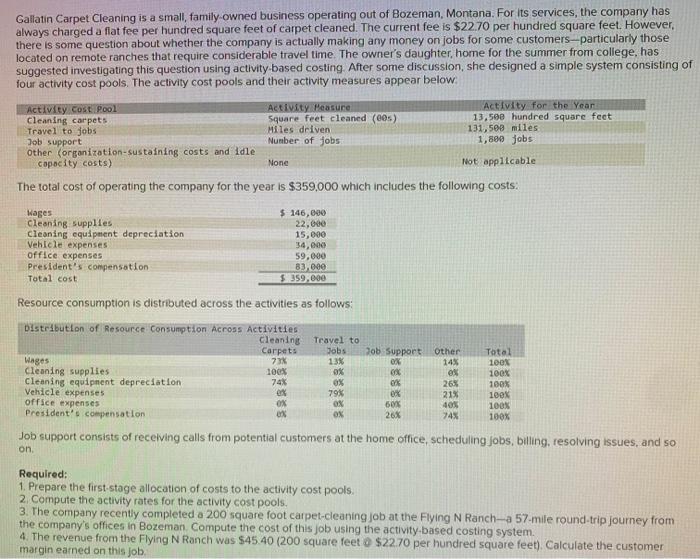

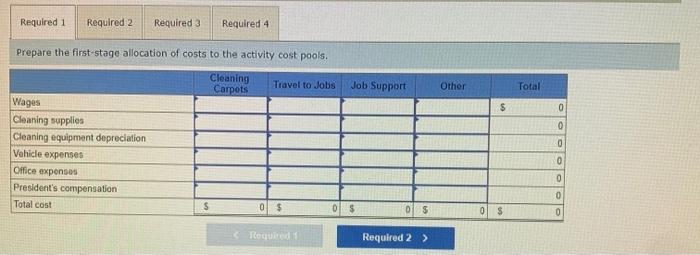

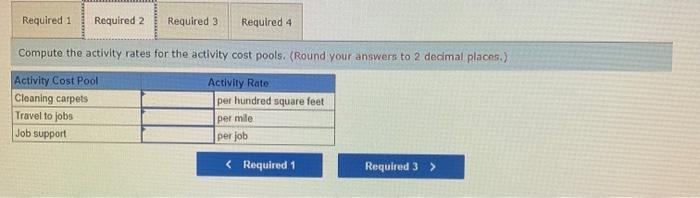

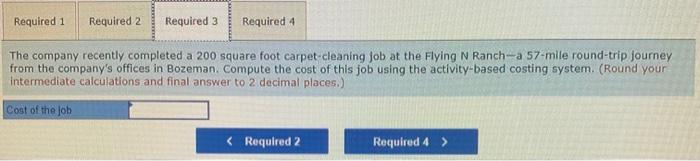

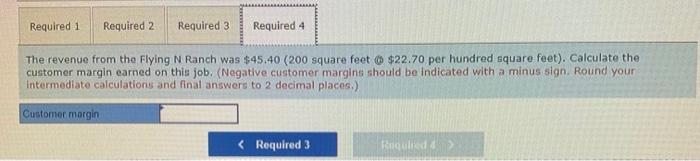

Prepare the first-stage allocation of costs to the activity cost pools. Gallatin Carpet Cleaning is a small, family-owned business operating out of Bozeman, Montana. For its services, the company has always charged a flat fee per hundred square feet of carpet cleaned. The current fee is $2270 per hundred square feet. However, there is some question about whether the company is actually making any money on jobs for some customers-particularly those located on remote ranches that require considerable travel time. The owner's daughter, home for the summer from college, has suggested investigating this question using activity-based costing. After some discussion, she designed a simple system consisting of four activity cost pools. The activity cost pools and their activity measures appear below: The total cost of operating the company for the year is $359,000 which includes the following costs: Resource consumption is distributed across the activities as follows: Job support consists of receiving calls from potential customers at the home office, scheduling jobs, billing, resolving issues, and so on. Required: 1. Prepare the first-stage allocation of costs to the activity cost pools. 2. Compute the activity rates for the activity cost pools. 3. The company recently completed a 200 square foot carpet-cleaning job at the Flying N Ranch-a 57 -mile round-trip journey from the company's offices in Bozeman. Compute the cost of this job using the activity-based costing system. 4. The revenue from the Flying N Ranch was $45.40 (200 square feet 0$22.70 per hundred square feet). Calculate the customer margin earned on this job. The company recently completed a 200 square foot carpet-cleaning job at the Flying N Ranch-a 57-mile round-trip journey from the company's offices in Bozeman. Compute the cost of this job using the activity-based costing system. (Round your intermediate calculations and final answer to 2 decimal places.) Compute the activity rates for the activity cost pools. (Round your answers to 2 decimal placos.) The revenue from the Flying N Ranch was $45.40 (200 square feet $22.70 per hundred square feet). Calculate the customer margin earned on this job. (Negative customer marglns should be indicated with a minus sign. Round your intermediate calculations and final answers to 2 decimal places.)