Question

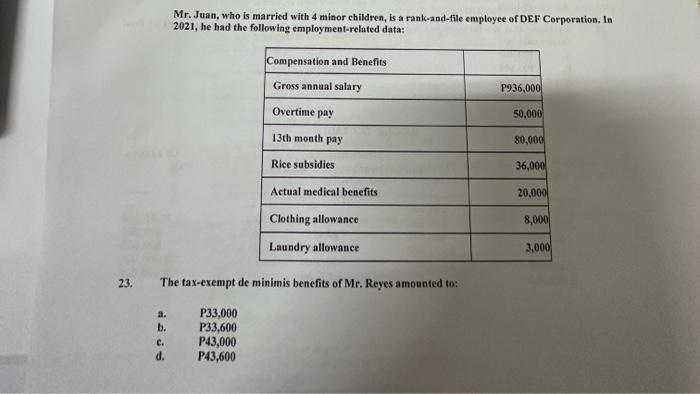

23. a. b. Mr. Juan, who is married with 4 minor children, is a rank-and-file employee of DEF Corporation. In 2021, he had the

23. a. b. Mr. Juan, who is married with 4 minor children, is a rank-and-file employee of DEF Corporation. In 2021, he had the following employment-related data: C. d. Compensation and Benefits Gross annual salary Overtime pay 13th month pay Rice subsidies Actual medical benefits The tax-exempt de minimis benefits of Mr. Reyes amounted to: P33,000 P33,600 P43,000 P43,600 Clothing allowance Laundry allowance P936,000 50,000 80,000 36,000 20,000 8,000 3,000

Step by Step Solution

3.36 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

The taxexempt de minimis benefits of Mr Juan amounted to P43600 Explanation De minimis benefits a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: kieso, weygandt and warfield.

14th Edition

9780470587232, 470587288, 470587237, 978-0470587287

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App