Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare the financial statements under Andrew's Instructions. Post the entries from the T-accounts provided and calculate the ending balance in each account. Based on your

- Prepare the financial statements under Andrew's Instructions.

- Post the entries from the T-accounts provided and calculate the ending balance in each account.

- Based on your ending balances, prepare necessary closing journal entries at May 31, 2020

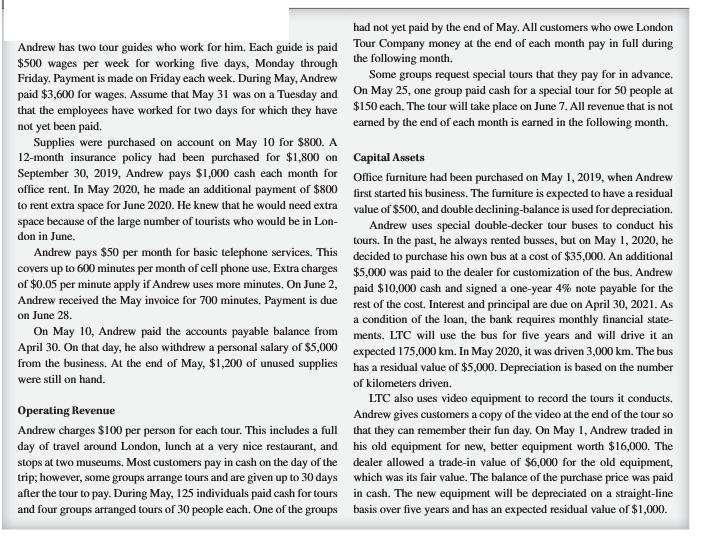

Andrew has two tour guides who work for him. Each guide is paid $500 wages per week for working five days, Monday through Friday. Payment is made on Friday each week. During May, Andrew paid $3,600 for wages. Assume that May 31 was on a Tuesday and that the employees have worked for two days for which they have not yet been paid. Supplies were purchased on account on May 10 for $800. A 12-month insurance policy had been purchased for $1,800 on September 30, 2019, Andrew pays $1,000 cash each month for office rent. In May 2020, he made an additional payment of $800 to rent extra space for June 2020. He knew that he would need extra space because of the large number of tourists who would be in Lon- don in June. Andrew pays $50 per month for basic telephone services. This covers up to 600 minutes per month of cell phone use. Extra charges of $0.05 per minute apply if Andrew uses more minutes. On June 2, Andrew received the May invoice for 700 minutes. Payment is due on June 28. On May 10, Andrew paid the accounts payable balance from April 30. On that day, he also withdrew a personal salary of $5,000 from the business. At the end of May, $1,200 of unused supplies were still on hand. Operating Revenue Andrew charges $100 per person for each tour. This includes a full day of travel around London, lunch at a very nice restaurant, and stops at two museums. Most customers pay in cash on the day of the trip; however, some groups arrange tours and are given up to 30 days after the tour to pay. During May, 125 individuals paid cash for tours and four groups arranged tours of 30 people each. One of the groups had not yet paid by the end of May. All customers who owe London Tour Company money at the end of each month pay in full during the following month. Some groups request special tours that they pay for in advance. On May 25, one group paid cash for a special tour for 50 people at $150 each. The tour will take place on June 7. All revenue that is not earned by the end of each month is earned in the following month. Capital Assets Office furniture had been purchased on May 1, 2019, when Andrew first started his business. The furniture is expected to have a residual value of $500, and double declining-balance is used for depreciation. Andrew uses special double-decker tour buses to conduct his tours. In the past, he always rented busses, but on May 1, 2020, he decided to purchase his own bus at a cost of $35,000. An additional $5,000 was paid to the dealer for customization of the bus. Andrew paid $10,000 cash and signed a one-year 4% note payable for the rest of the cost. Interest and principal are due on April 30, 2021. As a condition of the loan, the bank requires monthly financial state- ments. LTC will use the bus for five years and will drive it an expected 175,000 km. In May 2020, it was driven 3,000 km. The bus has a residual value of $5,000. Depreciation is based on the number of kilometers driven. LTC also uses video equipment to record the tours it conducts. Andrew gives customers a copy of the video at the end of the tour so that they can remember their fun day. On May 1, Andrew traded in his old equipment for new, better equipment worth $16,000. The dealer allowed a trade-in value of $6,000 for the old equipment, which was its fair value. The balance of the purchase price was paid in cash. The new equipment will be depreciated on a straight-line basis over five years and has an expected residual value of $1,000.

Step by Step Solution

★★★★★

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 Calculations for Operating Expenses Wages Total Wages 3600 Rent Basic Rent 50 x 5 250 Additional Rent 800 Total Rent 250 800 1050 Telephone Basic Telephone 50 Additional Telephone 700600 x ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started