Question

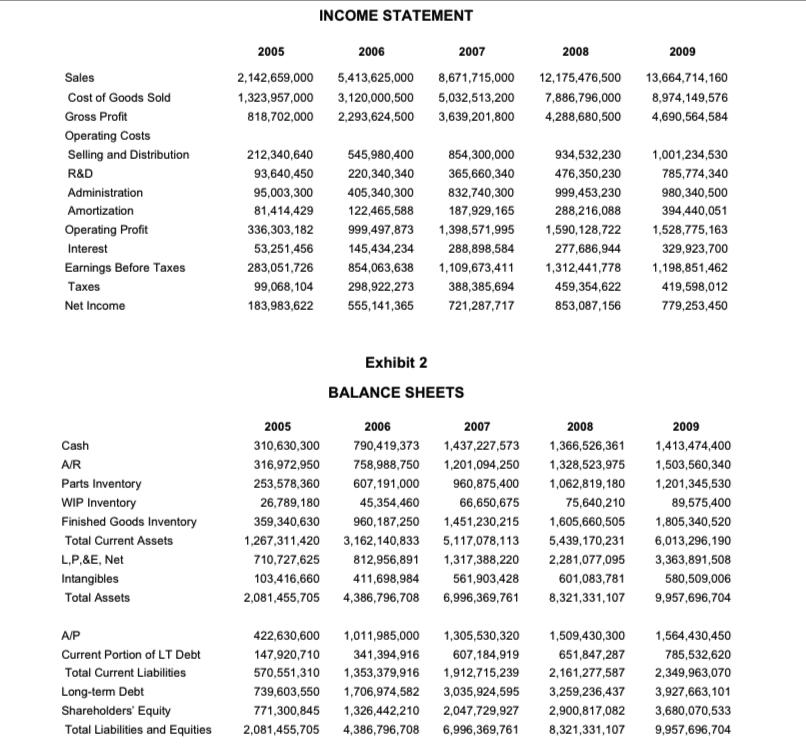

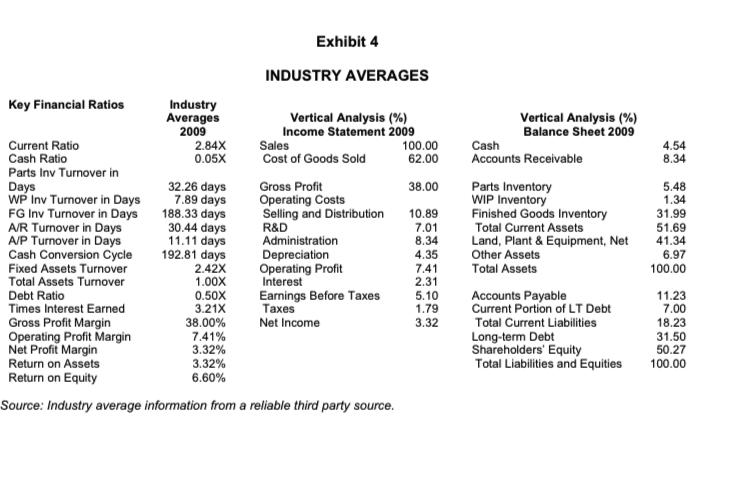

Prepare the following financial exhibits for 2005 through 2009: Ratio table Vertical analysis of income statements and balance sheets (For Income Statement, divide all items

Prepare the following financial exhibits for 2005 through 2009:

Ratio table

Vertical analysis of income statements and balance sheets (For Income Statement, divide all items in a year by Sales; for Balance Sheet, divide by Total Assets.

Horizontal analysis (index numbers) of income statements and balance sheets (Divide line-item values in a year by the base year value.)

Cash flow statements (2006 through 2009)*

Five-part analysis of ROE (EBIT/Sales, EBT/EBIT, NI/EBT, Total Asset Turnover, Debt Ratio (%), ROE (%) for 2005 – 2009.

Note: All ratios should use year-end totals and not averages

*Cash Flow Structure (2006 – 2009)

Operations |

Net Income |

Add/Minus: (just a label) |

Depreciation (Amortization) |

Accounts Receivable |

Parts Inventory |

WIP Inventory |

FG Inventory |

Accounts Payable |

Total |

Investing |

LPE |

Other Assets |

Total |

Financing |

Long-term Debt |

Total |

Change in Cash |

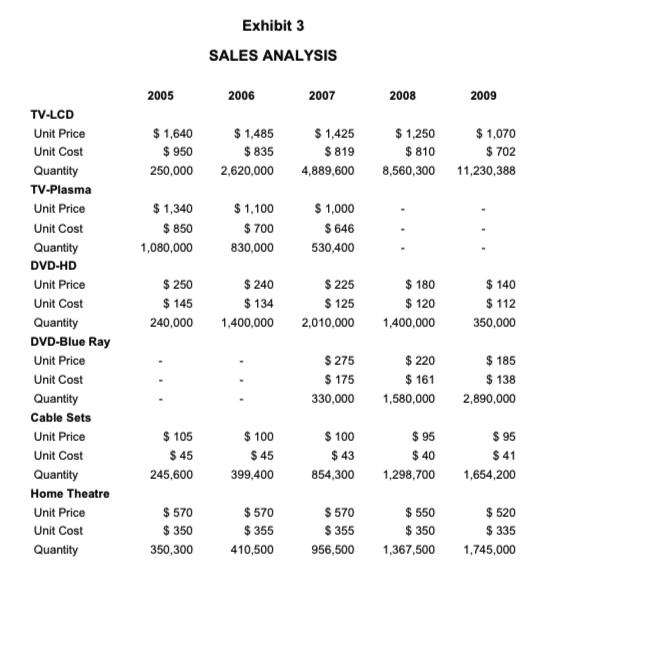

Sales Cost of Goods Sold Gross Profit Operating Costs Selling and Distribution R&D Administration Amortization Operating Profit Interest Earnings Before Taxes Taxes Net Income Cash A/R Parts Inventory WIP Inventory Finished Goods Inventory Total Current Assets L,P,&E, Net Intangibles Total Assets A/P Current Portion of LT Debt Total Current Liabilities Long-term Debt Shareholders' Equity Total Liabilities and Equities 2005 2006 2007 2008 2,142,659,000 5,413,625,000 8,671,715,000 12,175,476,500 1,323,957,000 3,120,000,500 5,032,513,200 7,886,796,000 818,702,000 2,293,624,500 3,639,201,800 4,288,680,500 212,340,640 93,640,450 95,003,300 81,414,429 INCOME STATEMENT 336,303,182 53,251,456 283,051,726 99,068,104 183,983,622 545,980,400 854,300,000 220,340,340 365,660,340 405,340,300 832,740,300 122,465,588 187,929,165 999,497,873 1,398,571,995 145,434,234 288,898,584 854,063,638 1,109,673,411 1,312,441,778 298,922,273 388,385,694 459,354,622 555,141,365 721,287,717 853,087,156 Exhibit 2 BALANCE SHEETS 934,532,230 1,001,234,530 476,350,230 999,453,230 288,216,088 1,590,128,722 277,686,944 2009 13,664,714,160 8,974,149,576 4,690,564,584 2005 2007 2008 2006 310,630,300 790,419,373 1,437,227,573 1,366,526,361 316,972,950 758,988,750 1,201,094,250 1,328,523,975 253,578,360 607,191,000 960,875,400 1,062,819,180 26,789,180 45,354,460 66,650,675 75,640,210 359,340,630 960,187,250 1,451,230,215 1,605,660,505 1,267,311,420 3,162,140,833 5,117,078,113 5,439,170,231 710,727,625 812,956,891 1,317,388,220 2,281,077,095 103,416,660 411,698,984 561,903,428 601,083,781 2,081,455,705 4,386,796,708 6,996,369,761 8,321,331,107 785,774,340 980,340,500 394,440,051 1,528,775,163 329,923,700 1,198,851,462 419,598,012 779,253,450 2009 1,413,474,400 1,503,560,340 1,201,345,530 89,575,400 1,805,340,520 6,013,296,190 3,363,891,508 580,509,006 9,957,696,704 1,564,430,450 422,630,600 1,011,985,000 1,305,530,320 1,509,430,300 147,920,710 341,394,916 607,184,919 570,551,310 1,353,379,916 1,912,715,239 2,161,277,587 651,847,287 785,532,620 2,349,963,070 739,603,550 1,706,974,582 3,035,924,595 3,259,236,437 3,927,663,101 771,300,845 1,326,442,210 2,047,729,927 2,900,817,082 3,680,070,533 8,321,331,107 9,957,696,704 2,081,455,705 4,386,796,708 6,996,369,761

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 Vertical Analysis Income Statement 2005 2006 2007 2008 2009 Sales 100 100 100 100 100 COGS 618 576 580 648 657 Gross profit 382 424 420 352 343 Oper...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started