Question

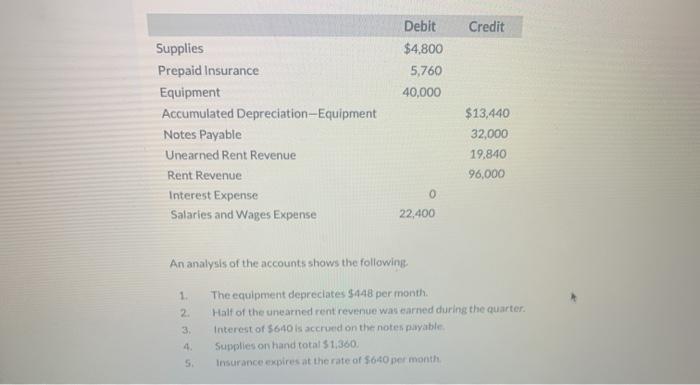

Prepare the adjusting entries at March 31, assuming that adjusting entries are made quarterly Supplies Prepaid Insurance Equipment Accumulated Depreciation-Equipment Notes Payable Unearned Rent Revenue

Prepare the adjusting entries at March 31, assuming that adjusting entries are made quarterly

Supplies Prepaid Insurance Equipment Accumulated Depreciation-Equipment Notes Payable Unearned Rent Revenue Rent Revenue Interest Expense Salaries and Wages Expense 1. 2. Debit Credit $4,800 5,760 40,000 3. 4. 5. 0 22,400 An analysis of the accounts shows the following. The equipment depreciates $448 per month. Half of the unearned rent revenue was earned during the quarter. $13,440 32,000 19,840 96,000 Interest of $640 is accrued on the notes payable. Supplies on hand total $1,360. Insurance expires at the rate of $640 per month

Step by Step Solution

3.31 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Adjusting Entries Transaction 1 2 3 4 5 General Journ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: kieso, weygandt and warfield.

14th Edition

9780470587232, 470587288, 470587237, 978-0470587287

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App