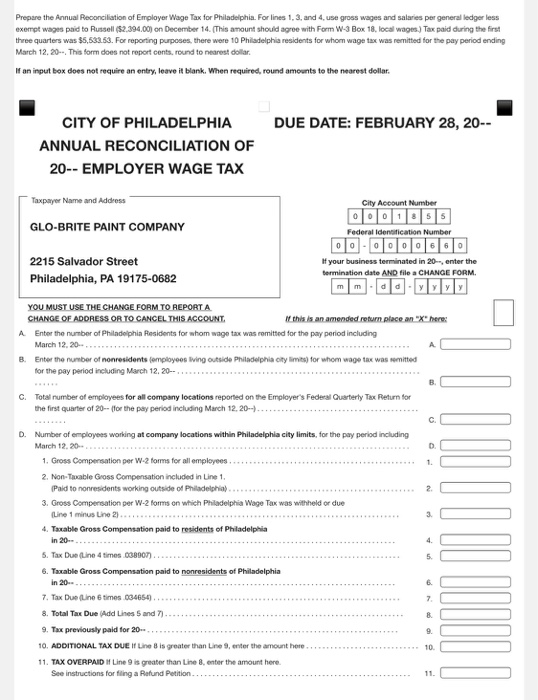

Prepare the Annual Reconciliation of Employer Wage Tax for Philadelphia Forlines 1.3. and use gross wages and salaries per general ledgerless exor wages paid to Russell (52,396.00 on December 14. (This amount should agree with Form W-Box 18. local wages.)Tax paid during the first three quarters was $5.583.53. For reporting purposes, there were 10 Philadelphia residents for whom wage tax was remited for the pay period ending March 12. 20- This form does not report cents. round to nearest dollar Wan input box does not require an entry leave it blank. When required, round amounts to the nearest of DUE DATE: FEBRUARY 28, 20-- CITY OF PHILADELPHIA ANNUAL RECONCILIATION OF 20 - EMPLOYER WAGE TAX Taxpayer Name and Address City Account Number GLO-BRITE PAINT COMPANY Federal Identification Number 2215 Salvador Street Philadelphia, PA 19175-0682 If your business terminated in 20 enter the termination date AND file a CHANGE FORM. ere YOU MUST USE THE CHANGE FORM TO REPORTA CHANGE OF ADDRESS OR TO CANCEL THIS ACCOUNT this is an amended return place an A Enter the number of Philadelphia Residents for whom wage tax was romitted for the pay period including March 12.20 B. Enter the number of nonresidents employees Iving outside Philadelphia otymis) for whom wage tax was omitted for the pay period including March 12, 20--.. Total number of employees for all company locations reported on the Employer's Federn Quarterly Tax Return for the first quarter of 20-- for the pay period including March 12, 20--).. 0 Number of employees working at company locations within Philadelphia city limits, for the pay period including March 12.20 1. Gross Compensation per W-2 forms for all employees... 2. Non-Table Gross Compensation included in Line 1. Paid to nonresidents working outside of Philadelphia 3. Gross Compensation per W-2 forms on which Philadelphia Wage Tax was withheld or due Line 1 minus Line 2). 4. Taxable Gross Compensation paid to residents of Philadelphia 5. Tax Due Line 4 times 038907)..... 6. Table Gross Compensation paid to nonresidents of Philadelphia in 20 7. Tax Due Linetimes 034654 8. Total Tax Due Add Lines5 and 7). 9. Tex previously paid for 20 10. ADDITIONAL TAX DUE Line is greater than Line 9. r the amount here to the amount here 11. TAX OVERPADU is greater than in See instructions for filing a Rolund Petition. Prepare the Annual Reconciliation of Employer Wage Tax for Philadelphia Forlines 1.3. and use gross wages and salaries per general ledgerless exor wages paid to Russell (52,396.00 on December 14. (This amount should agree with Form W-Box 18. local wages.)Tax paid during the first three quarters was $5.583.53. For reporting purposes, there were 10 Philadelphia residents for whom wage tax was remited for the pay period ending March 12. 20- This form does not report cents. round to nearest dollar Wan input box does not require an entry leave it blank. When required, round amounts to the nearest of DUE DATE: FEBRUARY 28, 20-- CITY OF PHILADELPHIA ANNUAL RECONCILIATION OF 20 - EMPLOYER WAGE TAX Taxpayer Name and Address City Account Number GLO-BRITE PAINT COMPANY Federal Identification Number 2215 Salvador Street Philadelphia, PA 19175-0682 If your business terminated in 20 enter the termination date AND file a CHANGE FORM. ere YOU MUST USE THE CHANGE FORM TO REPORTA CHANGE OF ADDRESS OR TO CANCEL THIS ACCOUNT this is an amended return place an A Enter the number of Philadelphia Residents for whom wage tax was romitted for the pay period including March 12.20 B. Enter the number of nonresidents employees Iving outside Philadelphia otymis) for whom wage tax was omitted for the pay period including March 12, 20--.. Total number of employees for all company locations reported on the Employer's Federn Quarterly Tax Return for the first quarter of 20-- for the pay period including March 12, 20--).. 0 Number of employees working at company locations within Philadelphia city limits, for the pay period including March 12.20 1. Gross Compensation per W-2 forms for all employees... 2. Non-Table Gross Compensation included in Line 1. Paid to nonresidents working outside of Philadelphia 3. Gross Compensation per W-2 forms on which Philadelphia Wage Tax was withheld or due Line 1 minus Line 2). 4. Taxable Gross Compensation paid to residents of Philadelphia 5. Tax Due Line 4 times 038907)..... 6. Table Gross Compensation paid to nonresidents of Philadelphia in 20 7. Tax Due Linetimes 034654 8. Total Tax Due Add Lines5 and 7). 9. Tex previously paid for 20 10. ADDITIONAL TAX DUE Line is greater than Line 9. r the amount here to the amount here 11. TAX OVERPADU is greater than in See instructions for filing a Rolund Petition