Answered step by step

Verified Expert Solution

Question

1 Approved Answer

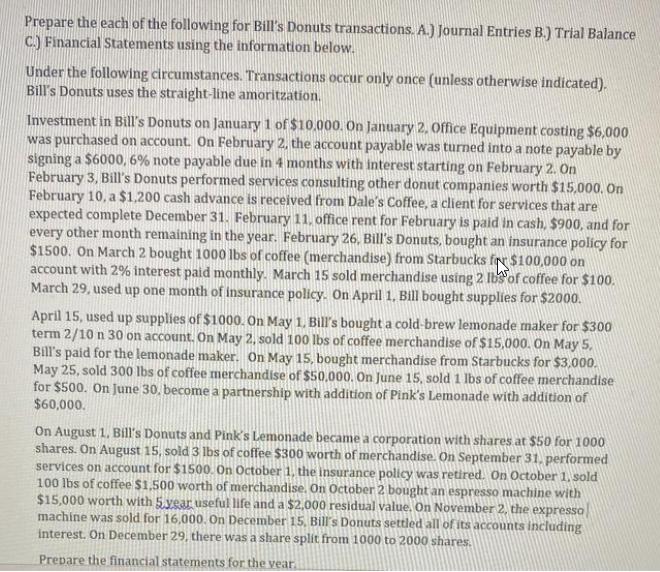

Prepare the each of the following for Bill's Donuts transactions. A.) Journal Entries B.) Trial Balance C.) Financial Statements using the information below. Under

Prepare the each of the following for Bill's Donuts transactions. A.) Journal Entries B.) Trial Balance C.) Financial Statements using the information below. Under the following circumstances. Transactions occur only once (unless otherwise indicated). Bill's Donuts uses the straight-line amoritzation. Investment in Bill's Donuts on January 1 of $10.000. On January 2, Office Equipment costing $6,000 was purchased on account. On February 2, the account payable was turned into a note payable by signing a $6000, 6% note payable due in 4 months with interest starting on February 2. On February 3, Bill's Donuts performed services consulting other donut companies worth $15,000. On February 10, a $1,200 cash advance is received from Dale's Coffee, a client for services that are expected complete December 31. February 11, office rent for February is paid in cash, $900, and for every other month remaining in the year. February 26, Bill's Donuts, bought an insurance policy for $1500. On March 2 bought 1000 lbs of coffee (merchandise) from Starbucks for $100,000 on account with 2% interest paid monthly. March 15 sold merchandise using 2 lbs of coffee for $100. March 29, used up one month of insurance policy. On April 1, Bill bought supplies for $2000. April 15, used up supplies of $1000. On May 1, Bill's bought a cold-brew lemonade maker for $300 term 2/10 n 30 on account. On May 2, sold 100 lbs of coffee merchandise of $15,000. On May 5, Bill's paid for the lemonade maker. On May 15, bought merchandise from Starbucks for $3,000. May 25, sold 300 lbs of coffee merchandise of $50,000. On June 15, sold 1 lbs of coffee merchandise for $500. On June 30, become a partnership with addition of Pink's Lemonade with addition of $60,000. On August 1, Bill's Donuts and Pink's Lemonade became a corporation with shares at $50 for 1000 shares. On August 15, sold 3 lbs of coffee $300 worth of merchandise. On September 31, performed services on account for $1500. On October 1, the insurance policy was retired. On October 1, sold 100 lbs of coffee $1,500 worth of merchandise. On October 2 bought an espresso machine with $15,000 worth with 5 year useful life and a $2,000 residual value. On November 2, the expresso machine was sold for 16,000. On December 15, Bill's Donuts settled all of its accounts including interest. On December 29, there was a share split from 1000 to 2000 shares. Prepare the financial statements for the year.

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

A Journal Entries B Trial Balance Bills Donut Corporation Trial Balance Ended December 31 Accounts Debit Credit Cash 183400 135230 Accounts Receivable ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started