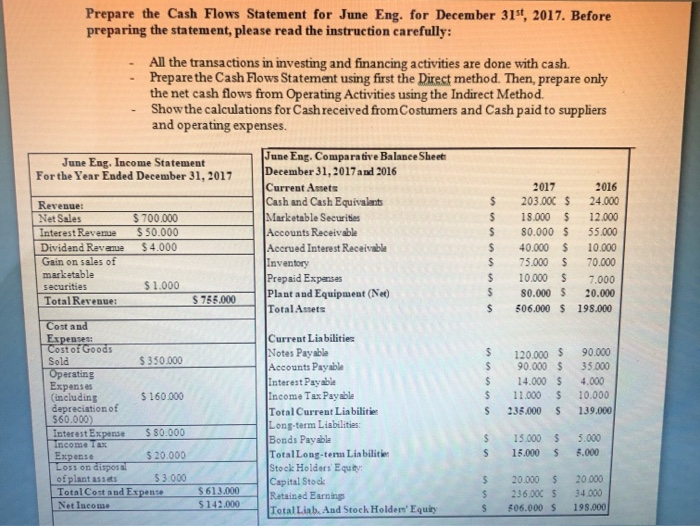

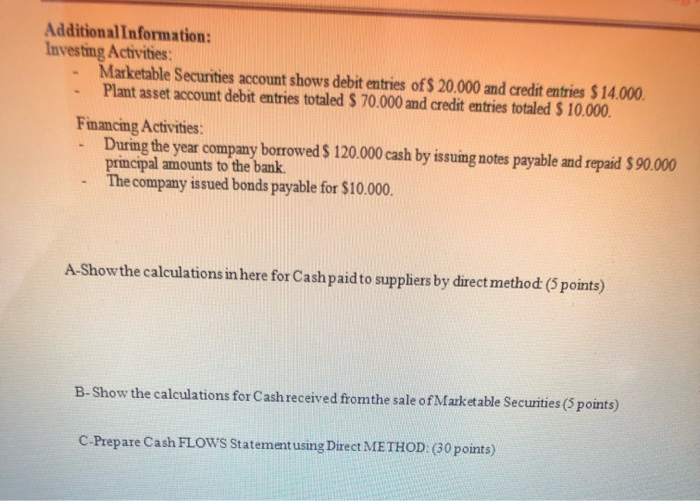

Prepare the Cash Flows Statement for June Eng. for December 31st, 2017. Before preparing the statement, please read the instruction carefully: All the transactions in investing and financing activities are done with cash. Prepare the Cash Flows Statement using first the Direct method. Then, prepare only the net cash flows from Operating Activities using the Indirect Method. Show the calculations for Cash received from Costumers and Cash paid to suppliers and operating expenses. June Eng. Income Statement June Eng. Comparative Balance Sheet For the Year Ended December 31, 2017 December 31, 2017 and 2016 Current Assets 2017 2016 Revenue: Cash and Cash Equivalents $ 203.00C $ 24.000 Net Sales $ 700.000 Marketable Securities $ 18.000 $ 12.000 Interest Revenue $ 50.000 Accounts Receivable $ 80.000 $ 55.000 Dividend Revame $ 4.000 Accrued Interest Receivable $ 40.000 $ 10.000 Gain on sales of Inventory $ 75.000 $ 70.000 marketable Prepaid Expenses $ 10.000 $ securities $1.000 7.000 S Total Revenue: Plant and Equipment (Net) $ 755.000 80.000 $ 20.000 Total Assets S 306.000 $ 198.000 Cost and Expenses: Current Liabilities Cost of Goods Notes Payable $ 90.000 Sold 120.000 $ $ 350.000 Accounts Payable 90.000 $ Operating 35.000 Interest Payable Expenses $ 14.000 $ 4.000 (including $160.000 Income Tax Payable $ 11.000 $ 10.000 depreciation of Total Current Liabilities S 235.000 $ 560.000) 139.000 Long-term Liabilities: Interest Expense $ 80.000 Income Tax Bonds Payable 15.000 $ 3.000 Expense $ 20.000 Total Long-term Liabilities S 15.000 $ 5.000 Loss on disposal Stock Holders Equity of plant assets $ 3.000 Capital Stock $ 20.000 $ 20.000 Total Cost and Expense $ 613.000 Ratained Earning $ 236.000 34.000 Net Income $142.000 Total Liab. And Stock Holders' Equity S 306.000 $ 195.000 $ $ Additional Information: Investing Activities: Marketable Securities account shows debit entries of $ 20.000 and credit entries $14.000 Plant asset account debit entries totaled $ 70.000 and credit entries totaled $ 10.000. Financing Activities: During the year company borrowed $ 120.000 cash by issuing notes payable and repaid $90.000 principal amounts to the bank. The company issued bonds payable for $10.000. A-Showthe calculations in here for Cash paid to suppliers by direct method (5 points) B-Show the calculations for Cash received fromthe sale of Marketable Securities (5 points) C-Prepare Cash FLOWS Statement using Direct METHOD: (30 points)