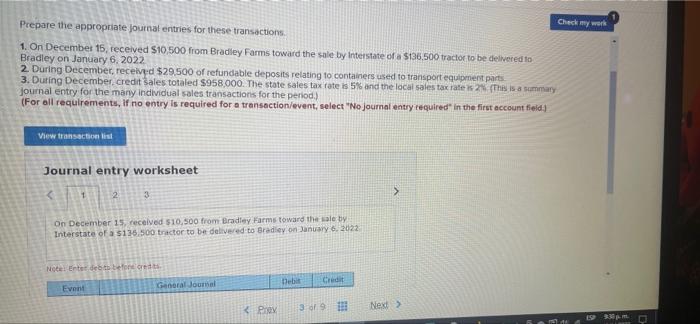

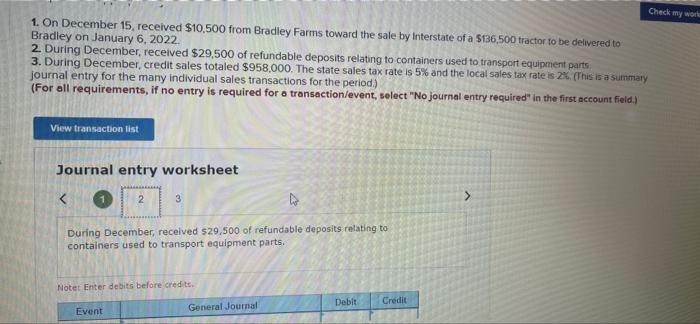

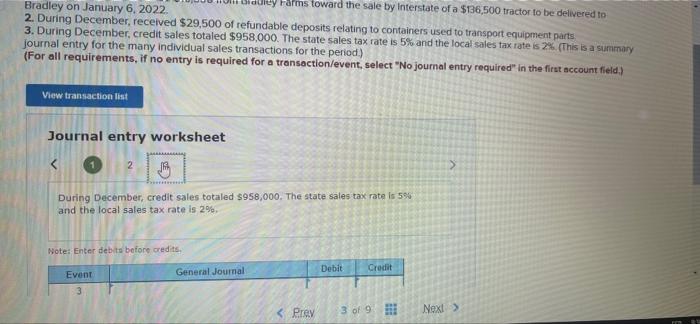

Prepare the appropriate journal entries for these transactions Check my work 1. On December 15, received $10,500 from Bradley Farms toward the sale by Interstate of a $136.500 tractor to be delivered to Bradley on January 6, 2022 2. During December, received $29.500 of refundable deposits relating to containers used to transport equipment parts 3. Duting December credit Sales totaled $958.000. The state sales tax rate is 5% and the local sales tax rate 2 The is a summary journal entry for the many individual sales transactions for the period.) (For all requirements, if no entry is required for a transaction/event, select "No journal entry required in the first account field) View transaction list Journal entry worksheet 2 3 > On December 15, received $10.500 from Bradley Farms toward the sale by Interstate of a $136.500 tractor to be delivered to Bradley on January 6, 2022 Note Edebts before Debit Credit Event General Journal 338 Check my wode 1. On December 15, received $10,500 from Bradley Farms toward the sale by Interstate of a 536,500 tractor to be delivered to Bradley on January 6, 2022 2. During December, received $29,500 of refundable deposits relating to containers used to transport equipment parts 3. During December, credit sales totaled $958,000. The state sales tax rate is 5% and the local sales tax rates 2%. (This is a summary journal entry for the many individual sales transactions for the period) (For all requirements, if no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet During December, received 29.500 of refundable deposits relating to containers used to transport equipment parts. Noter Enter debits before credits Deble Credit Event General Journal Didley Farms toward the sale by Interstate of a $136,500 tractor to be delivered to Bradley on January 6, 2022 2. During December, received $29,500 of refundable deposits relating to containers used to transport equipment parts 3. During December, credit sales totaled $958,000. The state sales tax rate is 5% and the local sales tax rate is 2% (This is a summary journal entry for the many individual sales transactions for the period.) (For all requirements, if no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 2 During December, credit sales totaled $958,000. The state sales tax rate is 596 and the local sales tax rate is 2%. Note: Enter debits before credits Debit General Journal Event Credit Prey 3 of 9 Next >