Answered step by step

Verified Expert Solution

Question

1 Approved Answer

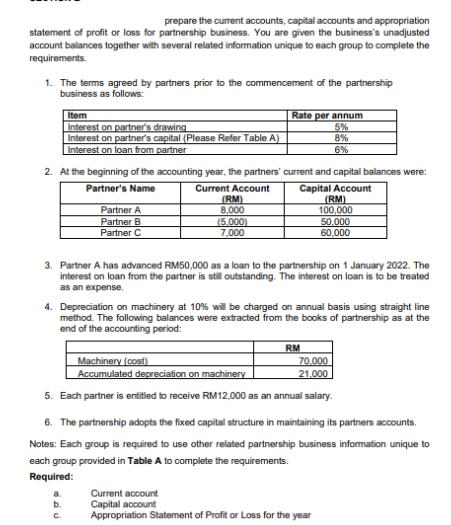

prepare the current accounts, capital accounts and appropriation statement of profit or loss for partnership business. You are given the business's unadjusted account balances

prepare the current accounts, capital accounts and appropriation statement of profit or loss for partnership business. You are given the business's unadjusted account balances together with several related information unique to each group to complete the requirements. 1. The terms agreed by partners prior to the commencement of the partnership business as follows: Item Interest on partner's drawing Interest on partner's capital (Please Refer Table A) Interest on loan from partner 2. At the beginning of the accounting year, the partners Partner's Name Current Account Partner A Partner B Partner C (RM) 8,000 (5,000) 7,000 Rate per annum 5% 8% 6% a. b. C. current and capital balances were: Capital Account 3. Partner A has advanced RM50,000 as a loan to the partnership on 1 January 2022. The interest on loan from the partner is still outstanding. The interest on loan is to be treated as an expense. 4. Depreciation on machinery at 10% will be charged on annual basis using straight line method. The following balances were extracted from the books of partnership as at the end of the accounting period: (RM) 100,000 50,000 60,000 RM Machinery (cost) Accumulated depreciation on machinery 5. Each partner is entitled to receive RM12,000 as an annual salary. 70.000 21.000 6. The partnership adopts the fixed capital structure in maintaining its partners accounts. Notes: Each group is required to use other related partnership business information unique to each group provided in Table A to complete the requirements. Required: Current account Capital account Appropriation Statement of Profit or Loss for the year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution a Current Accounts Partner A Current Account RM Beginning Balance 8000 Add Interest on Capital 4800 50000 x 8 Less Interest on Drawings 2000 5000 x 5 Less Salary 12000 Less Depreciation 3500 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started