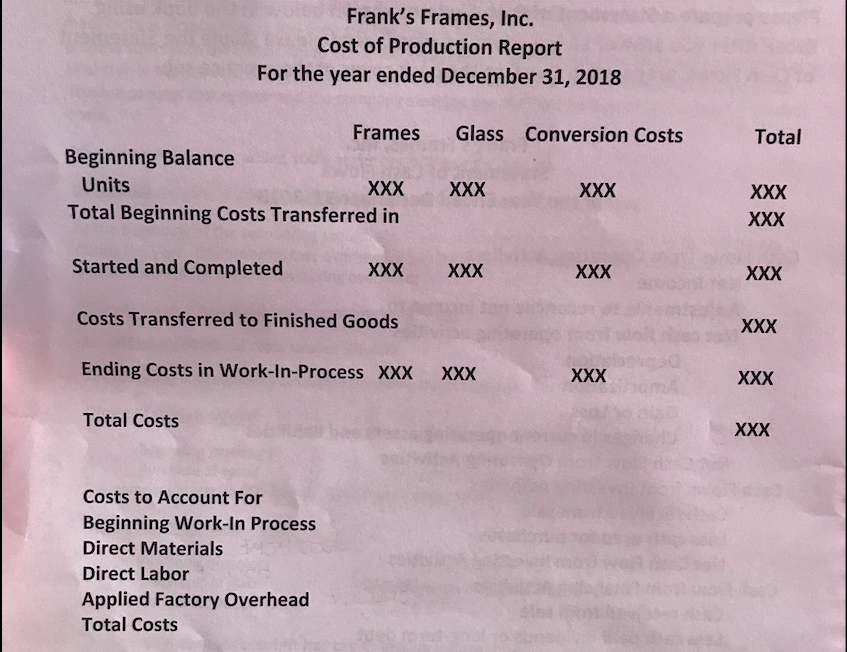

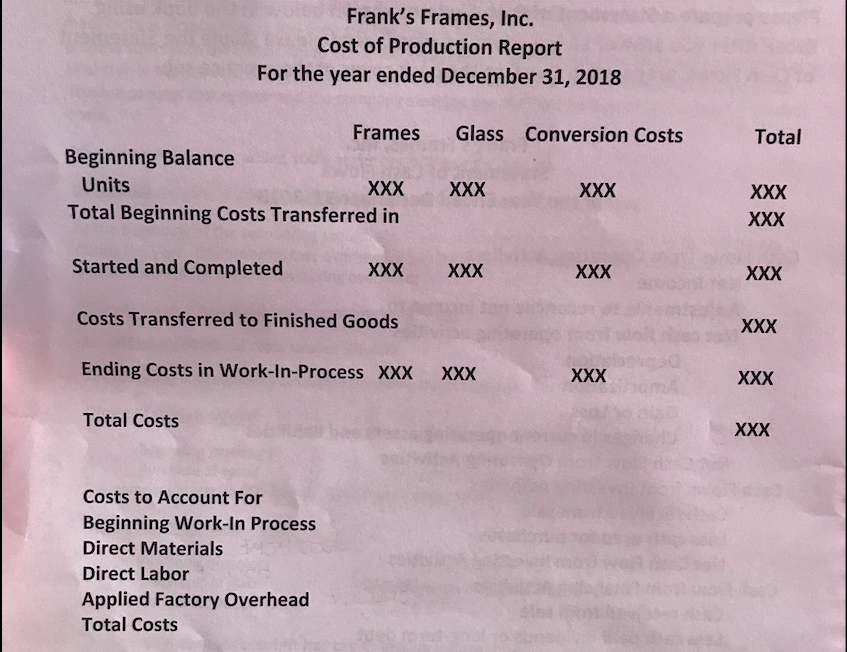

Prepare the Cost of Production Report by turning the equivalent units schedule into dollars.

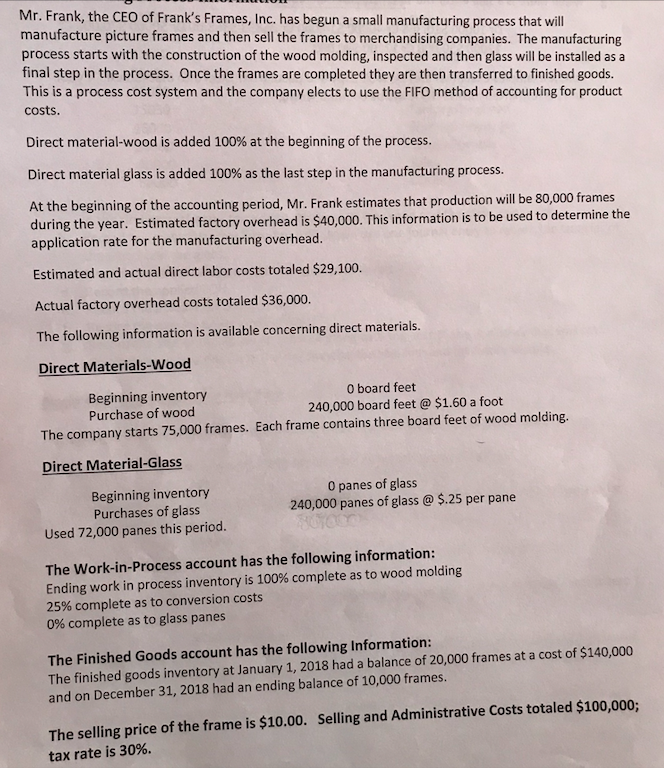

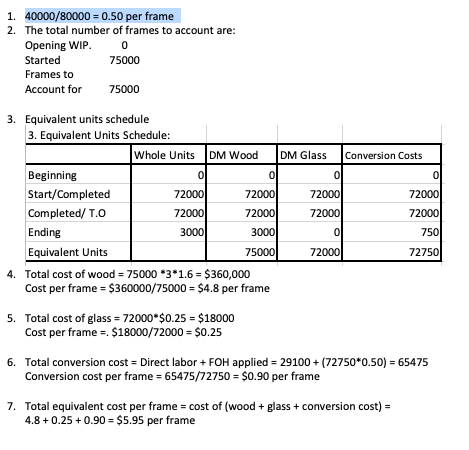

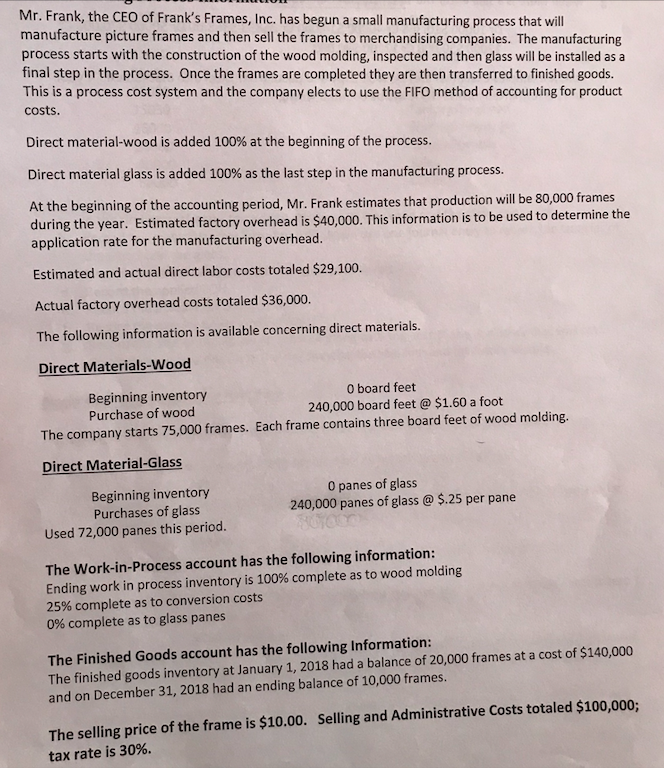

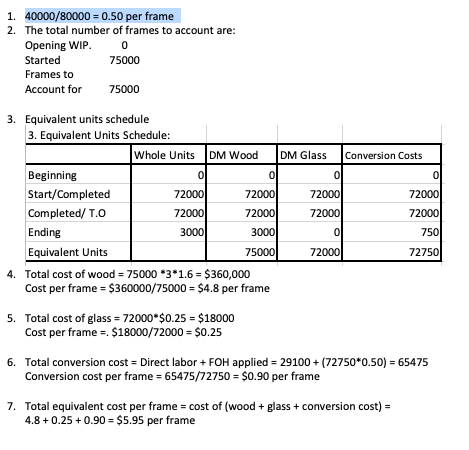

Frank's Frames, Inc. Cost of Production Report For the year ended December 31, 2018 FramesGlass Conversion Costs Total Beginning Balance Units Total Beginning Costs Transferred in Started and Completed Costs Transferred to Finished Goods Ending Costs in Work-In-Process XXX Total Costs XxX XXx Costs to Account For Beginning Work-In Process Direct Materials Direct Labor Applied Factory Overhead Total Costs Mr. Frank, the CEO of Frank's Frames, Inc. has begun a small manufacturing process that wil manufacture picture frames and then sell the frames to merchandising companies. The manufacturing process starts with the construction of the wood molding, inspected and then glass will be installed as a final step in the process. Once the frames are completed they are then transferred to finished goods. This is a process cost system and the company elects to use the FIFO method of accounting for product costs Direct material-wood is added 100% at the beginning of the process. Direct material glass is added 100% as the last step in the manufacturing process. At the beginning of the accounting period, Mr. Frank estimates that production willbe 80,000 frames during the year. Estimated factory overhead is $40,000. This application rate for the manufacturing overhead information is to be used to determine the Estimated and actual direct labor costs totaled $29,100. Actual factory overhead costs totaled $36,000. The following information is available concerning direct materials Direct Materials-Wood Beginning inventory Purchase of wood 0 board feet 240,000 board feet @ $1.60 a foot The company starts 75,000 frames. Each frame contains three board feet of wood molding Direct Material-Glass 0 panes of glass Beginning inventory Purchases of glass 240,000 panes of glass @ $.25 per pane Used 72,000 panes this period The Work-in-Process account has the following information Ending work in process inventory is 100% complete as to wood molding 25% complete as to conversion costs 0% complete as to glass panes The Finished Goods account has the following Information: The finished goods inventory at January 1, 2018 had a balance of 20,000 frames at a cost of $140,000 and on December 31, 2018 had an ending balance of 10,000 frames The selling price of the frame is $10.00. Selling and Administrative Costs totaled $100,000; tax rate is 30%. 1. 40000/80000 0.50 per frame 2. The total number of frames to account are Opening WIP Started Frames to Account for 0 75000 75000 3. Equivalent units schedule 3. Equivalent Units Schedule: Whole Units DM Wood DM Glass Conversion Costs Beginning Start/Completed Completed/ T.O Ending Equivalent Units 72000 72000 3000 72000 72000 72000 72000 750 72750 72000 3000 72000 4. Total cost of wood 75000 3 1.6 $360,000 Cost per frame $360000/75000 $4.8 per frame 5. Total cost of glass 72000 $0.25 $18000 Cost per frame-. $18000/72000 $0.25 6. Total conversion cost Direct laborFOH applied 29100 (72750*0.50)65475 Conversion cost per frame 65475/72750 $0.90 per frame 7. Total equivalent cost per frame cost of (woodlass+conversion cost) 4.8+0.250.90 $5.95 per frame