Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A New Zealand-based business has exported goods to Canada and will receive payment of CAD 620.000 in three months' time. The spot exchange rate

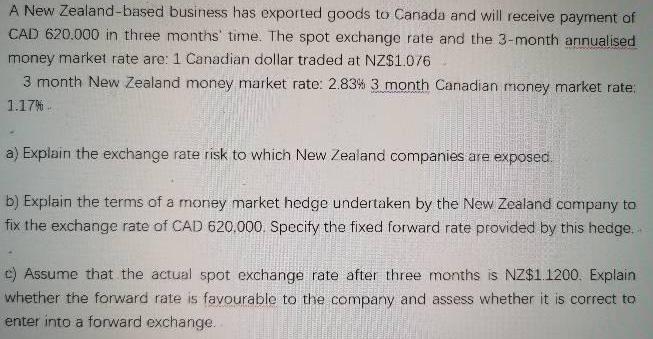

A New Zealand-based business has exported goods to Canada and will receive payment of CAD 620.000 in three months' time. The spot exchange rate and the 3-month annualised money market rate are: 1 Canadian dollar traded at NZ$1.076 3 month New Zealand money market rate: 2.83% 3 month Canadian money market rate: 1.17%. a) Explain the exchange rate risk to which New Zealand companies are exposed. b) Explain the terms of a money market hedge undertaken by the New Zealand company to fix the exchange rate of CAD 620.000. Specify the fixed forward rate provided by this hedge.. c) Assume that the actual spot exchange rate after three months is NZ$1.1200. Explain whether the forward rate is favourable to the company and assess whether it is correct to enter into a forward exchange..

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a Exchange rate risk is the risk that the value of a currency will change relative to another currency This risk is particularly relevant to New Zeala...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started