Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare the Bank Reconciliation Statement of M/s. R.K. Brothers on 30th June 2018 from the particulars given below : (i) The Bank Pass Book

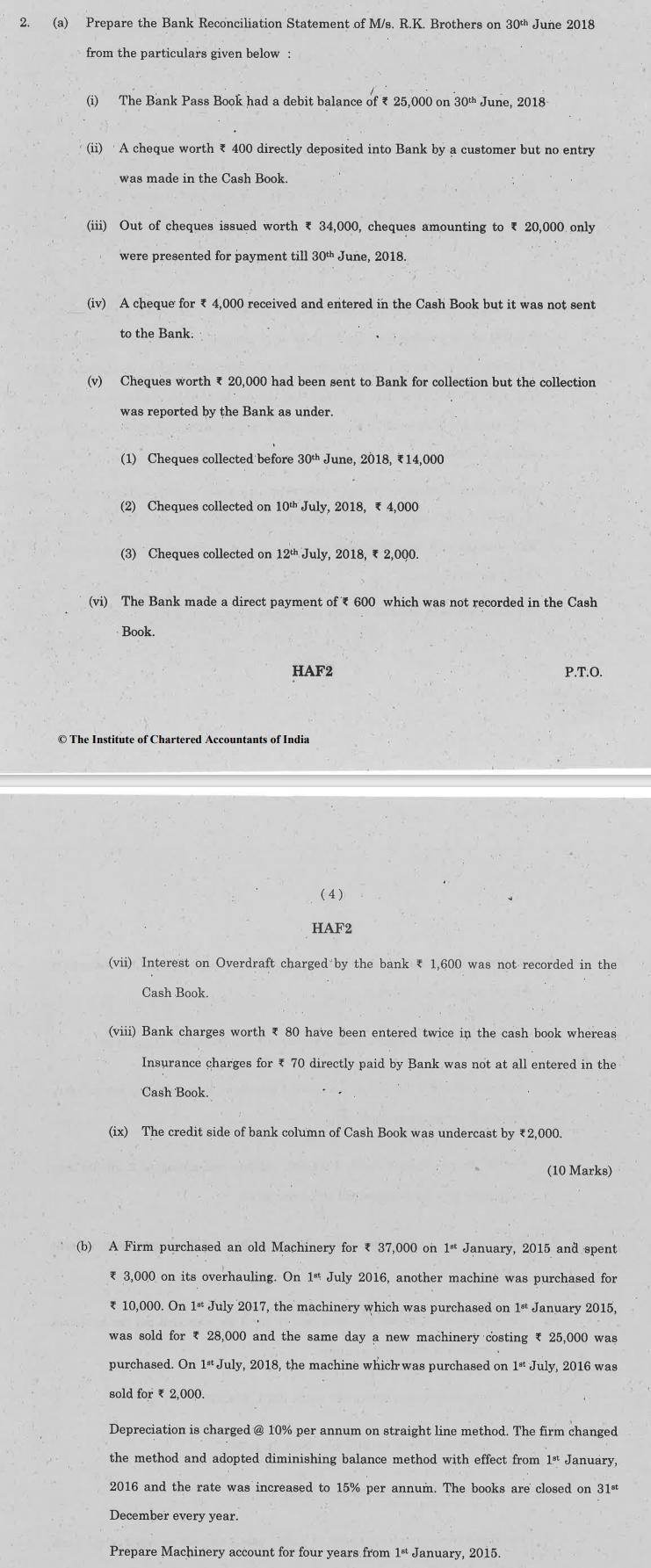

Prepare the Bank Reconciliation Statement of M/s. R.K. Brothers on 30th June 2018 from the particulars given below : (i) The Bank Pass Book had a debit balance of 25,000 on 30th June, 2018- (ii) A cheque worth 400 directly deposited into Bank by a customer but no entry was made in the Cash Book. (iii) Out of cheques issued worth 34,000, cheques amounting to 20,000 only were presented for payment till 30th June, 2018. (iv) A cheque for 4,000 received and entered in the Cash Book but it was not sent to the Bank. (v) Cheques worth 20,000 had been sent to Bank for collection but the collection was reported by the Bank as under. (1) Cheques collected before 30th June, 2018, 14,000 (2) Cheques collected on 10th July, 2018, 4,000 (3) Cheques collected on 12th July, 2018, 2,000. (vi) The Bank made a direct payment of 600 which was not recorded in the Cash Book. HAF2 The Institute of Chartered Accountants of India (4) HAF2 P.T.O. (vii) Interest on Overdraft charged by the bank 1,600 was not recorded in the Cash Book. (viii) Bank charges worth 80 have been entered twice in the cash book whereas Insurance charges for 70 directly paid by Bank was not at all entered in the Cash Book. (ix) The credit side of bank column of Cash Book was undercast by 2,000. (10 Marks) (b) A Firm purchased an old Machinery for 37,000 on 1st January, 2015 and spent * 3,000 on its overhauling. On 1st July 2016, another machine was purchased for * 10,000. On 1st July 2017, the machinery which was purchased on 1st January 2015, was sold for 28,000 and the same day a new machinery costing 25,000 was purchased. On 1st July, 2018, the machine which was purchased on 1st July, 2016 was sold for 2,000. Depreciation is charged @ 10% per annum on straight line method. The firm changed the method and adopted diminishing balance method with effect from 1st January, 2016 and the rate was increased to 15% per annum. The books are closed on 31st December every year. Prepare Machinery account for four years from 1st January, 2015.

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started