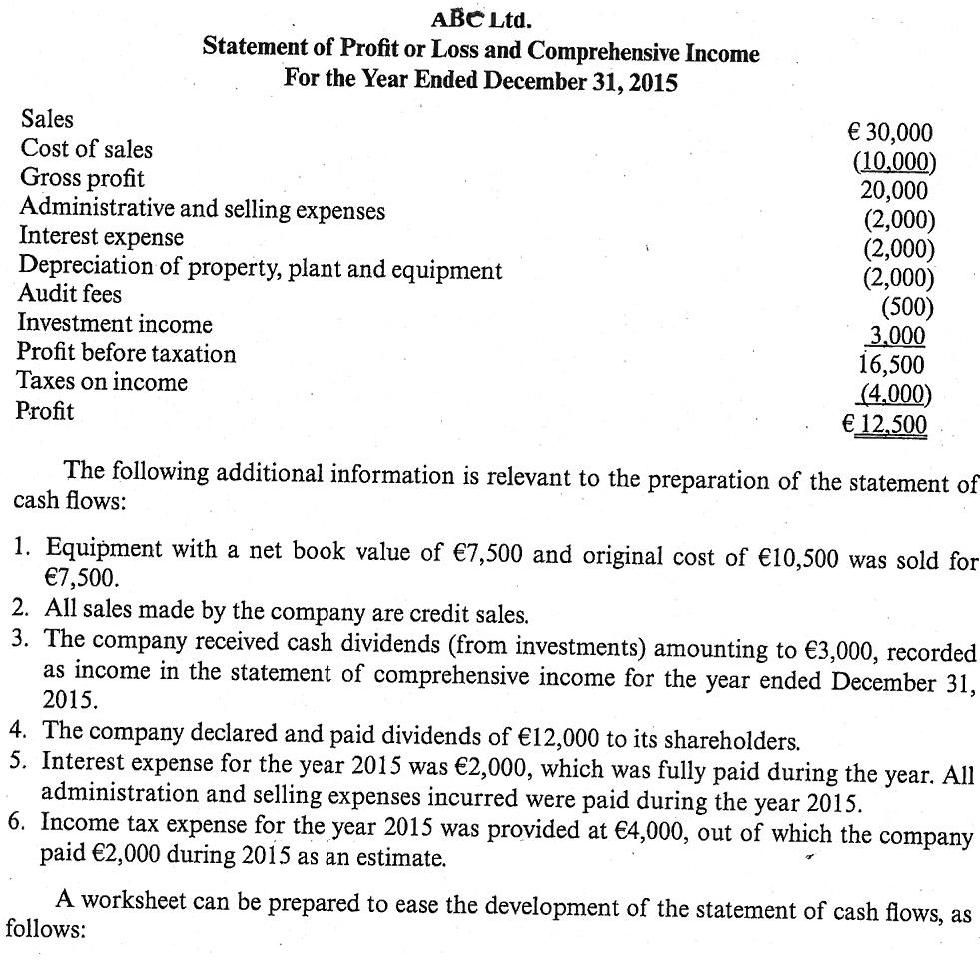

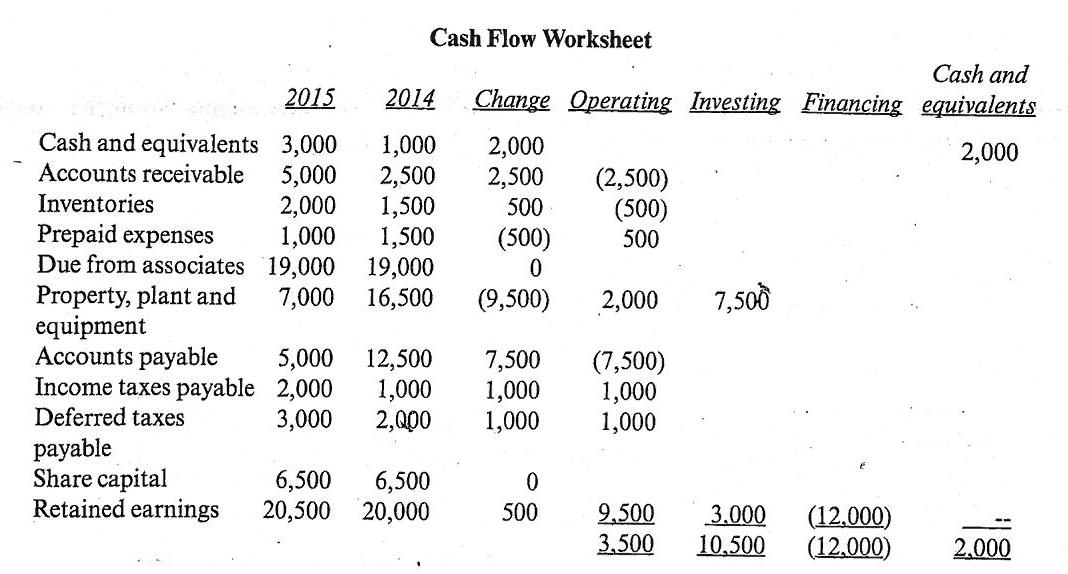

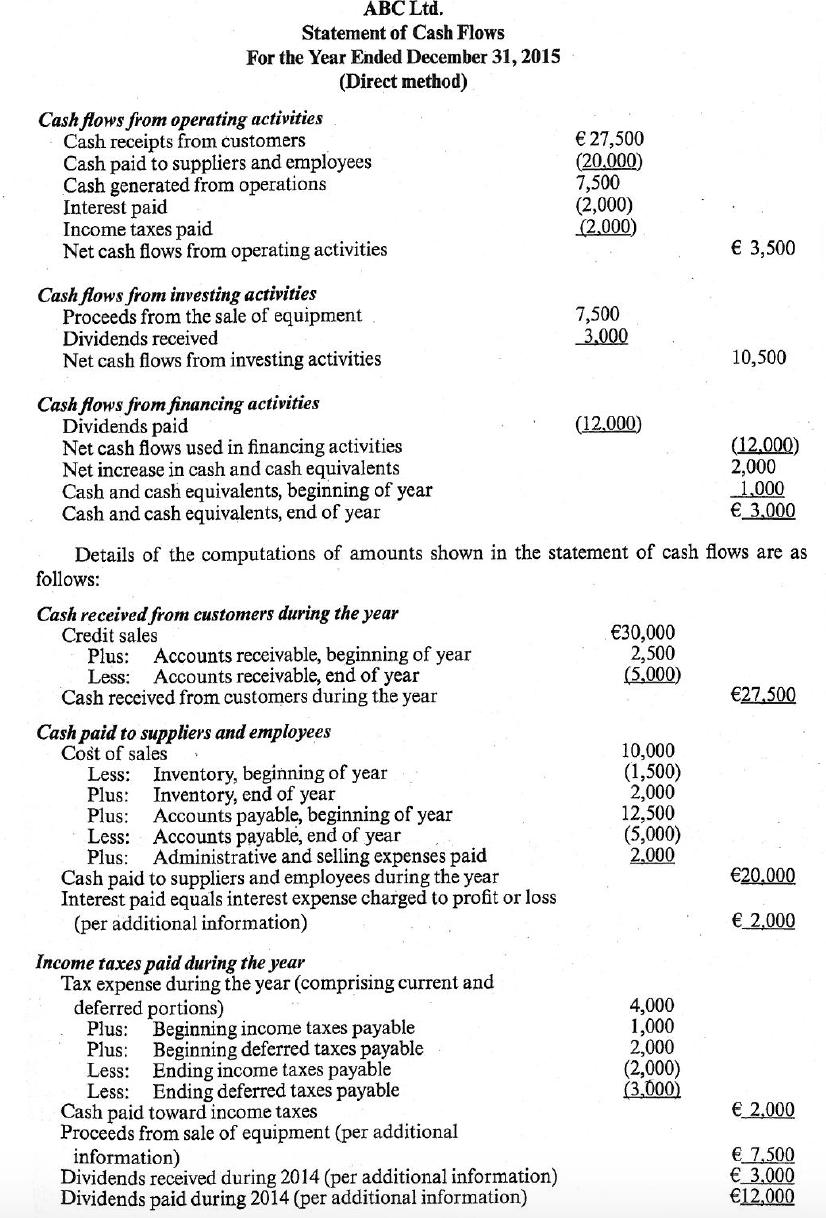

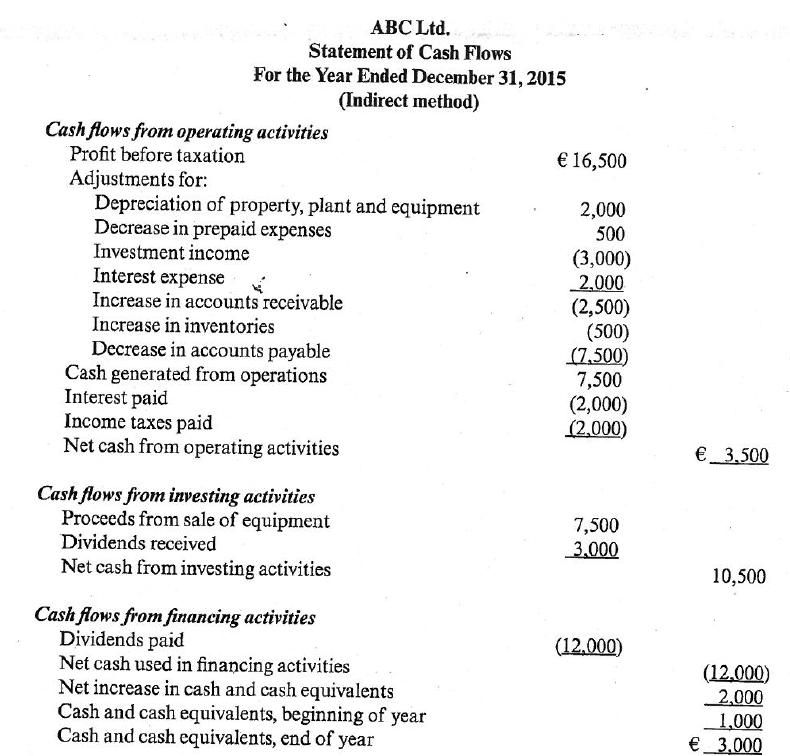

Prepare T-account entries for all appropriate (see tips below) B/S and I/S accounts to obtain a 3,000 debit balance in the C&CEMain T-account. Prepare the T-accounts under the Direct method approach. You need to email me a MSWord file. Tips: 1. You need T-accounts for: Cash and Cash Equivalents-Main (C&CEM) that starts with a $1,000 debit; separate C&CEs for Operating items, another for Investing, and another for Financing. After you are done posting entries that explain the changes in the balance sheet accounts, you close these 3 into C&CEM; the balance in C&CEM should be $3,000 after all said and done. 2. In addition to the (4) C&CE-Main; C&CE-operating; C&CE-investing; and C&CE-financing, you will need 18 T-accounts for: Balance sheet side (9) - A/R; A/P; Inventory; Prepaid Exp.; Income Tax/P; Deferred Tax/P; PP&E; A/D - PP&E; and R/E. The accounts for Due from Assoc. and Share Capital did not have entries. On the income statement side (8) - Sales; investment income (the cash goes to C&CE-Inv. T-account); Depr. Exp.; Audit fees; Tax exp.; S&A Exp.; Interest Exp.; and COGS (credit to Inventory). One (1) more -If you want to do everything by the book, you'll close all Income Statement accounts into Income summary and then close I/S into R/E. 3. One example [Sales T-account]- sales were credited 30000 and A/R was debited 30000. Next, cash (C&CE-Oper.) was debited 27500 and A/R was credited 27500. Next, close $30,000 (debit it) and credit Income summary. 4. When you get through all the entries using the data, you'll have a 3500 debit balance in C&CE- Operating which you will credit to close and debit C&CEM. Do the same for C&CE-I (10,500 debit balance before closing) and C&CE-F (12,000 credit balance before closing). 5. To sum up, after all that, you'll have a 3000 balance in C&CEM. Basic example of preparation of the statement of cash flows under IAS 7 using a worksheet approach Using the following financial information for ABC Ltd., preparation and presentation of the statement of cash flows according to the requirements of IAS 7 are illustrated. (Note that all figures in this example are in thousands of euros.) Assets Cash and cash equivalents Accounts receivable Inventory Prepaid expenses Due from associates ABC Ltd. Statements of Financial Position December 31, 2015 and 2014 Property, plant and equipment, at cost Accumulated depreciation Property, plant and equipment, net Total assets Liabilities Accounts payable Income taxes payable Deferred taxes payable Total liabilities Shareholders' equity Share capital Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 2015 3,000 5,000 2,000 1,000 19,000 12,000 (5,000) 7,000 37.000 5,000 2,000 3,000 10.000 6,500 20.500 27,000 37,000 2014 1,000 2,500 1,500 1,500 19,000 22,500 (6.000) 16.500 42,000 12,500 1,000 2,000 15,500 6,500 20,000 26,500 42,000 ABC Ltd. Statement of Profit or Loss and Comprehensive Income For the Year Ended December 31, 2015 Sales Cost of sales Gross profit Administrative and selling expenses Interest expense Depreciation of property, plant and equipment Audit fees Investment income Profit before taxation Taxes on income Profit 30,000 (10,000) 20,000 (2,000) (2,000) (2,000) (500) 3,000 16,500 (4.000) 12,500 The following additional information is relevant to the preparation of the statement of cash flows: 1. Equipment with a net book value of 7,500 and original cost of 10,500 was sold for 7,500. 2. All sales made by the company are credit sales. 3. The company received cash dividends (from investments) amounting to 3,000, recorded as income in the statement of comprehensive income for the year ended December 31, 2015. 4. The company declared and paid dividends of 12,000 to its shareholders. 5. Interest expense for the year 2015 was 2,000, which was fully paid during the year. All administration and selling expenses incurred were paid during the year 2015. 6. Income tax expense for the year 2015 was provided at 4,000, out of which the company paid 2,000 during 2015 as an estimate. A worksheet can be prepared to ease the development of the statement of cash flows, as follows: Prepaid expenses Due from associates 2015 Cash and equivalents 3,000 Accounts receivable 5,000 Inventories 2,000 1,500 1,000 1,500 19,000 19,000 7,000 16,500 Property, plant and equipment Accounts payable Income taxes payable Deferred taxes payable Share capital Retained earnings Cash Flow Worksheet Cash and 2014 Change Operating Investing Financing equivalents 2,000 6,500 20,500 1,000 2,000 2,500 2,500 (2,500) 500 (500) (500) 500 0 (9,500) 5,000 12,500 2,000 1,000 3,000 2,000 6,500 20,000 7,500 1,000 1,000 0 500 2,000 (7,500) 1,000 1,000 7,500 9,500 3.000 (12.000) 3,500 10,500 (12.000) 2,000 ABC Ltd. Statement of Cash Flows For the Year Ended December 31, 2015 (Direct method) Cash flows from operating activities Cash receipts from customers Cash paid to suppliers and employees Cash generated from operations Interest paid Income taxes paid Net cash flows from operating activities Cash flows from investing activities Proceeds from the sale of equipment Dividends received Net cash flows from investing activities Cash flows from financing activities Dividends paid Cash paid to suppliers and employees Cost of sales Less: Inventory, beginning of year Inventory, end of year Plus: Plus: Accounts payable, beginning of year Less: Accounts payable, end of year Plus: Administrative and selling expenses paid Cash paid to suppliers and employees during the year Interest paid equals interest expense charged to profit or loss (per additional information) Income taxes paid during the year Tax expense during the year (comprising current and deferred portions) Plus: Beginning income taxes payable Plus: Beginning deferred taxes payable Less: Ending income taxes payable Less: Ending deferred taxes payable Cash paid toward income taxes Proceeds from sale of equipment (per additional 27,500 (20.000) 7,500 (2,000) (2,000) information) Dividends received during 2014 (per additional information) Dividends paid during 2014 (per additional information) 7,500 3,000 (12,000) Net cash flows used in financing activities Net increase in cash and cash equivalents Cash and cash equivalents, beginning of year Cash and cash equivalents, end of year 1,000 3,000 Details of the computations of amounts shown in the statement of cash flows are as follows: Cash received from customers during the year Credit sales Plus: Accounts receivable, beginning of year Less: Accounts receivable, end of year Cash received from customers during the year 30,000 2,500 (5,000) 10,000 (1,500) 2,000 12,500 (5,000) 2,000 4,000 1,000 2,000 3,500 (2,000) (3,000) 10,500 (12,000) 2,000 27,500 20.000 2,000 2,000 7,500 3.000 12,000 ABC Ltd. Statement of Cash Flows For the Year Ended December 31, 2015 (Indirect method) Cash flows from operating activities Profit before taxation Adjustments for: Depreciation of property, plant and equipment Decrease in prepaid expenses Investment income Interest expense Increase in accounts receivable Increase in inventories Decrease in accounts payable Cash generated from operations Interest paid Income taxes paid Net cash from operating activities Cash flows from investing activities Proceeds from sale of equipment Dividends received Net cash from investing activities Cash flows from financing activities Dividends paid Net cash used in financing activities Net increase in cash and cash equivalents Cash and cash equivalents, beginning of year Cash and cash equivalents, end of year 16,500 2,000 500 (3,000) 2,000 (2,500) (500) (7,500) 7,500 (2,000) (2,000) 7,500 3,000 (12,000) 3.500 10,500 (12.000) 2,000 1,000 3.000 Prepare T-account entries for all appropriate (see tips below) B/S and I/S accounts to obtain a 3,000 debit balance in the C&CEMain T-account. Prepare the T-accounts under the Direct method approach. You need to email me a MSWord file. Tips: 1. You need T-accounts for: Cash and Cash Equivalents-Main (C&CEM) that starts with a $1,000 debit; separate C&CEs for Operating items, another for Investing, and another for Financing. After you are done posting entries that explain the changes in the balance sheet accounts, you close these 3 into C&CEM; the balance in C&CEM should be $3,000 after all said and done. 2. In addition to the (4) C&CE-Main; C&CE-operating; C&CE-investing; and C&CE-financing, you will need 18 T-accounts for: Balance sheet side (9) - A/R; A/P; Inventory; Prepaid Exp.; Income Tax/P; Deferred Tax/P; PP&E; A/D - PP&E; and R/E. The accounts for Due from Assoc. and Share Capital did not have entries. On the income statement side (8) - Sales; investment income (the cash goes to C&CE-Inv. T-account); Depr. Exp.; Audit fees; Tax exp.; S&A Exp.; Interest Exp.; and COGS (credit to Inventory). One (1) more -If you want to do everything by the book, you'll close all Income Statement accounts into Income summary and then close I/S into R/E. 3. One example [Sales T-account]- sales were credited 30000 and A/R was debited 30000. Next, cash (C&CE-Oper.) was debited 27500 and A/R was credited 27500. Next, close $30,000 (debit it) and credit Income summary. 4. When you get through all the entries using the data, you'll have a 3500 debit balance in C&CE- Operating which you will credit to close and debit C&CEM. Do the same for C&CE-I (10,500 debit balance before closing) and C&CE-F (12,000 credit balance before closing). 5. To sum up, after all that, you'll have a 3000 balance in C&CEM. Basic example of preparation of the statement of cash flows under IAS 7 using a worksheet approach Using the following financial information for ABC Ltd., preparation and presentation of the statement of cash flows according to the requirements of IAS 7 are illustrated. (Note that all figures in this example are in thousands of euros.) Assets Cash and cash equivalents Accounts receivable Inventory Prepaid expenses Due from associates ABC Ltd. Statements of Financial Position December 31, 2015 and 2014 Property, plant and equipment, at cost Accumulated depreciation Property, plant and equipment, net Total assets Liabilities Accounts payable Income taxes payable Deferred taxes payable Total liabilities Shareholders' equity Share capital Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 2015 3,000 5,000 2,000 1,000 19,000 12,000 (5,000) 7,000 37.000 5,000 2,000 3,000 10.000 6,500 20.500 27,000 37,000 2014 1,000 2,500 1,500 1,500 19,000 22,500 (6.000) 16.500 42,000 12,500 1,000 2,000 15,500 6,500 20,000 26,500 42,000 ABC Ltd. Statement of Profit or Loss and Comprehensive Income For the Year Ended December 31, 2015 Sales Cost of sales Gross profit Administrative and selling expenses Interest expense Depreciation of property, plant and equipment Audit fees Investment income Profit before taxation Taxes on income Profit 30,000 (10,000) 20,000 (2,000) (2,000) (2,000) (500) 3,000 16,500 (4.000) 12,500 The following additional information is relevant to the preparation of the statement of cash flows: 1. Equipment with a net book value of 7,500 and original cost of 10,500 was sold for 7,500. 2. All sales made by the company are credit sales. 3. The company received cash dividends (from investments) amounting to 3,000, recorded as income in the statement of comprehensive income for the year ended December 31, 2015. 4. The company declared and paid dividends of 12,000 to its shareholders. 5. Interest expense for the year 2015 was 2,000, which was fully paid during the year. All administration and selling expenses incurred were paid during the year 2015. 6. Income tax expense for the year 2015 was provided at 4,000, out of which the company paid 2,000 during 2015 as an estimate. A worksheet can be prepared to ease the development of the statement of cash flows, as follows: Prepaid expenses Due from associates 2015 Cash and equivalents 3,000 Accounts receivable 5,000 Inventories 2,000 1,500 1,000 1,500 19,000 19,000 7,000 16,500 Property, plant and equipment Accounts payable Income taxes payable Deferred taxes payable Share capital Retained earnings Cash Flow Worksheet Cash and 2014 Change Operating Investing Financing equivalents 2,000 6,500 20,500 1,000 2,000 2,500 2,500 (2,500) 500 (500) (500) 500 0 (9,500) 5,000 12,500 2,000 1,000 3,000 2,000 6,500 20,000 7,500 1,000 1,000 0 500 2,000 (7,500) 1,000 1,000 7,500 9,500 3.000 (12.000) 3,500 10,500 (12.000) 2,000 ABC Ltd. Statement of Cash Flows For the Year Ended December 31, 2015 (Direct method) Cash flows from operating activities Cash receipts from customers Cash paid to suppliers and employees Cash generated from operations Interest paid Income taxes paid Net cash flows from operating activities Cash flows from investing activities Proceeds from the sale of equipment Dividends received Net cash flows from investing activities Cash flows from financing activities Dividends paid Cash paid to suppliers and employees Cost of sales Less: Inventory, beginning of year Inventory, end of year Plus: Plus: Accounts payable, beginning of year Less: Accounts payable, end of year Plus: Administrative and selling expenses paid Cash paid to suppliers and employees during the year Interest paid equals interest expense charged to profit or loss (per additional information) Income taxes paid during the year Tax expense during the year (comprising current and deferred portions) Plus: Beginning income taxes payable Plus: Beginning deferred taxes payable Less: Ending income taxes payable Less: Ending deferred taxes payable Cash paid toward income taxes Proceeds from sale of equipment (per additional 27,500 (20.000) 7,500 (2,000) (2,000) information) Dividends received during 2014 (per additional information) Dividends paid during 2014 (per additional information) 7,500 3,000 (12,000) Net cash flows used in financing activities Net increase in cash and cash equivalents Cash and cash equivalents, beginning of year Cash and cash equivalents, end of year 1,000 3,000 Details of the computations of amounts shown in the statement of cash flows are as follows: Cash received from customers during the year Credit sales Plus: Accounts receivable, beginning of year Less: Accounts receivable, end of year Cash received from customers during the year 30,000 2,500 (5,000) 10,000 (1,500) 2,000 12,500 (5,000) 2,000 4,000 1,000 2,000 3,500 (2,000) (3,000) 10,500 (12,000) 2,000 27,500 20.000 2,000 2,000 7,500 3.000 12,000 ABC Ltd. Statement of Cash Flows For the Year Ended December 31, 2015 (Indirect method) Cash flows from operating activities Profit before taxation Adjustments for: Depreciation of property, plant and equipment Decrease in prepaid expenses Investment income Interest expense Increase in accounts receivable Increase in inventories Decrease in accounts payable Cash generated from operations Interest paid Income taxes paid Net cash from operating activities Cash flows from investing activities Proceeds from sale of equipment Dividends received Net cash from investing activities Cash flows from financing activities Dividends paid Net cash used in financing activities Net increase in cash and cash equivalents Cash and cash equivalents, beginning of year Cash and cash equivalents, end of year 16,500 2,000 500 (3,000) 2,000 (2,500) (500) (7,500) 7,500 (2,000) (2,000) 7,500 3,000 (12,000) 3.500 10,500 (12.000) 2,000 1,000 3.000 Prepare T-account entries for all appropriate (see tips below) B/S and I/S accounts to obtain a 3,000 debit balance in the C&CEMain T-account. Prepare the T-accounts under the Direct method approach. You need to email me a MSWord file. Tips: 1. You need T-accounts for: Cash and Cash Equivalents-Main (C&CEM) that starts with a $1,000 debit; separate C&CEs for Operating items, another for Investing, and another for Financing. After you are done posting entries that explain the changes in the balance sheet accounts, you close these 3 into C&CEM; the balance in C&CEM should be $3,000 after all said and done. 2. In addition to the (4) C&CE-Main; C&CE-operating; C&CE-investing; and C&CE-financing, you will need 18 T-accounts for: Balance sheet side (9) - A/R; A/P; Inventory; Prepaid Exp.; Income Tax/P; Deferred Tax/P; PP&E; A/D - PP&E; and R/E. The accounts for Due from Assoc. and Share Capital did not have entries. On the income statement side (8) - Sales; investment income (the cash goes to C&CE-Inv. T-account); Depr. Exp.; Audit fees; Tax exp.; S&A Exp.; Interest Exp.; and COGS (credit to Inventory). One (1) more -If you want to do everything by the book, you'll close all Income Statement accounts into Income summary and then close I/S into R/E. 3. One example [Sales T-account]- sales were credited 30000 and A/R was debited 30000. Next, cash (C&CE-Oper.) was debited 27500 and A/R was credited 27500. Next, close $30,000 (debit it) and credit Income summary. 4. When you get through all the entries using the data, you'll have a 3500 debit balance in C&CE- Operating which you will credit to close and debit C&CEM. Do the same for C&CE-I (10,500 debit balance before closing) and C&CE-F (12,000 credit balance before closing). 5. To sum up, after all that, you'll have a 3000 balance in C&CEM. Basic example of preparation of the statement of cash flows under IAS 7 using a worksheet approach Using the following financial information for ABC Ltd., preparation and presentation of the statement of cash flows according to the requirements of IAS 7 are illustrated. (Note that all figures in this example are in thousands of euros.) Assets Cash and cash equivalents Accounts receivable Inventory Prepaid expenses Due from associates ABC Ltd. Statements of Financial Position December 31, 2015 and 2014 Property, plant and equipment, at cost Accumulated depreciation Property, plant and equipment, net Total assets Liabilities Accounts payable Income taxes payable Deferred taxes payable Total liabilities Shareholders' equity Share capital Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 2015 3,000 5,000 2,000 1,000 19,000 12,000 (5,000) 7,000 37.000 5,000 2,000 3,000 10.000 6,500 20.500 27,000 37,000 2014 1,000 2,500 1,500 1,500 19,000 22,500 (6.000) 16.500 42,000 12,500 1,000 2,000 15,500 6,500 20,000 26,500 42,000 ABC Ltd. Statement of Profit or Loss and Comprehensive Income For the Year Ended December 31, 2015 Sales Cost of sales Gross profit Administrative and selling expenses Interest expense Depreciation of property, plant and equipment Audit fees Investment income Profit before taxation Taxes on income Profit 30,000 (10,000) 20,000 (2,000) (2,000) (2,000) (500) 3,000 16,500 (4.000) 12,500 The following additional information is relevant to the preparation of the statement of cash flows: 1. Equipment with a net book value of 7,500 and original cost of 10,500 was sold for 7,500. 2. All sales made by the company are credit sales. 3. The company received cash dividends (from investments) amounting to 3,000, recorded as income in the statement of comprehensive income for the year ended December 31, 2015. 4. The company declared and paid dividends of 12,000 to its shareholders. 5. Interest expense for the year 2015 was 2,000, which was fully paid during the year. All administration and selling expenses incurred were paid during the year 2015. 6. Income tax expense for the year 2015 was provided at 4,000, out of which the company paid 2,000 during 2015 as an estimate. A worksheet can be prepared to ease the development of the statement of cash flows, as follows: Prepaid expenses Due from associates 2015 Cash and equivalents 3,000 Accounts receivable 5,000 Inventories 2,000 1,500 1,000 1,500 19,000 19,000 7,000 16,500 Property, plant and equipment Accounts payable Income taxes payable Deferred taxes payable Share capital Retained earnings Cash Flow Worksheet Cash and 2014 Change Operating Investing Financing equivalents 2,000 6,500 20,500 1,000 2,000 2,500 2,500 (2,500) 500 (500) (500) 500 0 (9,500) 5,000 12,500 2,000 1,000 3,000 2,000 6,500 20,000 7,500 1,000 1,000 0 500 2,000 (7,500) 1,000 1,000 7,500 9,500 3.000 (12.000) 3,500 10,500 (12.000) 2,000 ABC Ltd. Statement of Cash Flows For the Year Ended December 31, 2015 (Direct method) Cash flows from operating activities Cash receipts from customers Cash paid to suppliers and employees Cash generated from operations Interest paid Income taxes paid Net cash flows from operating activities Cash flows from investing activities Proceeds from the sale of equipment Dividends received Net cash flows from investing activities Cash flows from financing activities Dividends paid Cash paid to suppliers and employees Cost of sales Less: Inventory, beginning of year Inventory, end of year Plus: Plus: Accounts payable, beginning of year Less: Accounts payable, end of year Plus: Administrative and selling expenses paid Cash paid to suppliers and employees during the year Interest paid equals interest expense charged to profit or loss (per additional information) Income taxes paid during the year Tax expense during the year (comprising current and deferred portions) Plus: Beginning income taxes payable Plus: Beginning deferred taxes payable Less: Ending income taxes payable Less: Ending deferred taxes payable Cash paid toward income taxes Proceeds from sale of equipment (per additional 27,500 (20.000) 7,500 (2,000) (2,000) information) Dividends received during 2014 (per additional information) Dividends paid during 2014 (per additional information) 7,500 3,000 (12,000) Net cash flows used in financing activities Net increase in cash and cash equivalents Cash and cash equivalents, beginning of year Cash and cash equivalents, end of year 1,000 3,000 Details of the computations of amounts shown in the statement of cash flows are as follows: Cash received from customers during the year Credit sales Plus: Accounts receivable, beginning of year Less: Accounts receivable, end of year Cash received from customers during the year 30,000 2,500 (5,000) 10,000 (1,500) 2,000 12,500 (5,000) 2,000 4,000 1,000 2,000 3,500 (2,000) (3,000) 10,500 (12,000) 2,000 27,500 20.000 2,000 2,000 7,500 3.000 12,000 ABC Ltd. Statement of Cash Flows For the Year Ended December 31, 2015 (Indirect method) Cash flows from operating activities Profit before taxation Adjustments for: Depreciation of property, plant and equipment Decrease in prepaid expenses Investment income Interest expense Increase in accounts receivable Increase in inventories Decrease in accounts payable Cash generated from operations Interest paid Income taxes paid Net cash from operating activities Cash flows from investing activities Proceeds from sale of equipment Dividends received Net cash from investing activities Cash flows from financing activities Dividends paid Net cash used in financing activities Net increase in cash and cash equivalents Cash and cash equivalents, beginning of year Cash and cash equivalents, end of year 16,500 2,000 500 (3,000) 2,000 (2,500) (500) (7,500) 7,500 (2,000) (2,000) 7,500 3,000 (12,000) 3.500 10,500 (12.000) 2,000 1,000 3.000

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started