Prepare the appropriate adjusting entries for July 31, 2017, based on the following information available at the end of July. a. An annual insurance

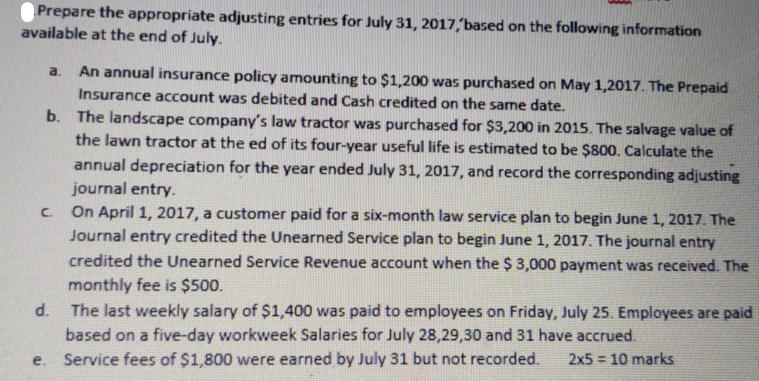

Prepare the appropriate adjusting entries for July 31, 2017, based on the following information available at the end of July. a. An annual insurance policy amounting to $1,200 was purchased on May 1,2017. The Prepaid Insurance account was debited and Cash credited on the same date. b. The landscape company's law tractor was purchased for $3,200 in 2015. The salvage value of the lawn tractor at the ed of its four-year useful life is estimated to be $800. Calculate the annual depreciation for the year ended July 31, 2017, and record the corresponding adjusting journal entry. On April 1, 2017, a customer paid for a six-month law service plan to begin June 1, 2017. The Journal entry credited the Unearned Service plan to begin June 1, 2017. The journal entry credited the Unearned Service Revenue account when the $ 3,000 payment was received. The monthly fee is $500. C d. The last weekly salary of $1,400 was paid to employees on Friday, July 25. Employees are paid based on a five-day workweek Salaries for July 28,29,30 and 31 have accrued. e. Service fees of $1,800 were earned by July 31 but not recorded. 2x5=10 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Adjustment for Prepaid Insurance Debit Insurance Expense 200 1200 12 months 2 mont...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started