Answered step by step

Verified Expert Solution

Question

1 Approved Answer

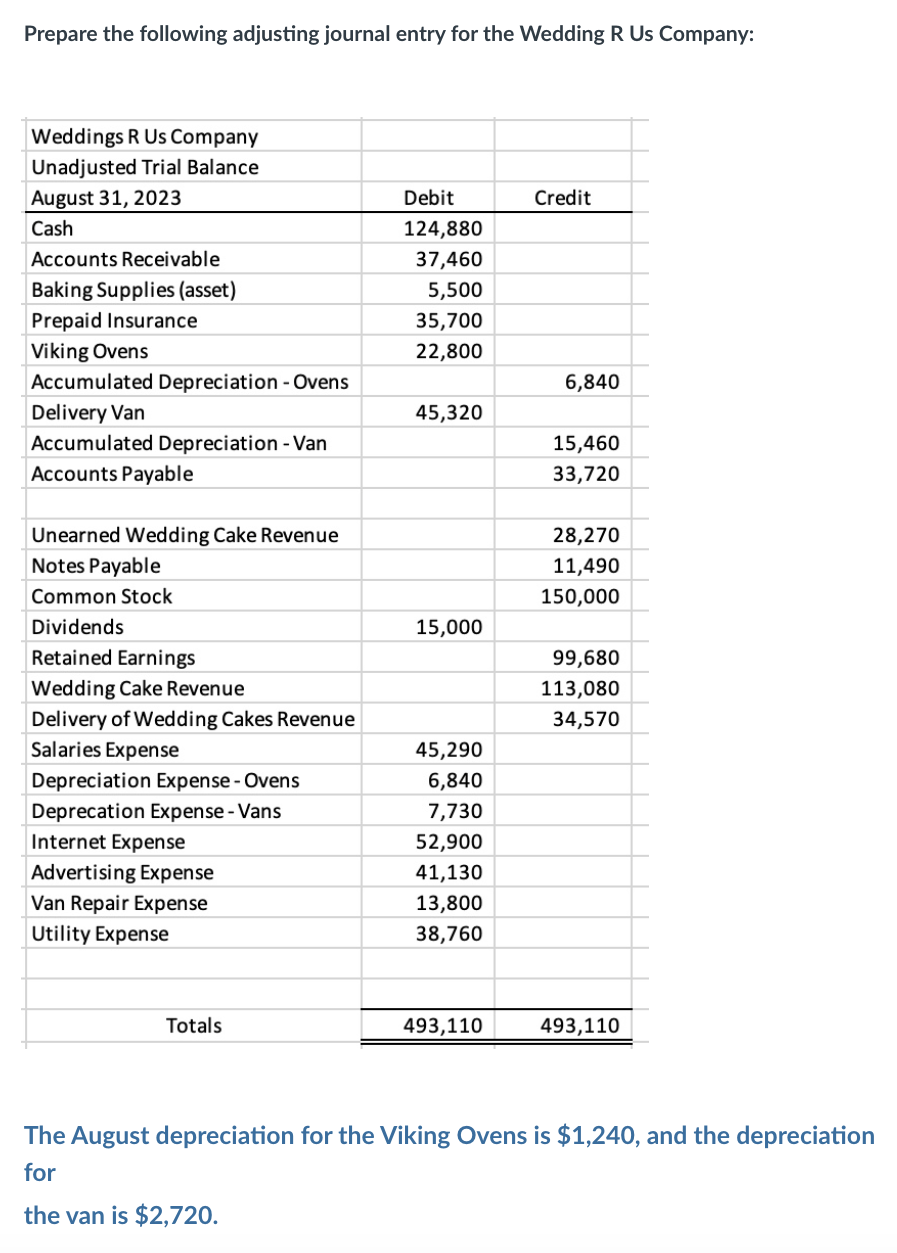

Prepare the following adjusting journal entry for the Wedding R Us Company: Weddings R Us Company Unadjusted Trial Balance August 31, 2023 Debit Credit

Prepare the following adjusting journal entry for the Wedding R Us Company: Weddings R Us Company Unadjusted Trial Balance August 31, 2023 Debit Credit Cash 124,880 Accounts Receivable 37,460 Baking Supplies (asset) 5,500 Prepaid Insurance 35,700 Viking Ovens 22,800 Accumulated Depreciation - Ovens 6,840 Delivery Van 45,320 Accumulated Depreciation - Van 15,460 Accounts Payable 33,720 Unearned Wedding Cake Revenue 28,270 Notes Payable 11,490 Common Stock 150,000 Dividends 15,000 Retained Earnings 99,680 Wedding Cake Revenue 113,080 Delivery of Wedding Cakes Revenue 34,570 Salaries Expense 45,290 Depreciation Expense - Ovens 6,840 Deprecation Expense - Vans 7,730 Internet Expense 52,900 Advertising Expense 41,130 Van Repair Expense Utility Expense 13,800 38,760 Totals 493,110 493,110 The August depreciation for the Viking Ovens is $1,240, and the depreciation for the van is $2,720.

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Wedding R Us Company Adjusting Journal Entry August 31 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started