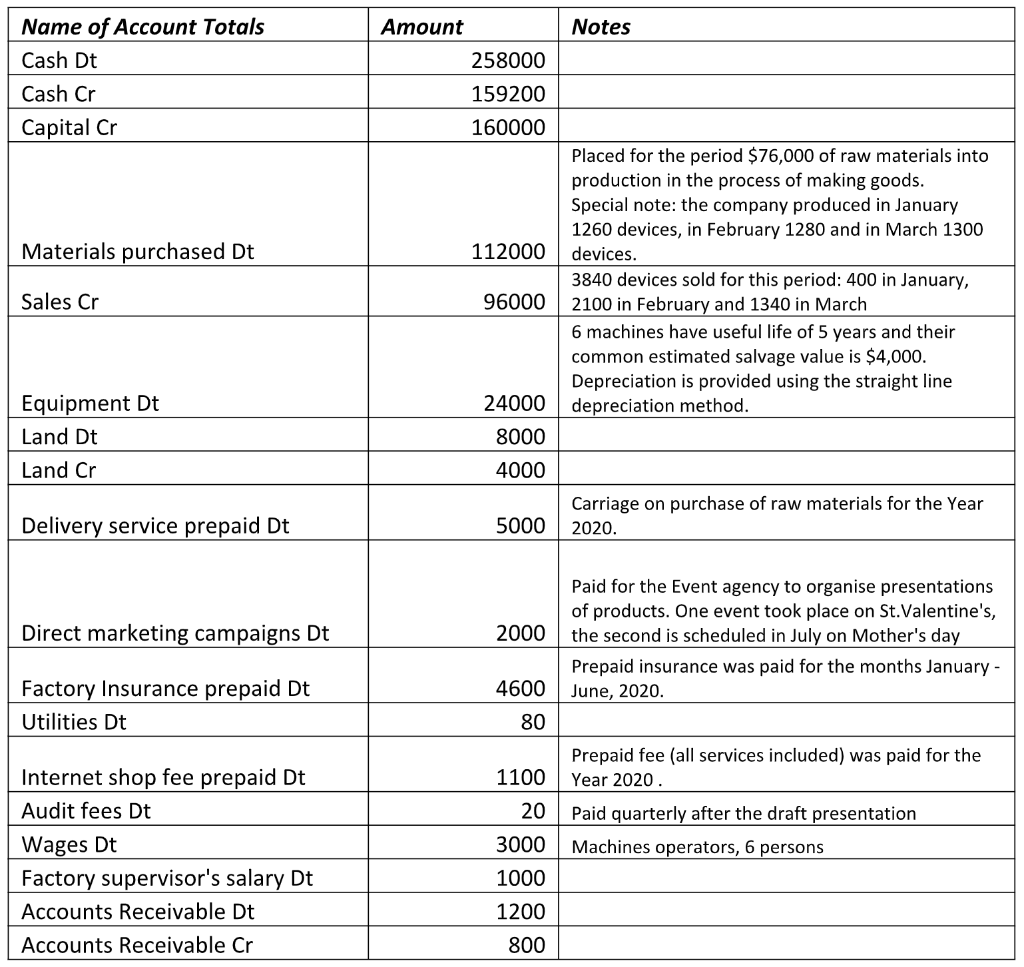

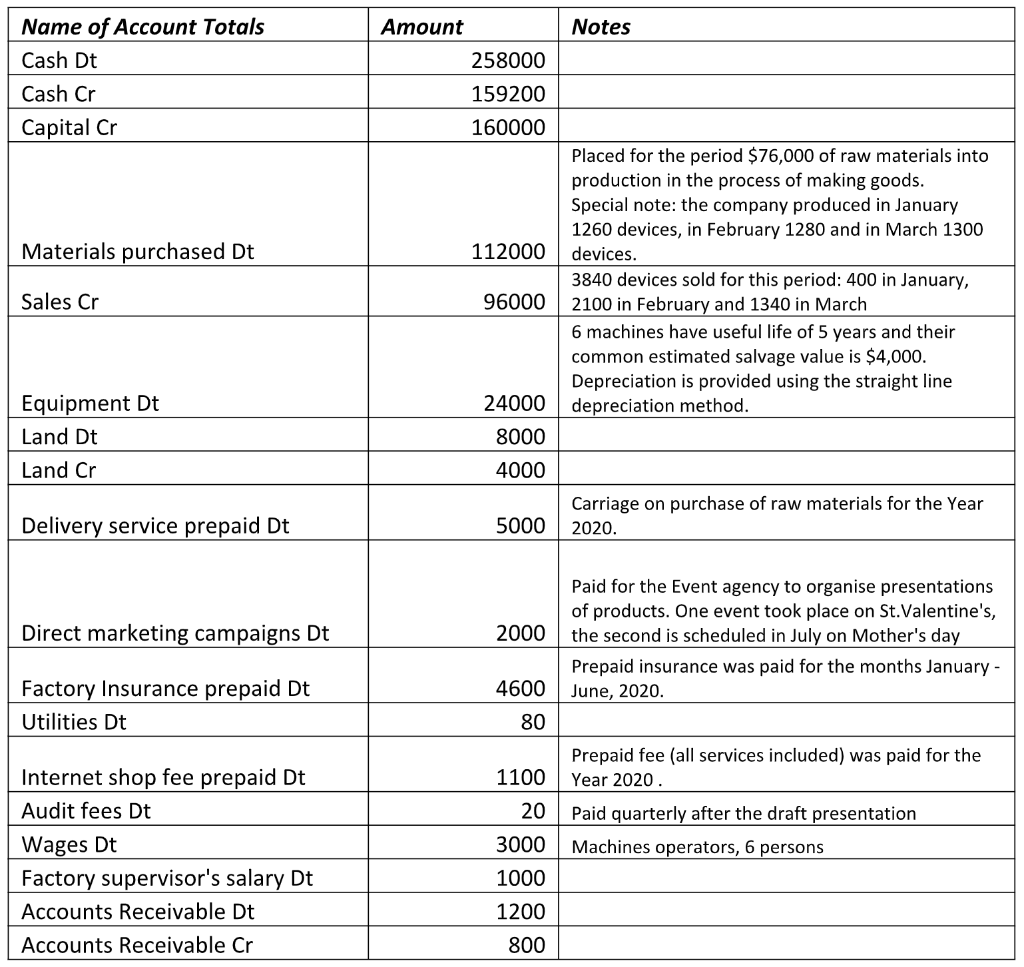

prepare the adjusted trial balance as on the Quarter Ended March 31, Year 2020.

Mr.Junjam is an only owner of the Junjam Inc., which is registered at the beginning of the year. The company produces a budget-friendly device (an audio book player) that boasts excellent functionality and satisfying sound production. he developed it on his own and in the next quarter he wants to apply for a patent, but for now he is going to sell it through specially organized marketing events and in the online store.

At the end of March, 2020, he records journal entries and posts them to ledger accounts calculating totals, to prepare the unadjusted trial balance. He is not much experienced in accounting, so make some useful notes for an accountant that should be taken into account while preparing final statements.

His records are presented in the pic.

known:

TOTAL ASSETS $ 170 076.00

Income from Continuing Operations $ 10 076.00

Amount Notes 258000 Name of Account Totals Cash Dt Cash Cr Capital Cr 159200 160000 Materials purchased Dt 112000 Placed for the period $76,000 of raw materials into production in the process of making goods. Special note: the company produced in January 1260 devices, in February 1280 and in March 1300 devices. 3840 devices sold for this period: 400 in January, 2100 in February and 1340 in March 6 machines have useful life of 5 years and their common estimated salvage value is $4,000. Depreciation is provided using the straight line depreciation method. Sales Cr 96000 Equipment Dt Land Dt Land Cr 24000 8000 4000 Delivery service prepaid Dt Carriage on purchase of raw materials for the Year 2020. 5000 Direct marketing campaigns Dt 2000 Paid for the Event agency to organise presentations of products. One event took place on St. Valentine's, the second is scheduled in July on Mother's day Prepaid insurance was paid for the months January - June, 2020. 4600 Factory Insurance prepaid Dt Utilities Dt 80 Prepaid fee (all services included) was paid for the Year 2020. Paid quarterly after the draft presentation Machines operators, 6 persons Internet shop fee prepaid Dt Audit fees Dt Wages Dt Factory supervisor's salary Dt Accounts Receivable Dt Accounts Receivable Cr 1100 20 3000 1000 1200 800 Amount Notes 258000 Name of Account Totals Cash Dt Cash Cr Capital Cr 159200 160000 Materials purchased Dt 112000 Placed for the period $76,000 of raw materials into production in the process of making goods. Special note: the company produced in January 1260 devices, in February 1280 and in March 1300 devices. 3840 devices sold for this period: 400 in January, 2100 in February and 1340 in March 6 machines have useful life of 5 years and their common estimated salvage value is $4,000. Depreciation is provided using the straight line depreciation method. Sales Cr 96000 Equipment Dt Land Dt Land Cr 24000 8000 4000 Delivery service prepaid Dt Carriage on purchase of raw materials for the Year 2020. 5000 Direct marketing campaigns Dt 2000 Paid for the Event agency to organise presentations of products. One event took place on St. Valentine's, the second is scheduled in July on Mother's day Prepaid insurance was paid for the months January - June, 2020. 4600 Factory Insurance prepaid Dt Utilities Dt 80 Prepaid fee (all services included) was paid for the Year 2020. Paid quarterly after the draft presentation Machines operators, 6 persons Internet shop fee prepaid Dt Audit fees Dt Wages Dt Factory supervisor's salary Dt Accounts Receivable Dt Accounts Receivable Cr 1100 20 3000 1000 1200 800