2. Prepare the adjusting entry required for each transaction at December 31 of the current year. (If no entry is required for a transaction/event,

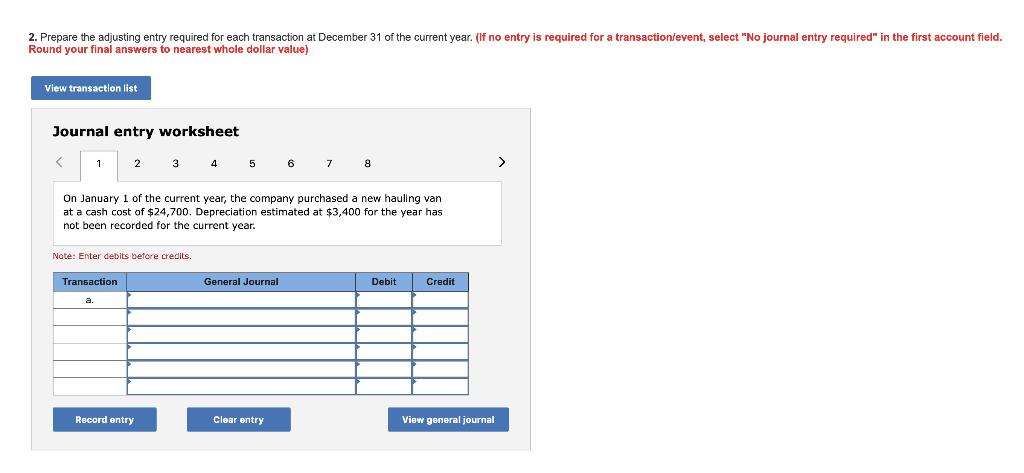

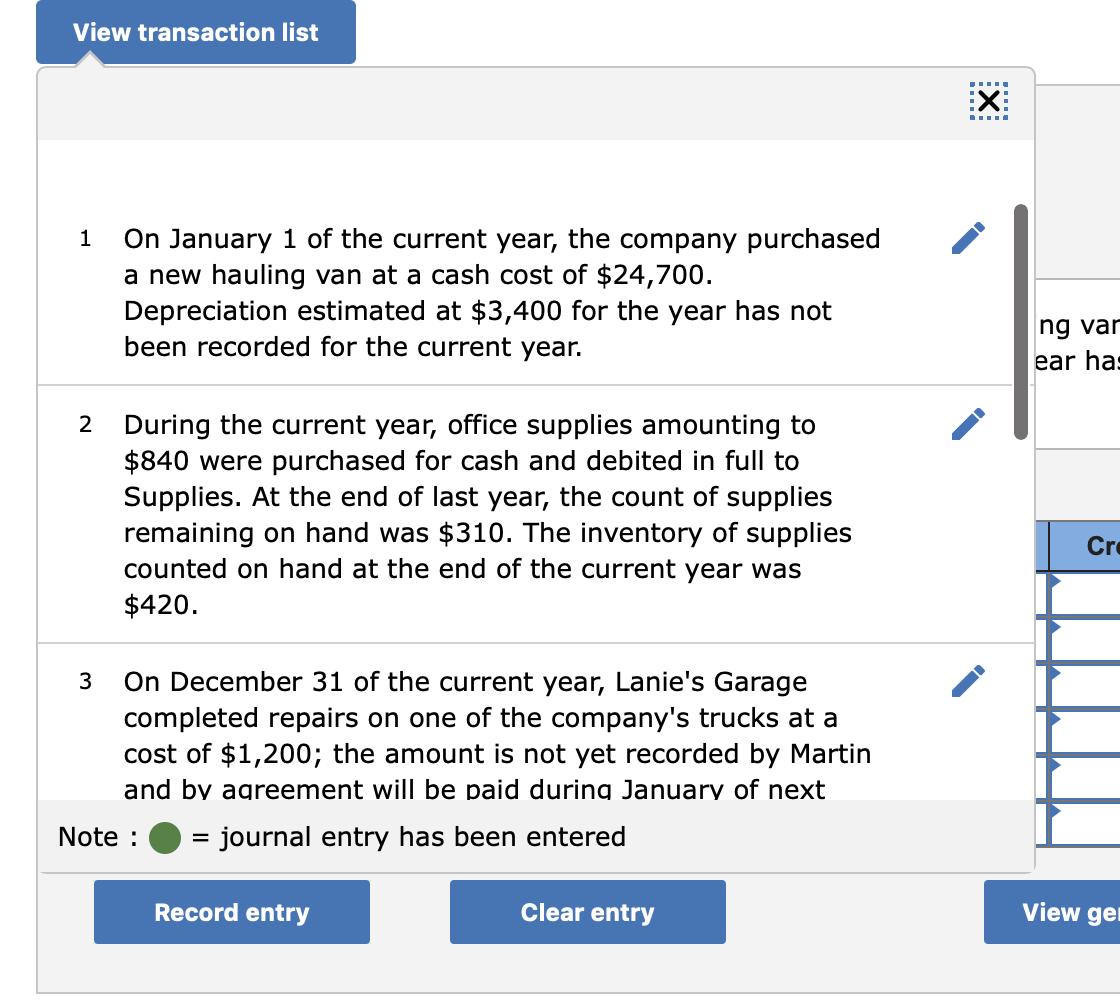

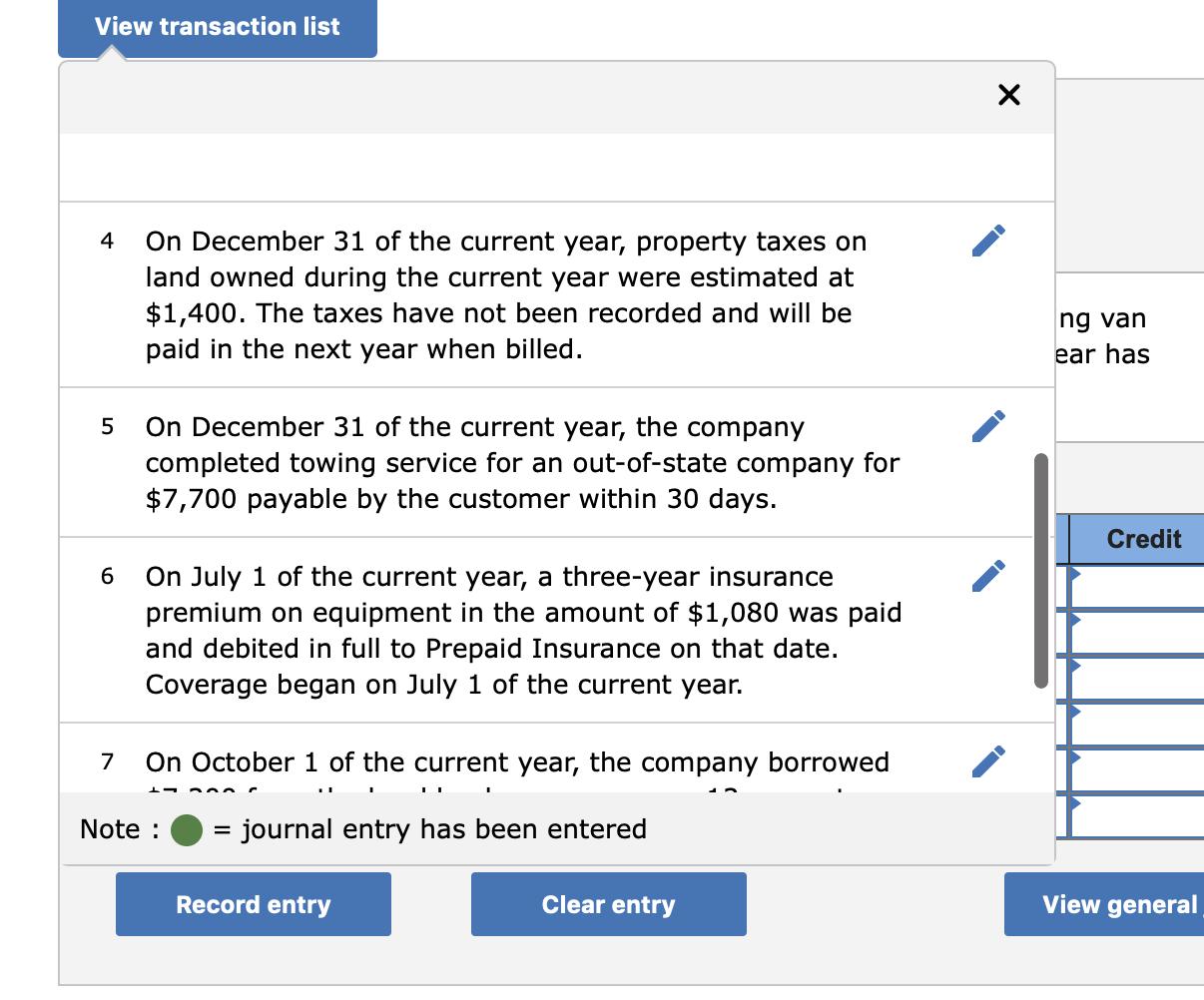

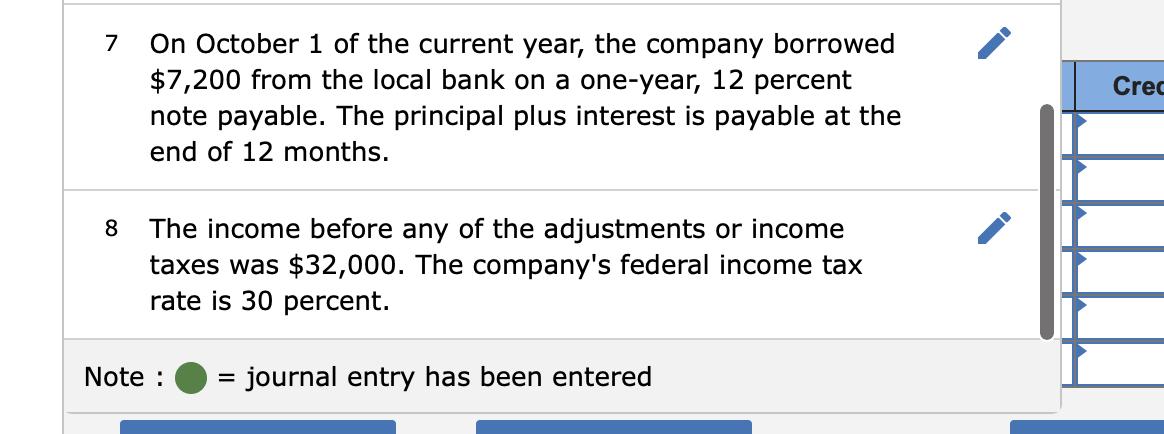

2. Prepare the adjusting entry required for each transaction at December 31 of the current year. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your final answers to nearest whole dollar value) View transaction list Journal entry worksheet < 1 2 Transaction a. Note: Enter debits before credits. 3 Record entry 4 5 On January 1 of the current year, the company purchased a new hauling van at a cash cost of $24,700. Depreciation estimated at $3,400 for the year has not been recorded for the current year. General Journal 6 Clear entry 7 8 Debit Credit View general journal View transaction list 1 On January 1 of the current year, the company purchased a new hauling van at a cash cost of $24,700. Depreciation estimated at $3,400 for the year has not been recorded for the current year. 2 During the current year, office supplies amounting to $840 were purchased for cash and debited in full to Supplies. At the end of last year, the count of supplies remaining on hand was $310. The inventory of supplies counted on hand at the end of the current year was $420. 3 On December 31 of the current year, Lanie's Garage completed repairs on one of the company's trucks at a cost of $1,200; the amount is not yet recorded by Martin and by agreement will be paid during January of next Note : journal entry has been entered = Record entry Clear entry EX w ng var ear has Cre View ger View transaction list 4 On December 31 of the current year, property taxes on land owned during the current year were estimated at $1,400. The taxes have not been recorded and will be paid in the next year when billed. 5 6 7 On December 31 of the current year, the company completed towing service for an out-of-state company for $7,700 payable by the customer within 30 days. On July 1 of the current year, a three-year insurance premium on equipment in the amount of $1,080 was paid and debited in full to Prepaid Insurance on that date. Coverage began on July 1 of the current year. On October 1 of the current year, the company borrowed LAA Note : I = journal entry has been entered Record entry Clear entry X ng van ear has Credit View general 7 8 On October 1 of the current year, the company borrowed $7,200 from the local bank on a one-year, 12 percent note payable. The principal plus interest is payable at the end of 12 months. The income before any of the adjustments or income taxes was $32,000. The company's federal income tax rate is 30 percent. Note : = journal entry has been entered Crec

Step by Step Solution

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

SiNo Transaction 1 a 2 3 4 5 6 b C d e f General Journal Dep...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started