Answered step by step

Verified Expert Solution

Question

1 Approved Answer

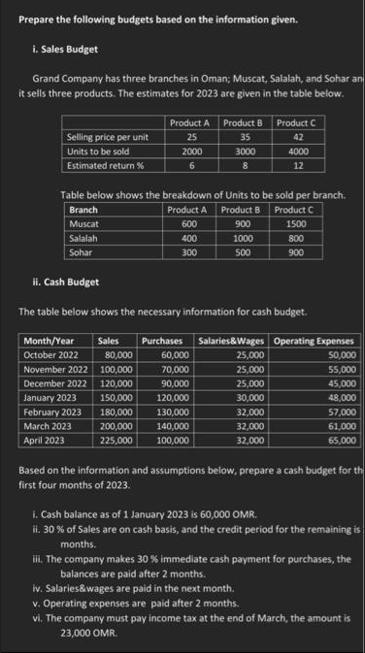

Prepare the following budgets based on the information given. i. Sales Budget Grand Company has three branches in Oman; Muscat, Salalah, and Sohar an

Prepare the following budgets based on the information given. i. Sales Budget Grand Company has three branches in Oman; Muscat, Salalah, and Sohar an it sells three products. The estimates for 2023 are given in the table below. Selling price per unit Units to be sold Estimated return% Branch Muscat Salalah Sohar Table below shows the breakdown of Units to be sold per branch. Product A Product B Product C 900 1500 1000 800 500 900 January 2023 February 2023 March 2023 April 2023 Product A Product B Product C 25 35 42 2000 3000 6 8 ii. Cash Budget The table below shows the necessary information for cash budget. Month/Year October 2022 November 2022 December 2022 80,000 100,000 120,000 600 400 300 150,000 180,000 200,000 225,000 Sales Purchases Salaries&Wages Operating Expenses 50,000 55,000 45,000 48,000 57,000 61,000 65,000 4000 12 60,000 70,000 90,000 120,000 130,000 140,000 100,000 25,000 25,000 25,000 30,000 32,000 32,000 32,000 Based on the information and assumptions below, prepare a cash budget for th first four months of 2023. i. Cash balance as of 1 January 2023 is 60,000 OMR. ii. 30 % of Sales are on cash basis, and the credit period for the remaining is months. iii. The company makes 30 % immediate cash payment for purchases, the balances are paid after 2 months. iv. Salaries&wages are paid in the next month. v. Operating expenses are paid after 2 months. vi. The company must pay income tax at the end of March, the amount is 23,000 OMR.

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Prepare a Sales Budget Grand Company Sales Budget for 2023 Product Selling Price per Unit Units to be Sold Estimated Return Total Sales Revenue Produc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started